We all know the secret to successful investing is buying low and selling high. But what does that mean, exactly – do we simply buy companies growing their top lines aggressively in today’s low-growth world?

There are dangers in this approach, which put you at risk for drastic losses. Take, for example, people who bought Twitter (TWTR) when its revenues were doubling, sure that they were getting a piece of the next big thing:

Big Losses for Twitter Enthusiasts

Smart, cautious investors avoid these dramatic losses by buying high quality, established companies when their earnings are cheap. Even better, they buy stocks that pay dividends – and raise them consistently.

Smart, cautious investors avoid these dramatic losses by buying high quality, established companies when their earnings are cheap. Even better, they buy stocks that pay dividends – and raise them consistently.

[ad#Google Adsense 336×280-IA]This is why Warren Buffett’s favorite holding time for an investment is “forever.”

He wants to buy good quality stocks that will pay him to keep those stocks.

This is also the secret to dividend growth investing, which has been a winning strategy for conservative investors for decades.

If you’re investing for retirement, dividend growth investing is your best bet to securing a growing passive income stream in the future.

There’s only one problem: there are thousands of dividend paying companies out there, and not all of them are promising investments.

Sure, you could buy an ETF like the SPDR S&P Dividend Fund (SDY), but a fund like this is blindly managed, meaning it will hold a lot of winners AND losers. It will also buy stocks when they are overpriced—a big concern now that the market continues to climb higher and higher.

With a bit of research, we can find dividend growth stocks that haven’t gotten to absurdly high levels in the last year with the broader market—yet they are stocks that also pay a solid and growing dividend.

How do we do this? Our goal should be to find stocks that have consistently grown earnings per share over the last 10 years but haven’t gone up more than 8% in the last year. This is getting harder to do, because returns for stocks are declining. A new McKinsey study concludes that returns from stocks are going down—which means there will be fewer and fewer stocks that keep growing their earnings into the future. Fortunately, there are four great stocks that fit the bill and that are worth buying right now.

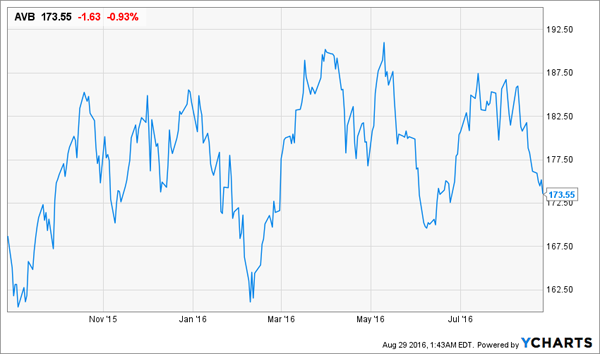

Let’s start with AvalonBay Communities (AVB), a real estate investment trust that has high-quality apartment complexes across America, from California to Massachusetts.

AvalonBay Stays Cheap—for Now

That national diversification means it can resist a downturn in one area, and its concentration in areas with population growth and high demand for housing (particularly California) helped power the stock up over 700% in the last 20 years. And the dividend? It’s 3.1% right now, having grown by over 50% in the last 5 years.

That national diversification means it can resist a downturn in one area, and its concentration in areas with population growth and high demand for housing (particularly California) helped power the stock up over 700% in the last 20 years. And the dividend? It’s 3.1% right now, having grown by over 50% in the last 5 years.

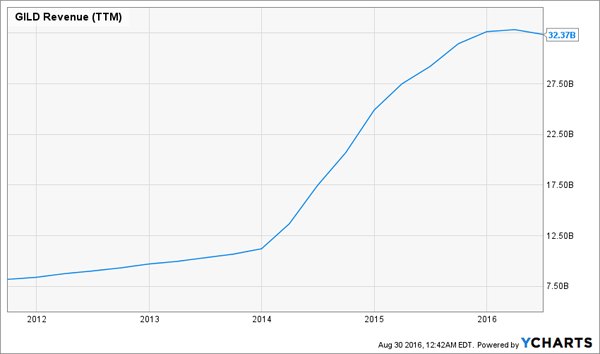

To diversify, let’s add Gilead Sciences (GILD), a massive pharmaceutical research firm that has been developing groundbreaking drugs that fight some of the worst diseases in the world. This is possibly one of the cheapest stocks on the planet right now:

