The last eight weeks have been nothing short of exhilarating, with the Dow closing a mere 25 points away from 20,000 last week after 17 record closes and an 8% run that’s added an estimated $1.8 trillion to investors’ wallets.

“We’re running out of things that can trip us up,” noted Wunderlich Securities Chief Investment Strategist, Art Hogan in remarks made to CNBC.

[ad#Google Adsense 336×280-IA]Save one.

It’s critical that you get this “right” because the risks of being wrong couldn’t be more costly.

In fact…

You could more than triple your money with what I’m about to tell you.

Pad Your Portfolio by 233%

Let me start off with a warning, though.

What I am about to share with you may make you extremely uncomfortable.

In fact, I’m hesitant to bring it up because it could easily be taken out of context.

But I am going to do so anyway for one simple reason – if you understand why Wall Street doesn’t talk about what we’ve going to cover today, then you’ll be perfectly positioned to understand the implications associated with what I want you to do next – and the tactics you’ll need to succeed.

Here’s what you need to know about the tactic that may already be costing you 233% returns. Maybe a lot more.

Brain-Damaged Investors Make Better Decisions

Nearly 10 years ago, I came across a study in Psychological Science that was as profound as it was politically incorrect, at least on the surface, anyway.

The implications are pretty striking so you’d think Wall Street would have been all over it but, sadly, they’re not and won’t ever be. In fact, the only time I’ve ever seen it mentioned in the years since was by another fiercely independent financial analyst like myself, Ric Edelman, CEO of Edelman Financial.

Here’s what it says.

Researchers at three major universities – Stanford, Carnegie Mellon and the University of Iowa – published findings showing that brain-damaged individuals made better investment decisions than the rest of us.

To be precise, what they studied was the impact of injuries that prevented the brains of the injured from processing emotional stimuli and, by implication, responses to those specific inputs.

Researchers found that when they compared the findings to folks with no brain damage, the “injured” individuals made significantly better investment decisions.

That’s because the human brain is wired to evaluate economic and investing information using connections and pathways that are closely linked to emotional inputs. You’d think this kind of decision-making would involve logical brain pathways, but that’s not true.

This is why making decisions with your money can be very challenging, especially when the markets are uncertain and the investing landscape emotionally charged like it is right now. Because you are taking what should be a logical decision and using emotional receptors to make it.

It’s also why Wall Street wants you to believe money is complicated and why their ads are so slick. Unlike the average individual investor, the Big Boys have spent billions understanding what makes your mind work and how specific inputs prompt specific actions on your part – chief among which is commission-generating buying and selling activity that’s worth $18 billion or more a year to the top 25 firms. It’s not uncommon for experienced financial advisors to generate more that $1 million in commissions and fees a year…each.

They know that if you’re happy, then you’re generally going to be a buyer, and that if you’re sad or fearful, you’ll be a seller. And usually at precisely the wrong time, I might add.

The result is tremendous underperformance that gets dramatically worse over time.

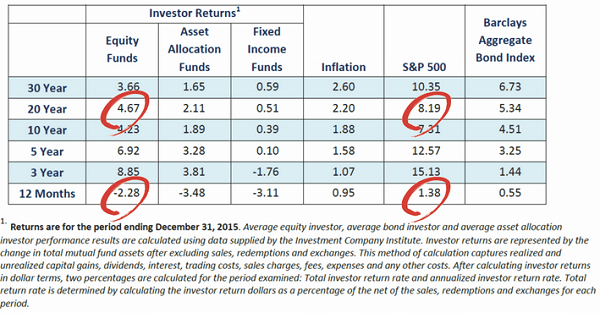

Case in point, the most recent DALBAR data shows that equity fund investors averaged only 4.67% per year in the 20 years leading up to 2015, versus the S&P 500 which turned in 8.19% over the same time frame – a 3.52% average annual difference.

As an aside, I’m expecting 2016 data to show an even larger difference vis a vie the post-election rally, but that’s a story for another time.

Let’s work with what we have.

A mere 3.52% a year doesn’t sound like a huge difference to most investors. But that’s what makes it so very dangerous and potentially so very costly.

Taken over 20 years, that difference means $10,000 socked away by the average investor would turn into $24,914, or a gain of 149.14%. But a $10,000 investment that matched the S&P 500’s return would amount to $48,277.24 in the same 20 years – a return of just over 382.77%. The difference is 233%, or more than triple your money.

And if you don’t have decades to wait?

