Everyone wants a high yield with low risk. But that’s incredibly tough to find.

If a stock has a safe and high yield, investors will pour into it, driving the stock price higher and the yield lower.

But there’s a little-known energy company that has a rock-solid dividend and a strong 7% yield.

[ad#Google Adsense 336×280-IA]Now the stock doesn’t have much trading volume.

You always want to be careful about stocks with low liquidity because, if you need to exit the position, you may not be able to get out at a price you’re happy with.

To be clear, I’m not making a recommendation today.

I’m just commenting on the safety of one company’s distribution.

Tallgrass Energy Partners (NYSE: TEP) is a master limited partnership (MLP). It operates oil and gas pipelines and processing plants.

It’s been publicly traded for only three years, so it doesn’t have much of a distribution history (MLPs pay distributions, not dividends).

But its short history is impressive. The company has raised its distribution every quarter since it began paying one in July 2013.

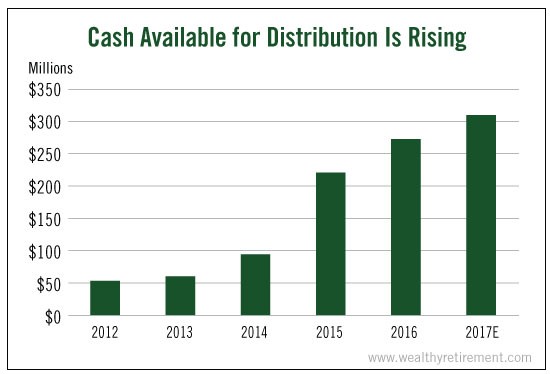

And its company’s cash available for distribution (a measure of cash flow) has exploded higher over the years.

Last year, it generated $221 million in cash while paying $140 million in distributions for a payout ratio of 64%. Payout ratio is the percentage of cash flow or earnings paid out in dividends or distributions.

Companies with payout ratios of 75% or less give me confidence that the dividend won’t be cut if the company experiences a tough year or two.

This year, Tallgrass’ cash available for distribution is expected to rocket 24% higher and another 15% next year.

All that cash means Tallgrass should have no problems paying and raising its distribution.

All that cash means Tallgrass should have no problems paying and raising its distribution.

Growing cash flow, a reasonable payout ratio and a commitment to raising its distribution should ensure that investors remain happy with their payouts for the next few years.

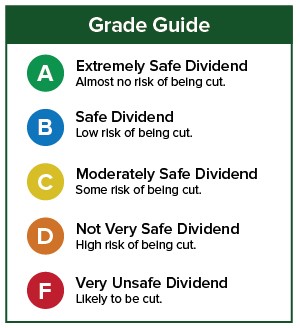

Only 10 companies with SafetyNet Pro’s highest rating have yields above 5%, and Tallgrass Energy Partners is one of them.

Dividend Safety Rating: A

Good investing,

Marc

[ad#wyatt-income]

Source: Wealthy Retirement