The Market Abandons Gilead

Down over 26% in the last year, Gilead has suffered as investors have run away from pharma companies in general. There are also fears that AbbVie (ABBV) and Merck & Co. (MRK) are poised to steal market share from the company’s important hepatitis C drugs, which make up the majority of Gilead’s revenues. But so far, Gilead’s revenues have been quite resilient—although they aren’t as growing as massively as they used to:

Down over 26% in the last year, Gilead has suffered as investors have run away from pharma companies in general. There are also fears that AbbVie (ABBV) and Merck & Co. (MRK) are poised to steal market share from the company’s important hepatitis C drugs, which make up the majority of Gilead’s revenues. But so far, Gilead’s revenues have been quite resilient—although they aren’t as growing as massively as they used to:

Cash Keeps Coming in

On top of that, Gilead has grown its earnings per share (EPS) over 39% in the last 10 years, which has helped its dividend rise to 2.4%. Gilead just started paying a dividend last year, but with its $8.8 billion in cash on hand, Gilead is in a great position to keep paying dividends, and have them grow in the future.

On top of that, Gilead has grown its earnings per share (EPS) over 39% in the last 10 years, which has helped its dividend rise to 2.4%. Gilead just started paying a dividend last year, but with its $8.8 billion in cash on hand, Gilead is in a great position to keep paying dividends, and have them grow in the future.

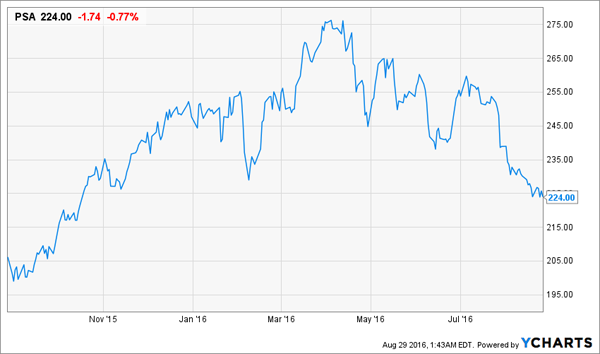

Going back to property, let’s now add Public Storage (PSA) to our portfolio. True, it’s paying just 3.2% in dividends, which is less than some other self-storage REITs, but it’s also one of the largest in the country.

Another Bargain Opportunity Appears

Its stated P/E ratio of 35 may appear a bit high, but PSA’s 12% EPS growth per year over the last decade proves its ability to keep paying out those dividends, and the company has had 8% year-over-year revenue growth throughout 2016. Analysts expect a similar growth rate for the foreseeable future. And with a profit margin over 50%, I see no reason to shy away from this company, especially since its dividend has grown by 89% in the last 5 years.

Its stated P/E ratio of 35 may appear a bit high, but PSA’s 12% EPS growth per year over the last decade proves its ability to keep paying out those dividends, and the company has had 8% year-over-year revenue growth throughout 2016. Analysts expect a similar growth rate for the foreseeable future. And with a profit margin over 50%, I see no reason to shy away from this company, especially since its dividend has grown by 89% in the last 5 years.

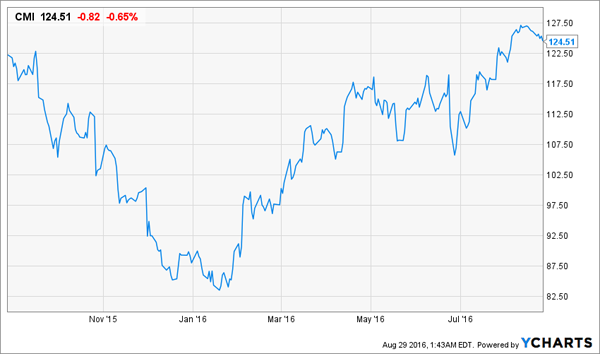

My final choice for this dividend growth portfolio? Cummins Inc. (CMI), a 3.3% yielder specializing in the manufacturing of diesel engines. I recently wrote about Cummins’s historical cycles—the company’s revenue growth tends to go up and down every few years, but free cash flow (FCF) stays constant. This makes CMI cheap when revenues are weak, but dividend growth will always remain strong. All of that leads me to one simple conclusion: CMI is on sale right now.

