Kindred Healthcare (NYSE: KND) has a problem.

The stock pays a fat 6.1% dividend yield. It’s paid a $0.12 per share dividend each quarter since 2013.

[ad#Google Adsense 336×280-IA]But SafetyNet Pro rates Kindred poorly.

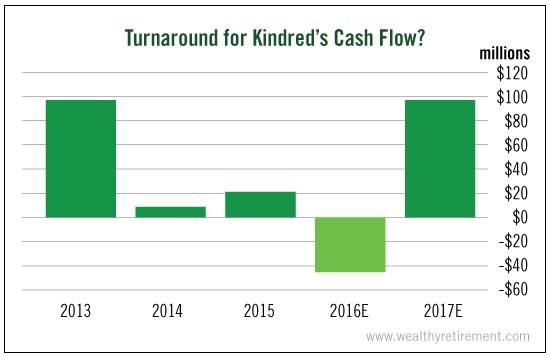

The company hasn’t been able to afford its dividend since the first year it started paying one.

In 2014 and 2015, it paid shareholders more than it made in cash flow.

2016 is an even worse situation…

The company’s cash flow is expected to be negative $45 million. Meanwhile, it paid out $40 million in dividends.

Essentially, that’s the whole problem.

Kindred Healthcare doesn’t make enough money to pay its dividend.

No matter how good a company’s dividend-paying track record is, it’ll have a low SafetyNet Pro rating if a company can’t afford to pay its dividend.

It’s just like having a perfect history of paying your debts – but having such large debts that the monthly interest exceeds your income. Your credit rating wouldn’t be too high, and you’d have a tough time getting a mortgage.

However, there’s reason to be optimistic about Kindred.

The company operates hospitals, nursing and rehab centers, and offers in-home care.

It was bleeding money due to its skilled nursing business.

But Kindred is exiting that business, which is expected to dramatically improve cash flow.

In fact, after selling off the skilled nursing segment, Wall Street forecasts Kindred to generate $97 million in free cash flow this year – more than enough to pay the $40 million in dividends.

Should the company even come close to meeting Wall Street’s figure, we’ll likely see SafetyNet Pro upgrade its dividend safety rating.

But until it proves that it can generate enough cash flow to pay shareholders, its dividend has to be considered unsafe.

But until it proves that it can generate enough cash flow to pay shareholders, its dividend has to be considered unsafe.

Another variable is how hospitals will fare after a repeal of Obamacare.

Hospitals were big beneficiaries of the Affordable Care Act, as more insured patients used their services. Hospitals had fewer write-offs for uninsured patients who couldn’t pay their bills.

Depending on how fast the law is repealed and what it’s replaced with, Kindred’s fortune – and the fortune of other hospital operators – could change dramatically.

Dividend Safety Rating: D

— Marc Lichtenfeld

[ad#agora]

Source: Wealthy Retirement