Donald Trump has income investors scrambling for rate-hike (and even inflation) insurance. Fixed yields are out, while floating yields – which adjust higher in tandem with rates – are in.

Even if you’re skeptical (as I am) that we’ll see rates continue meaningfully higher anytime soon, inflation insurance is never a bad thing provided that:

- It pays a decent current yield (sorry, gold).

- We can buy it at a fair price.

The sudden popularity of “floating rate” issues may have you rightfully wondering whether or not this trade is already too crowded. Fortunately, my preferred vehicle for buying them is currently out of favor itself! And that presents us with some potential deals.

Closed-End Funds Trading at Discounts

Closed-end funds (CEFs) are a great place for contrary-minded income seekers like us to comb through.

[ad#Google Adsense 336×280-IA]Unlike mutual funds, they have fixed pools of shares, like stocks.

Which means they trade like equities – swinging up and down wildly, often for no good reason.

When investors decide CEFs are no good, they dump these issues below their net asset values (NAVs), or the value of their underlying assets.

When a fund trades for a 10% discount to its NAV, you’re able to buy its holdings for just 90 cents on the dollar.

This is basically “free money” because these underlying assets are constantly marked to market. If a fund trades at a 10% discount, management could theoretically liquidate the fund and cash out everyone at fair value immediately. Or it can buy back its own shares to close the discount window (and boost the share price).

If you choose wisely, you can even buy a fund managed by the best bond minds on the planet. Like DoubleLine’s Jeffrey Gundlach, or PIMCO’s Dan Ivascyn.

A drawback of CEFs? The current headline concern is that they don’t do well when rates rise. These funds are able to use leverage and borrow cheap – at the LIBOR rate, which is just 0.88%. A more hawkish Fed may move LIBOR higher, and end the cheap money party for CEFs.

That’s the theory, at least. In practice, it’s wrong. Historically higher rates have been no problem at all for CEFs. During the last major rate hike period (2004 to 2006), blue chip CEFs beat the broader market easily:

Higher Rates No Problem for Top Closed-Ends 2004-06

Overhyped Worries Make Floating Rate CEFs Cheap

Overhyped Worries Make Floating Rate CEFs Cheap

CEFs themselves aren’t a distinct investment class. They’re just a vehicle, like mutual funds, with varieties of managers, mandates and investment strategies.

Since closed-ends tend to pay higher yields, investors hear “higher rates” and think, “sell CEFs.” In doing so, they indiscriminately toss some excellent funds in the bargain bin.

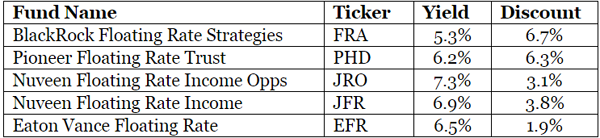

And that’s where we can find some floating rate bargains today. Here are five floating rate bond funds paying 5.3% to 7.3% yields discounts or more currently trading at discounts up to 6.7%:

— Brett Owens

— Brett Owens

[ad#contrarian outlook]

Source: Contrarian Outlook