With the Trump bump squeezing stocks higher, retirees (and near-retirees) are asking me two questions a lot these days:

Is it still a good time to buy? And if so, what the heck should I buy?

The answer to the first is, undoubtedly, yes.

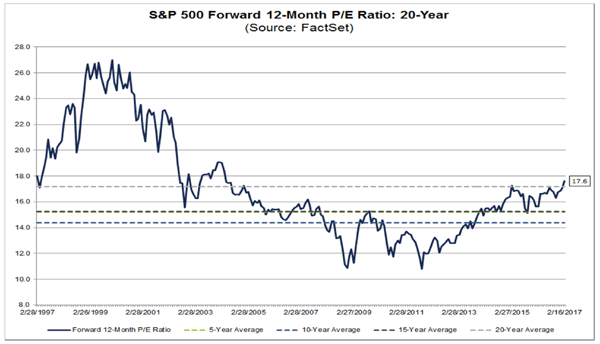

And it’s no secret what’s behind the second: according to FactSet, this market is trading at a forward price-to-earnings (P/E) ratio that hasn’t been seen in 13 years.

Investors Double Down

Source: FactSet

Source: FactSet

No wonder folks are struggling with what to buy!

One thing I recommend avoiding now is an index fund like the SPDR S&P 500 ETF (SPY). At that price—and with an anemic 1.9% trailing-twelve-month dividend yield—you’re just not getting enough income for the risk you’re taking on.

[ad#Google Adsense 336×280-IA]To get at the sectors (and investments) that will hand us the biggest upside, the highest yields and the greatest safety, we need to dig deeper.

Below, I’m going to reveal 2 corners of the market that don’t get the respect they deserve.

They’re home to 3 terrific retirement buys with a potent combo: 4% to 9% dividends and healthy discounts I see driving their shares up sharply in short order.

But first, we need to talk about two other sectors (and 6 stocks) millions of people see as retirement sacred cows.

Too bad they’re primed to deliver middling returns at best—and surprisingly big losses at worst.

Consumer Staples: A Wile E. Coyote Moment?

Many investors put stocks like General Mills (GIS), Campbell Soup (CPB) and ConAgra Brands (CAG) at the heart of their portfolios. It makes sense. People need to eat, right?

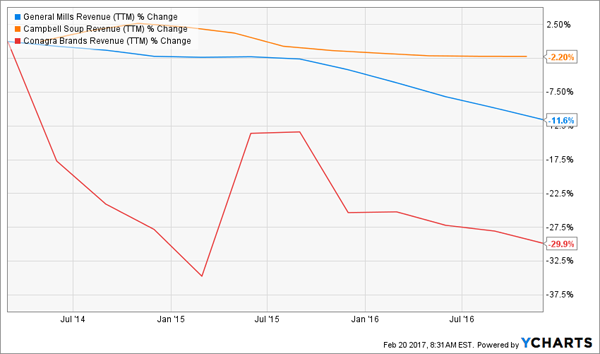

Too bad these companies’ sales have been backsliding for years.

Revenue Gets Lean

There’s little hope for improvement. A week ago, GIS said its sales would fall 4% for fiscal 2017. That news sliced a corresponding 4% off the share price—a big one-day drop for a stock plenty of folks look to for stability.

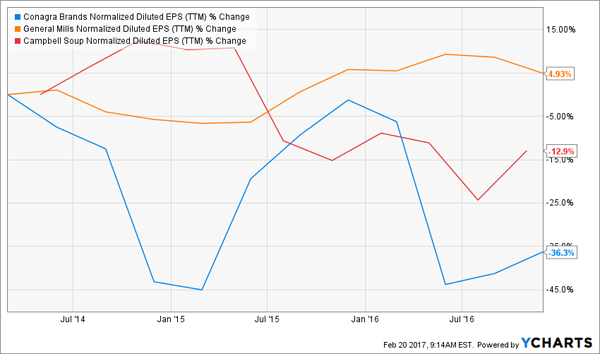

All three are being “disrupted” by local producers who are stealing away customers with fresh, premium fare. The food giants have been slashing costs to protect their profits, but, of course, cost cuts can only take you so far.

Earnings Growth Goes Cold

They’re also taking on the trend by scrambling to consolidate—even when doing so makes no sense. The failed tie-up between Kraft-Heinz (KHC) and Unilever (UL), for example, would have created a company with a dizzying number of products and markets: the US and Canada together supply 79% of KHC’s sales, and the company mainly sells food. UL, meanwhile, is a multinational behemoth, with its products (everything from deodorant to detergent) in 7 of every 10 homes around the world.

Meantime, KHC, CAG, GIS and CPB are only paying 2.7% dividends, on average. And with all four priced for growth—with forward P/E ratios ranging from 19.2 (Campbell) to 24.6 (Kraft Heinz)—there’s likely more indigestion ahead.

Utilities: High Payouts, Flickering Growth

Utilities have a couple advantages over consumer-staples stocks. One is yield: buying the Utilities Select SPDR ETF (XLU) gets you 3.3% right now, compared to 2.4% for the Consumer Staples Select Sector SPDR ETF (XLP).

And if you do a little legwork, you can do better: Duke Energy (DUK), for example, the biggest US utility by market cap, pays 4.2%, while Dominion Resources (D), the No. 4 player, yields 3.7%.

