Last week, during a TV interview of a portfolio manager, the fact was dropped that the stock markets had declined in August each of the last seven years. That particular investment manager is bullish on stocks but is looking for a near-term pullback to provide better buying values.

In the real estate investment trust (REIT) sector, almost all stock prices have risen nicely this year.

[ad#Google Adsense 336×280-IA]It could be time to take some profits and then buy back in after share prices have dropped.

With my dividend-focused investment strategies, I divide REITs into two camps based on yield. With higher yield REITs, my primary focus is earning the dividend income stream.

I do not spend much time on market direction because I plan to earn that 6%, 7% or higher cash yield right through any downturns in the market.

And, we know that market declines happen, with a 10% or greater correction hitting the market on average once a year. High-yield shares are held continuously to make sure that the income stream never stops. With my high-yield REIT selections, market declines are viewed as opportunities to add shares in order to boost the overall portfolio yield.

The REITs I select with lower yields are purchased for a combination of the dividend yield plus share price gains. The reason yields on these stocks are lower is that the market expects greater earnings and dividend growth.

My return target on this type of REIT will be roughly the cash flow per share growth rate plus the current dividend yield. Here is a hypothetical example: A REIT yields 3% and my analysis forecasts 12% annual cash flow and dividend growth.

This stock should then theoretically over time produce a 15% average annual return. If the share price moves up rapidly in a short period of time, the return will get ahead of my target.

This is not a bad thing, but I will strongly consider selling all or some of my shares to lock in the gains. As noted above, the market will hit a downturn at some point and I can buy back in at a lower price.

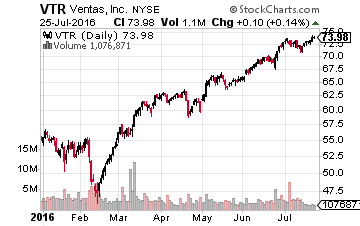

I did exactly that with Ventas, Inc. (NYSE: VTR) for subscribers of my Dividend Hunter newsletter.

I did exactly that with Ventas, Inc. (NYSE: VTR) for subscribers of my Dividend Hunter newsletter.

In January 2015, the REIT sector was hitting new highs, and the VTR yield had dropped below 4%, compared to the historical average of 4.5% to 5%.

I recommended selling the stock at $80, locking in a 21% gain from when I first recommended buying VTR.

Seven months later, the share price was down to $55 and I re-added Ventas to my recommendations list.

Since then, the stock has returned 38%, and I am again reviewing the company with an eye towards closing the position.

Higher share prices mean lower yields, which mean a lower expected total return going forward.

Higher share prices mean lower yields, which mean a lower expected total return going forward.

The REIT sector has been hot for the first half of 2016, so it may be time to sell and lock in some of those gains.

Here are seven REITs whose yields have fallen to very low levels and are showing nice share price gains.

If the market repeats history and drops in August, these same stocks will be available with lower prices and higher yields in the near future.

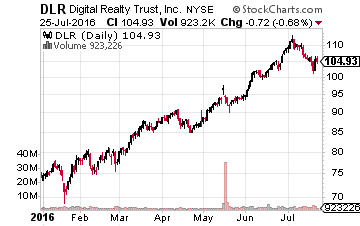

Digital Realty Trust, Inc. (NYSE: DLR) is one of the very hot data center REITs.

Digital Realty Trust, Inc. (NYSE: DLR) is one of the very hot data center REITs.

The DLR share price is up 38% so far in 2016 and the yield has dropped from around 4.5% to 3.4%.

On a pullback, this stock would again be attractive when the yield is back up to 4.5%.

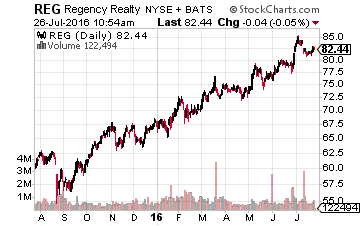

Regency Centers Corp (NYSE:REG) is a shopping center REIT, another group that has done very well in 2016.

The share price is up 21% year-to-date and the current yield is a measly 2.4%.

Taking a profit would provide cash that could be put to work at a significantly higher yield.

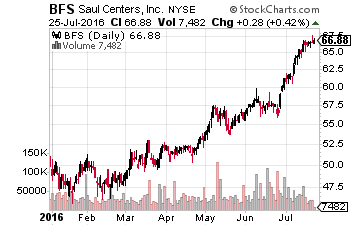

The share price of Saul Centers Inc. (NYSE: BFS) has gained over 30% in 2016. BFS now yields 2.8%. 30% is three to four years of expected gains on a REIT like this. Sell and consider buying back when the yield is again in the high 3% range.

The share price of Saul Centers Inc. (NYSE: BFS) has gained over 30% in 2016. BFS now yields 2.8%. 30% is three to four years of expected gains on a REIT like this. Sell and consider buying back when the yield is again in the high 3% range.

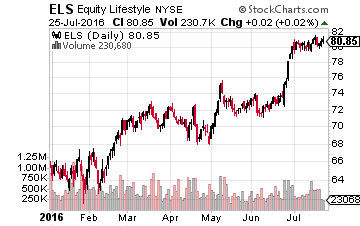

Equity Lifestyle Properties, Inc. (NYSE: ELS) owns manufactured home and RV parks.

Equity Lifestyle Properties, Inc. (NYSE: ELS) owns manufactured home and RV parks.

The ELS share price is up 21% in 2016 and up 40% over the last 12 months.

The current yield is just 2.1%. Take some profits!

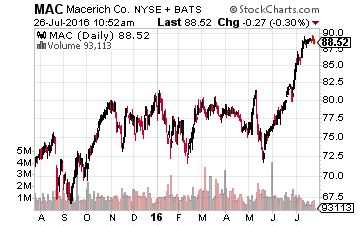

Macerich Co. (NYSE:MAC) is up 11% year-to-date, but the share value has gained 20% in just the last two months. MAC yields 3.1%

Macerich Co. (NYSE:MAC) is up 11% year-to-date, but the share value has gained 20% in just the last two months. MAC yields 3.1%

This is not a high growth rate REIT, so investors who bought in the last two to four months should take advantage and take some profits.

If you own any of these stocks and do sell them, consider investing those earnings back into a higher yielding stock.

Doing this will immediately increase your investing income, and if you pick the right stock, you might once again find yourself with capital gains that can be realized and invested again.

Doing this just a few times, you will see your investing income rise exponentially.

— Tim Plaehn

[ad#ia-tim]

Source: Investors Alley