Wall Street is salivating over the upcoming public debut for Snap Inc.

And who can blame them?

[ad#Google Adsense 336×280-IA]The initial public offering (IPO) for this developer of the popular instant-messaging service Snapchat will likely be huge.

And I’m not exaggerating.

Once shares begin trading as soon as next month, Snap could be valued between $21 billion and $25 billion – making it the largest U.S. tech IPO since that of Facebook Inc. (Nasdaq: FB) back in 2012.

That’s a figure that could serve as a big catalyst for the rebounding IPO market.

Also salivating: thousands and thousands of retail investors… and maybe even you.

But hold on…

As a longtime Silicon Valley insider, I love IPOs. If you’re an investment banker, venture capitalist, or company insider, you can make a fortune with them. (Plus, nothing keeps a bull market running like popular new issues that bring fresh cash out of the sidelines.)

However, most investors should avoid buying Snap – or any other company going public – at the open.

At that point, you’re likely to pay top dollar and very well could see the value of your investment drop immediately and steeply.

No fun.

But we’ve got a way around that.

In fact, we’ve got a way to cash in on the Snap IPO with none of that risk.

It’s an investment that will bring you many years of profits.

And you can get in right now…

2017’s Blockbuster IPO

In May 2015, Snap CEO Evan Spiegel announced he intends to take his company public. Although he didn’t offer many specifics at the time, it was the first time any company official mentioned going public.

Although we don’t have an exact date yet, we know most of the specifics.

You can find them here, in an excellent free guide to the Snap IPO – its recent financial performance, its shareholder rights, etc. – that my colleagues at Money Morning put together.

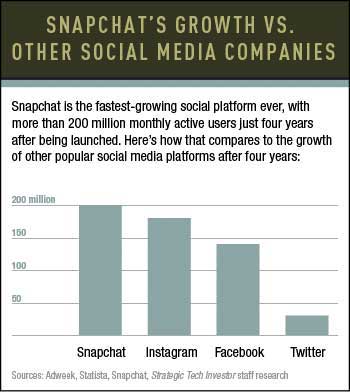

Started as a class project for Stanford University in 2011 by then-students Spiegel, Reggie Brown and Bobby Murphy, Snapchat has grown to become one of the fastest-growing social media platforms ever.

It currently has more than 160 million daily active users. That’s significantly better than what Facebook was doing at this point in its history.

It currently has more than 160 million daily active users. That’s significantly better than what Facebook was doing at this point in its history.

Over its pre-public life, Snap raised nearly $2.63 billion over eight rounds of funding from 24 investors, including Glade Brook Capital Partners, Benchmark, General Catalyst Partners, Kleiner Perkins Caufield & Byers, Lightspeed Venture Partners, and SV Angel.

Snap, which will be traded on the NYSE under the SNAP symbol, made $404.5 million in 2016, which beat analyst estimates of $350 million by 15.42%.

By 2017, it could generate nearly $1 billion in revenue. By 2018, it could generate nearly $2 billion.

However, Snap isn’t profitable right now…

It generated $58 million in revenue for 2015 but reported a net loss of $372 million.

In 2016, Snap reported a net loss of $514 million.

That’s a 38% year-over-year increase in net losses.

Beyond the usual hazards that come with trying to play IPOs in their early stages, that makes Snap a risky investment.

And that’s why I’m showing you something different today…

Not Hating – Just Saying

When I say that the real IPO money is made by investment bankers, insiders, and VCs, I’m not exaggerating.

Consider this…

In its recent IPO filing, Snap suggested an offering price of $16.33, setting up a valuation of roughly $21 billion. But let’s break that down so you can see firsthand how hard it is for regular folks to profit the day a stock starts trading:

- CEO Evan Spiegel and Chief Technology Officer Bobby Murphy – the ultimate insiders – could see their current holdings be valued at $3.7 billion each, for a combined $7.4 billion.

- VC firm Benchmark holds 131.6 million shares that would be worth $2.1 billion.

- The VCs at Lightspeed Venture Partners own6 million shares that would be worth $1.4 billion.

- After the open, CEO Spiegel will receive a bonus worth up to another 3% of Snap, valued at roughly $600 million.

If I sound like a “hater” here, don’t get me wrong…

I love IPOs. They’re one of the main reasons Silicon Valley is able to bring us a steady stream of innovations.

Where else can young entrepreneurs go from running struggling startups to heading up cash-rich publicly traded firms in just a few years?