A Meager Recovery Means a Cheap Stock Now

This is an entirely different industry than our other picks, which is a good thing—we’re diversifying our exposure. And we’re also getting cheap growth. With a P/E ratio of 17 and a 10-year EPS growth rate of 11%, we are getting strong and consistent earnings growth at a ridiculous bargain. Also, dividends have grown at a monster rate: payouts have gone up 155% in the last 5 years. If that continues, the payouts we will get in just another 5 years will be substantial.

This is an entirely different industry than our other picks, which is a good thing—we’re diversifying our exposure. And we’re also getting cheap growth. With a P/E ratio of 17 and a 10-year EPS growth rate of 11%, we are getting strong and consistent earnings growth at a ridiculous bargain. Also, dividends have grown at a monster rate: payouts have gone up 155% in the last 5 years. If that continues, the payouts we will get in just another 5 years will be substantial.

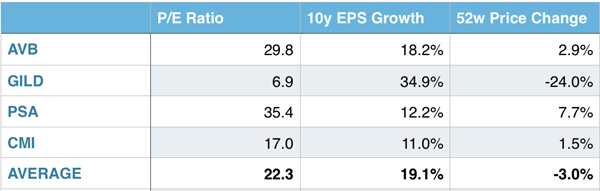

Putting it all together, we get a portfolio that looks like this:

Earnings Growth at a Low Price

On average, we’re getting a P/E ratio of about 22 (which is lower than the S&P 500), but we’re also getting EPS growth of 19% over the last decade. That’s a lot better than if we just bought an index fund, since the S&P 500’s EPS is pretty much flat over the last decade:

On average, we’re getting a P/E ratio of about 22 (which is lower than the S&P 500), but we’re also getting EPS growth of 19% over the last decade. That’s a lot better than if we just bought an index fund, since the S&P 500’s EPS is pretty much flat over the last decade:

The Market’s Earnings? Going Nowhere Fast

Now let’s take a look at the EPS for our picks:

Now let’s take a look at the EPS for our picks:

Earnings: Up and To the Right

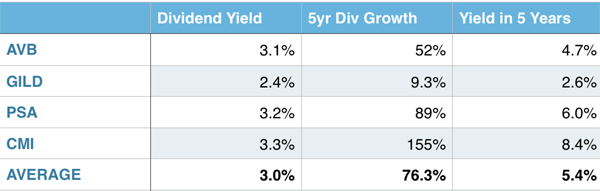

Quite a refreshing difference. But there’s even better news. If we take the dividend growth rate from the last 5 years and assume a similar growth rate for the next 5 years, we can project just how much our portfolio will yield in 2021. The result is amazing:

Quite a refreshing difference. But there’s even better news. If we take the dividend growth rate from the last 5 years and assume a similar growth rate for the next 5 years, we can project just how much our portfolio will yield in 2021. The result is amazing:

A High Yield from Cheap, Safe Stocks

Our four-stock portfolio will pay out a dividend of 5.4% based on our current price in just 5 years. That’s a massive dividend, higher than any you could get from risky junk bonds or many dangerous high yield investments that are out there.

Our four-stock portfolio will pay out a dividend of 5.4% based on our current price in just 5 years. That’s a massive dividend, higher than any you could get from risky junk bonds or many dangerous high yield investments that are out there.

This is why I am a fan of dividend growth stocks. Stocks’ ability to produce growing earnings is falling, which is why McKinsey is predicting an upcoming retirement crisis because investors will receive a lower return from their stock holdings than they are used to.

— Brett Owens

Sponsored Link: I’m helping my readers avoid this dilemma by highlighting dividend growth stocks that can buck the trend and continue their strong history of growing earnings – and I like three in particular as “best buys” right now. Click here and I’ll show you [more information] and will explain how right dividend growth stocks can help you avoid the looming retirement crisis by turning your portfolio into a nest egg that will last a lifetime.

Source: Contrarian Outlook