It’s not easy to care for our aging, chronically ill relatives and friends. It’s vital work, but it often requires costly medicines and treatments and around-the-clock care.

Most families make it a priority to get their sick and elderly relatives the care they need, but sometimes they’re forced to seek professional help.

[ad#Google Adsense 336×280-IA]Luckily, there are plenty of good options to consider.

And Kindred Healthcare Inc. (NYSE: KND) administers many of them.

Kindred operates hospitals, nursing centers and assisted living facilities.

The majority of patients in Kindred’s facilities are very ill and need a lot of care, so the company profits by providing this invaluable assistance.

Robust business should benefit Kindred Healthcare’s bottom line… but let’s look at the health of its dividend.

Free Cash Flow Is Getting Better

In order to analyze any dividend, we have to look at free cash flow.

Free cash flow is a measure of the company’s liquidity and its ability to make every dividend payment. And Kindred Healthcare’s cash flow is improving.

In 2015, the company generated $21.4 million of free cash flow – up 135% from $9.1 million in 2014.

That’s a big increase. But Kindred’s 2015 numbers aren’t nearly as healthy as they were in 2012. Back then, it banked $97.1 million.

Free cash flow is expected to continue recovering this year and next year. Analysts expect the company to produce $37.3 million in 2016 and $131.1 million in 2017.

Based solely on its ability to generate cash, Kindred’s dividend safety rating is on the verge of an upgrade.

But let’s find out if the company’s cash will continue to cover its dividend each year.

Payout Ratio Falls in Line

Kindred Healthcare spends approximately $40 million a year on dividend payments. In 2015, the company’s free cash flow didn’t cover it.

The dividend to free cash flow payout ratio was 187%. That’s way above the 75% maximum we like to see for a healthy dividend.

This year, the company’s cash flow won’t cover the dividend either. Its payout ratio of 108% doesn’t guarantee dividend safety.

But analysts expect Kindred to comfortably fund its dividend with cash flow in 2017.

Companies with strong dividend track records will go to great lengths to preserve their payments and keep shareholders happy.

Unfortunately, Kindred Healthcare isn’t one of them.

The company began paying its $0.12 quarterly dividend in 2013. With just a three-year history of dividend payments, its management’s commitment is unproven.

If times get tough, the company may be more likely to cut its dividend than a company with a strong history would be.

Prognosis Improving – But Safety Still in Jeopardy

Kindred Healthcare’s free cash flow and dividend safety are on the road to recovery. But there is still a lot of rehabilitation to go.

Kindred Healthcare’s free cash flow and dividend safety are on the road to recovery. But there is still a lot of rehabilitation to go.

The company still has to prove it can meet and beat expectations. It also has to prove its commitment to its dividend.

Rising free cash flow and a falling payout ratio next year are both positives for future dividend health. But today, its dividend is in dire condition.

If Kindred’s free cash flow continues to move in the right direction, look for a safety upgrade next year.

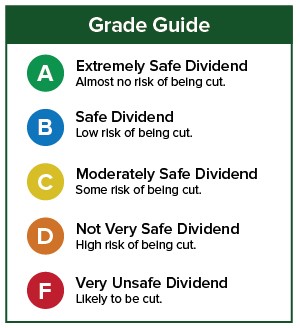

Dividend Safety Rating: F

— Kristen Haugk

[ad#IPM-article]

Source: Wealthy Retirement