It seems oil’s big recovery may never come.

Last week, chatter from the IEA and Saudi Arabia helped oil rebound, but we’re still down 50% from 2014 prices.

What’s more, continuing concerns about energy companies’ ability to pay out dividends has caused massive declines for many stocks in 2016, even after steep losses spanning two years.

[ad#Google Adsense 336×280-IA]Some people are giving up on energy altogether.

But that would be a mistake.

Now that oil is low, we contrarians can see which companies can survive in a world of cheap energy and which companies are woefully unprepared.

Surprisingly, a group of oil refineries are able to survive a world of sub-$40 oil, and now that crude has risen to over $43, these refineries are astoundingly underpriced.

Betting directly on oil itself is not only a headache, but also exposes investors to tremendous price fluctuations without an income stream. Finding the bottom is tough for anyone, as the negative balance sheets for oil producers demonstrates. But underpriced refineries provide secure high dividends with some additional price upside if energy rallies.

My top five? Valero Energy (VLO), Tesoro (TSO), Western Refining (WNR), Phillips 66 (PSX) and Marathon Petroleum Corporation (MPC).

Why these refineries in particular? Let me give you three good reasons.

#1: Cheap Valuations

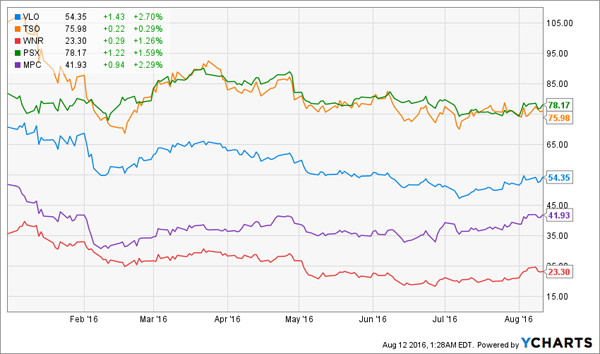

2016 has not been kind to any energy stock, and these refineries are no exception. On average, these stocks are down 22% year-to-date:

Falling Prices Despite Oil’s Resilience

If oil prices kept going down, this decline would make sense—but as I’ve said, oil is actually recovering in 2016. That means these companies’ abilities to turn a profit should improve, meaning this price decline is an irrational turn of the market.

On top of that, the decline in prices has caused the forward P/E Ratio for these companies to plummet:

Earnings on Sale

With an average P/E ratio of 15.2, these stocks are currently 40% cheaper than the S&P 500. And since these companies remain profitable—unlike big and supposedly safe energy companies like Chevron Corporation (CVX)—it also means we are not buying companies that are losing money.

#2: Healthy Operating Margins

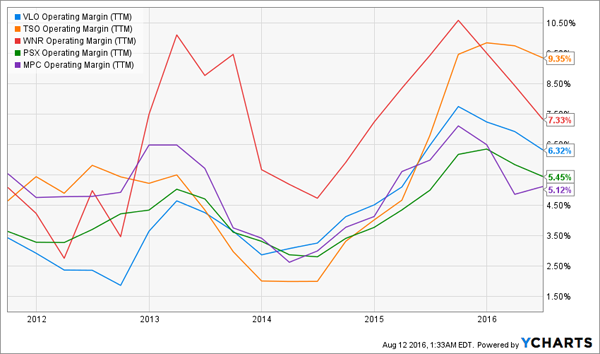

Despite crude’s price decline, refinery margins are actually on a long-term upswing:

Profitability is Improving

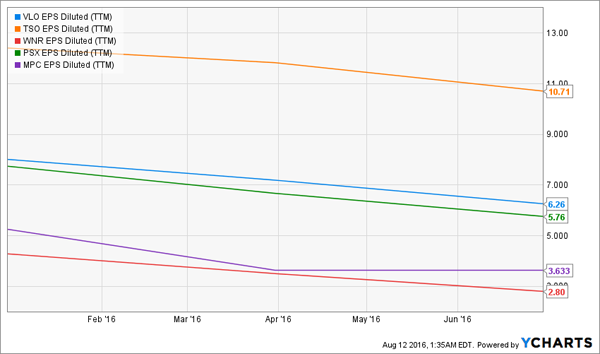

Last year was a period of margin improvement, and these firms have continued to be profitable even through the worst moments of 2014 when oil was falling fastest. As a result, EPS (while not growing by leaps and bounds) has at least remained positive over the last twelve months:

EPS Still High

And EPS still remains higher than dividends paid over the last twelve months for each company:

Dividend Coverage is Fine

Which means we can rest assured that our payouts from these companies are not threatened by cheap oil—and if energy continues to recover, our income may even grow.

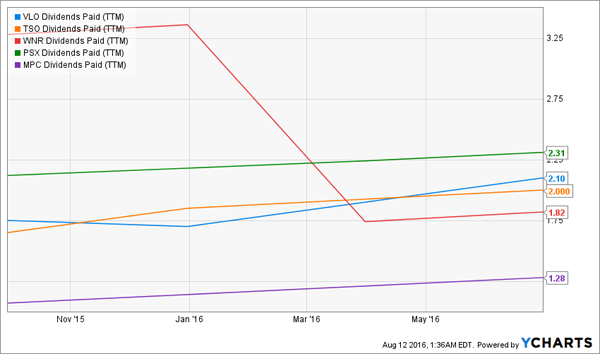

#3: Strong and Resilient Dividend Stream

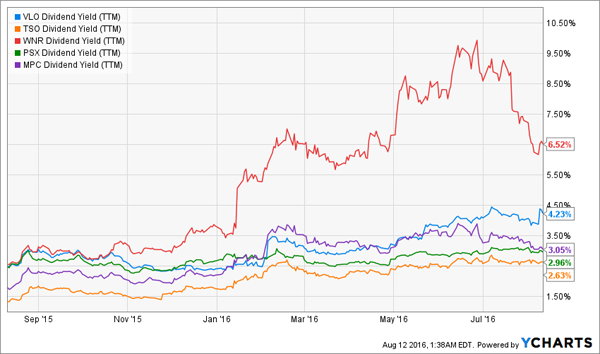

Buying these stocks at low levels gives us the potential for capital gains. And while we’re waiting for these stocks to move higher, we can get an average dividend yield of nearly 4%:

Big Dividends Just Got Bigger:

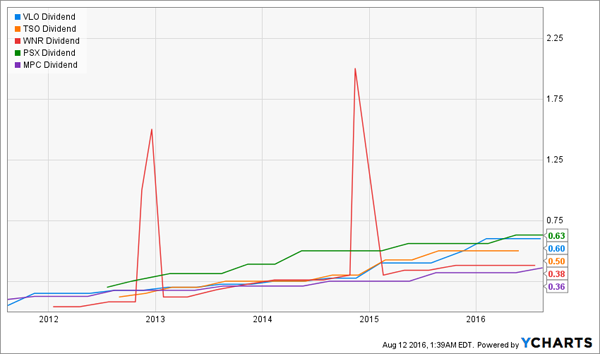

Worried about dividend cuts? Don’t be. These companies have all grown their dividends over the last five years:

Dividend Growth Continues for All

— Brett Owens

Sponsored Link: Of course, refineries are not true long-term buy and holds for a dividend growth portfolio. They are interesting speculations now, but I prefer stocks and funds with less sensitive business models that actually pay double these dividends – literally 8% or better each year.

The best bond manager on the planet is fond of these issues, too. He recently recommended them to Barron’s – which means the best time to buy these funds is right now. Their prices have already begun to move, and I don’t expect them to stay this cheap for much longer. Click here and I’ll show you how these funds can pay out so much and why you should buy them today.

Source: Contrarian Outlook