It Pays to Go With Market Leaders

Utilities also don’t have to worry about upstart competitors eating their lunch, like the smaller players are doing to Big Food.

The problem?

Bargains aren’t exactly plentiful here, either. Duke, for example, sports a forward P/E ratio of 17.5, just a shade below the market but above its five-year average of 16.9. And at 20.4, Dominion is still priced at a premium to both the market and its five-year average (19.4).

We can do better, starting with…

REITs: A Sector on Sale

If you’ve been following my articles on ContrarianOutlook.com, you know I’m bullish on real estate investment trusts (REITs), particularly because overwrought interest-rate fears have held them back.

Look at how the benchmark Vanguard REIT ETF (VNQ) has trailed SPY in the past year.

REITs Bump Along the Bottom

And as I wrote last week, I like to hunt for cheap dividend payers in the midcap space. This is because there’s a lack of analyst coverage, and that—along with the bargain valuations plenty of REITs already sport—gives us a shot at picking them up at historically low valuations and historically high yields.

Two that have largely escaped the herd’s notice: self-storage expert ExtraSpace Storage (EXR) and retail REIT Tanger Factory Outlet Centers (SKT).

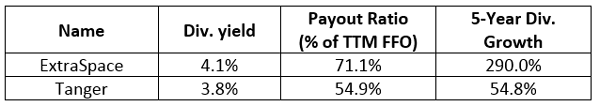

The best way to show you why I like them is to stack them up by five crucial indicators, starting with dividend yield, dividend growth and payout ratio, with the latter expressed as a percentage of funds from operations (FFO), the equivalent of earnings in the REIT world.

Safe, Growing Payouts

Right away, we can see that these two above-average yields are safe (payout ratios of 85% to 90% are common with REITs), and these trusts’ dividend-growth histories are outstanding.

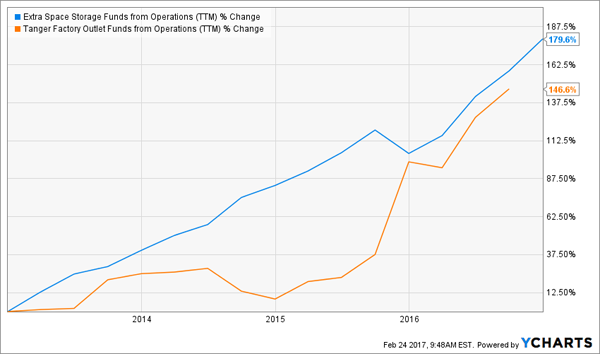

Now let’s look at our fourth indicator: the FFO backing those histories up, giving us a clue to whether they can keep this stellar payout growth going.

Cash Generators

No problem there, either.

And finally, their valuations look reasonable, with Tanger trading at 14.5 times trailing-twelve-month FFO and ExtraSpace at 19.3. EXR’s multiple may seem high, but it’s reasonable in light of the self-storage REIT’s growth potential as baby boomers downsize and the economy picks up.

Which brings me to…

A Great Closed-End Fund for Income and Gains

Closed-end funds (CEFs) have a place in your retirement portfolio because they let you hold the same blue-chip stocks you’re used to … but with yields you’re likely not.

When you invest in a CEF, you pay higher fees than you would for, say, an ETF like SPY or XLU. But you get a manager who uses strategies like leverage (or borrowing money at cheap rates and reinvesting in securities with higher returns) and option-selling to juice their funds’ income.

A good choice right now: the Eaton Vance Tax-Managed Diversified Equity Income Fund (ETY). The fund holds household names like Alphabet (GOOGL), JPMorgan Chase & Co. (JPM) and Visa (V)—stocks that get few income investors’ blood pumping.

But by selling call options—a strategy that essentially swaps potential gains later for cash upfront now—30-year industry vet Michael Allison pumps ETY’s yield all the way up to 9.3%.

What’s more, ETY trades on the NYSE at a 7.7% discount to its net asset value, which is wider than its three-year average of 7.2% and far wider than its 5.3% low last year. That means you can look forward to some nice price upside as that gap narrows.

Great Time to Buy ETY

Source: Morningstar

Source: Morningstar

Finally, ETY charges a 1.08% management fee for Allison’s expertise. But keep in mind that this comes straight out of NAV, so you’ll still collect GDV’s fat 9.3% yield. And all returns and yields I’ve quoted you are net of fees.

— Brett Owens

6 More Red Hot Buys to Double Your Income [sponsor]

These 4 income wonders are terrific retirement picks for any investor. And I can show you a way to go beyond REITs and CEFs—and bulk up your portfolio’s yield even more—with the 6 unsung plays in our 8.0% “No-Withdrawal” retirement portfolio.

As the name says, these 6 picks pay an average yield of 8%. That’s enough to hand you $40,000 in income for every $500,000 you invest! And some of these stealth income plays pay even more than ETY. I’m talking payouts of 9.9%, 10.4% and up!

Just like ETY and the 3 REITs I just showed you, they’re off the herd’s radar, so they’re cheap now, but that won’t last. Don’t miss out. Click here and I’ll share our 6 top picks for 8% income and double-digit upside.

Source: Contrarian Outlook