And you’d be hard pressed to find a better IPO environment than we have right now. After a weak start in volume, the IPO class of 2016 made up for it in the end with great returns.

The average new issue gained 23% from the time it started trading until year’s end, according to Renaissance Capital. That’s the best showing in three years, and well above the 10-year average of 14%.

Those kinds of gains leave investors thirsty for more IPOs, and firms are clearly responding. Snap is just one of 154 startups valued at $1 billion or more, according to Wall Street Journal data, and many of those “unicorns” have signaled plans to go public in coming quarters.

That’s why I believe right now we should all take a look at this…

The IPO “Backdoor” Play

I think every tech investor ought to consider holding First Trust U.S. Equity Opportunities ETF Fund (NYSE: FPX) – formerly known as the First Trust U.S. IPO Index Fund – for the long haul

With it, you can grab the upside and excitement that IPOs offer – and sidestep all the volatility inherent in new issues.

In other words, let the fund managers do all the heavy lifting while you sit back and watch the profits pile up.

Let’s be clear about one thing. Strictly speaking, FPX doesn’t specialize in new tech stocks. Instead, it seeks to mirror the broad market for IPOs.

That’s fine – in fact, it’s a good thing.

FPX gives us a good combination of tech-centric stocks and broad diversification. That makes it a great “twofer” in which 40% of the top 20 holdings relate to tech or the life sciences.

A fund that holds 102 stocks, FPX also gives us access to finance, auto, retail, heavy industry, energy, and even some metals.

Indeed, around 45% of the FPX’s holdings are mid-caps with and the average, and its average holding is worth $20.2 billion. To me, that says the managers have been smart enough to acquire stocks at solid entry points.

Kraft Heinz Co. (NYSE: KHC) is currently FPX’s top holding, accounting for 10.05% of the fund. Not so “tech.” But social-networking leader Facebook Inc. (Nasdaq: FB) remains a top holding as well, at 3.58% of the fund.

Let’s take a look at some of the other exciting tech names FPX holds…

- In less than a year, Acacia Communications Inc. (Nasdaq: ACIA), a developer of communications network products, has seen its shares double. And with sales growing more than 30% a year, a lot more upside remains. Even though it was founded in 2009, Acacia has already emerged as a strong player in the optical networking field. These are the firms that are ushering in the “Gigabahn Web Era.” Acacia’s gear is being used by corporate and telecom network operators to boost data speeds tenfold. The Maynard, Mass.-based company’s sales likely doubled in 2016 – and should rise another 33% this year.

- Lumentum Holdings Inc. (Nasdaq: LITE) is also a fast-growing provider of optical networking gear. Thanks to sharp gains in profit margins, it was able to boost profits 46% last year. Look for profits to rise just as fast this year – and to rise a still-robust 25% in 2018 to around $2.40 a share. That outlook recently pushed shares up to a fresh all-time high and to more than double its July 2015 IPO price.

- Box Inc. (NYSE: BOX) has moved on from its roots as a cloud-based storage provider and developed into a full-fledged document collaboration platform. More to the point, existing clients are signing up for bigger deal sizes. From a base of just $21 million in sales in 2011, Box should hit the $500 million mark this year.

- Hewlett Packard Enterprise Co. (NYSE: HPE) – In a bid to tighten its focus, sprawling tech firm Hewlett-Packard Co. carved out this division in late 2015. HP Enterprise focuses on the servers, storage, networking, consulting, and support segments. It plans to further spin off some of these remaining businesses in the second quarter.

Now trading at around $57, FPX is priced cheaper than many of its portfolio holdings, making it a cost-effective way for retail investors to cash in on the coming IPO boom.

Over the past five years, FPX has returned 110.7% to investors, beating the S&P’s 74.7% gain in that time by 48.2%. And just over the past year, it has beat the S&P 500 by 49.8% – with its 31.6% returns demolishing the broad market’s gains of 21.1%.

I see no reason FPX can’t maintain that leadership in 2017, considering how active the IPO market will become.

And considering that its managers will likely be sweeping up Snap into their fund on Day 1.

Plus – with an expense ratio of 0.6, a five-star rating from Morningstar, and a rebounding IPO market – FPX meets all three of our ETF Profit Screens.

That makes this the kind of ETF you want to hold for the long haul in order to tap in on the steady stream of new innovations represented by the booming IPO market.

— Michael A. Robinson

[ad#mmpress]

Source: Money Morning