That’s a valid concern and one I hear every time I bring up data like this. That’s a lot like buying a winter coat in April on the assumption that colder weather will continue after a freak one-day snowstorm when summer’s always warmer.

Short term market moves do not invalidate the laws of money or the longer-term perspective that comes with profitable investing…ever.

In fact, quite the opposite is true if you know what to look for.

Raytheon Co. (NYSE:RTN), for example, has returned 225% since I recommended it to Money Map Report Members in August 2011. My recommendation to play Halliburton Co. (NYSE:HAL) posted more than 500% in only 31 days. Any investor following along as directed could have turned $10,000 into $32,500 with the former and $10,000 into $62,900 with the latter.I don’t know anybody – rich or poor – who can afford to throw that kind of potential away. Not in the short term and certainly not longer term.

Again, this is an uncomfortable subject for a lot of investors.

Many of my own subscribers, in fact, thought I’d lost my marbles when I told them in 2007 to batten down the hatches at a time when they wanted to chase performance. On the way down, those who followed along with my recommendations had the opportunity to enjoy returns like the 101.68% we captured in iShares MSCI Brazil Capped (NYSEArca:EWZ) and 83.33% from iShares China Large-Cap (NYSEArca:FXI) respectively.

The same thing happened in March 2009 when I told them that it was time to buy. On the way up, those same subscribers had the opportunity to capture a slew of double- and triple-digit winners like CNH Industrial NV (NYSE:CNHI), Navios Maritime Holdings Inc. (NYSE:NM), and ABB Ltd. (NYSE:ABB) which we closed out recommendations at 104.43%, 104.05%, and 103.12% in three trades, respectively.

Most recently, on November 5, I called for a significant Trump-induced bump on national television should he win at a time when people like Nobel-winning economist Dr. Paul Krugman were almost uniformly predicting a massive crash. In fact, the exact term I used was a “rip your face off rally.”

My point is not to brag. In fact, quite the opposite. What I want you to understand is that there are always two sides to the story. Being profitable is more important than being “right.”

So how do you do the same thing, especially now that markets are tapping new all-time highs?

Three Ways to Remove Emotion from the Equation

Success comes down to removing emotion from the equation… actually, in much the same way injuries removed the emotional processing from individuals in the research I just told you about.

First, use a “risk-parity” portfolio model like the 50-40-10. Wall Street will try to convince you that diversification is the way to go, because not all assets go down at once if things blow up. But there’s a flaw in that model. Spreading your money out to get the lowest mean gains is not a recipe for wealth – in fact, it leaves you at the mercy of unseen risks.

Just ask anybody who got “halved” twice in the last decade how “diversification” worked out! Long story short, it didn’t. The best professional investors of our time DO NOT blindly distribute their money across a slew of asset classes, and you shouldn’t either.

The better way to go is a “risk-parity” model, like the 50-40-10 portfolio I advocate in the Money Map Report. (I’ll show you exactly how in an upcoming column.) By concentrating assets and periodically rebalancing between core assets, growth/income, and speculative positions, you are effectively “forcing” yourself to buy low and sell high using proven logic – not emotion. Plus, this keeps performance-robbing fees low, which Wall Street hates but you’ll love because it can add a lot to your returns over time.

Second, capitalize on chaos. If you’re like me, you grew up with “buy low, sell high” being pounded into your head. It’s absolutely true – but emotion makes that maxim hard to apply. Knowing that everybody else is panicking should be an open invitation to put new capital to work when prices are low. The key is buying companies that have solid business models and long-term growth potential at a time when they’ve been temporarily put on sale by short-term events.

Third, use simple trailing stops to protect your capital and control risk. The goal here is, again, to remove emotion from the equation. Having a trailing stop percent that’s pre-selected the moment you buy something helps you do just that. I typically recommend setting a 25% trailing stop on most investments. As an added benefit, trailing stops help you maintain a calm, reasoned perspective at times when everybody else is seemingly losing their minds (and making tremendously costly decisions that are not in their best interest). Most online platforms have stops built in. So there’s no excuse for not using them.

To be fair, the common complaint I get on trailing stops is that they force you to sell when you may not want to. I hear ya, which is why I’d like to point out that you can use options or inverse funds to accomplish the same thing.

For now, just remember, the more “sophisticated” you get, the higher the risk of emotional decision-making. And that’s not the goal.

Simplicity, security, and the tactics needed to harvest big profits – that’s the goal and…

…the path to profits.

I’ll be with you every step of the way!

Best regards for great investing,

Keith

[ad#mmpress]

Source: Total Wealth Research