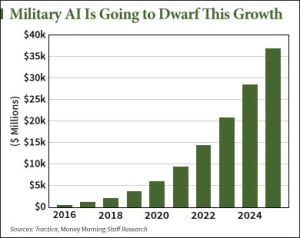

We’ve been talking about the defense “supercycle” of spending – set to last for at least a decade – that’s only just beginning to ramp up. But there’s one segment in this broad category that’s already seeing huge amounts of increased spending.

Now, time was, this sector was more science fiction than actual, deployable technology.

[ad#Google Adsense 336×280-IA]But an increase in computing speeds and a renewed focus on deploying “smart” technology means that this industry is actually in a supercycle inside a supercycle.

In fact, online research firm MarketsandMarkets projects that the $420 million market in 2014 will explode in the next five years to $5 billion – that’s a CAGR of nearly 54% for the next five years.

Another study by techemergence.com anticipates an $8.3 trillion market by 2035 in the U.S. alone.

From $420 million to $8.3 trillion in just 20 years… Much of that windfall will come from one whale of a customer: the United States government.

I’m going to show you how to tap this growth dynamo quickly and easily, so you can get positioned for maximum upside as this trend takes off.

The Military Is Getting Smart About Artificial Intelligence

Like I said, this sounds like sci-fi, but the truth is, artificial intelligence – at least in concept – has been with us a long time.

Like I said, this sounds like sci-fi, but the truth is, artificial intelligence – at least in concept – has been with us a long time.

You could say the discipline started with Aristotle in the mid-3rd century BCE, with syllogism: formal, mechanical thought.

But beyond that, we have to fast-forward to the 1950s, when British mathematician and cryptologist Alan Turing developed his “Turing Test” to measure machine intelligence.

In any case, artificial intelligence has grown up significantly in the past 10 years. Nowadays, they have added a new ‘AI’, artificial intuition, and in some circles talk about ‘AI squared’ now.

Maybe you remember the computer HAL 9000 (one letter apart from IBM) in Arthur C. Clarke’s “2001: A Space Odyssey.” HAL was an AI computer that ran the ship for the astronauts… but saw more value in killing them than helping them in the end.

The point is, from that scary vision of smart computing, we now see AI everywhere. We can talk to our phones and ask for directions for a nearby restaurant. We can simultaneously translate and write or pronounce foreign languages. Cars can parallel park themselves.

This technology, which had found very few uses until computing power had become exponentially bigger and faster, is now being deployed everywhere.

But the most important AI work is being done in cybersecurity, intelligence, and for the military.

As we have seen in this election cycle, with private servers, WikiLeaks, and hacked emails becoming the focus of most of the back and forth in this presidential election, staying ahead of the hackers is becoming exceedingly important.

AI helps by finding patterns as well as “thinking on the fly” about how to adapt to cyberattacks. In intelligence work, AI builds strong real-time networks and signals (photographic, digital, and communications) analysis, which comes in handy whether you’re fighting Russian and Chinese hackers or Daeesh.

AI is a huge development for investors as well…

The Very Best Artificial Intelligence Play

There are dozens of ways to play this AI bonanza. But the easiest, high-upside play in this rapidly emerging field is surprising. In fact, you may even own the shares already – though if you do, this is the perfect time to add more.

I’m talking about Microsoft Corp. (Nasdaq: MSFT).

The reason I like Microsoft so much is because it is already a major player with the U.S. government.

It takes a massive amount of time and effort to become a major government contractor. It also takes some serious work to become a leading enterprise software provider. Microsoft has accomplished both.

These are competitive moats that will keep the big competition away and allow Microsoft to seek out the best potential small firms to buy out and incorporate into its own operations.

Buying into tech doesn’t mean buying the coolest or fastest-growing firm, it means finding companies that are on track to dominate the competitive sectors it wants to compete in. And when you’re stepping into the fast-moving waters of AI, it’s wise to start with quality first.

Microsoft dominates the enterprise software market, bringing around $46 billion in revenue annually from enterprise software. Its closest competitor sits at about $30 billion in revenue.

And the U.S. Army, Navy, and Air Force already represent three of Microsoft’s top five enterprise customers. Microsoft builds a flight simulator that the armed forces use for training, for instance. In civilian branches of government, Microsoft also has a very strong presence.

But the most interesting fact about Microsoft’s competitive moat in the U.S. federal sector is the fact that while the military and civilian sectors account for about half of the company’s federal revenue, the intelligence community makes up for more than half that federal enterprise revenue, according to Curt Kulcan, VP of Microsoft’s U.S. public sector division. Kulcan also noted that the intelligence sector is seeing the biggest growth of any government sector.

Microsoft Has Never Looked Stronger

Just a handful of years ago, it looked like Microsoft was fighting for its existence. An old licensing revenue model; bad operating system upgrades that were milking customers for revenue more than providing quality innovations; some ridiculous mergers and acquisitions; and missing out on the mobile movement, had slammed the company.

[ad#Google Adsense 336×280-IA]But in February 2014, Satya Nadella took over as CEO.

He started to clean house.

He scrapped much of the mobile phone division, built a subscription-based revenue stream rather than a licensing one, and focused on building out the technologies that had a future.

And Nadella would be the one to know, since he had been in Microsoft’s R&D department since 1992.

Charles de Gaulle once observed that the cemeteries are littered with the bodies of “indispensable” men.

And the same can be said of the tech graveyard. Companies that can’t adapt die. And the fastest way to die is by constricting your product pipeline from “lab to fab.” Nadella understood this and revitalized Microsoft.

It’s most recent quarterly numbers certainly bear this out:

Commercial software and cloud-based services revenues were up yet again, by 5%. But within this number is the fact that its Office 365 revenue was up 51%.

Office consumer and cloud services revenues were up 8%. At Azure, its cloud storage division, revenue increased a stunning 116%. Free cash flow is also growing back to the size it was in the “good old days.”

According to techemergence.com, less than 1% of medium-to-large companies in the U.S. are doing any work in AI on a regular basis. For Microsoft, this is a big opportunity to grow its position not only in the public sector, but the private one as well.

— Michael A. Robinson

[ad#mmpress]

Source: Money Morning