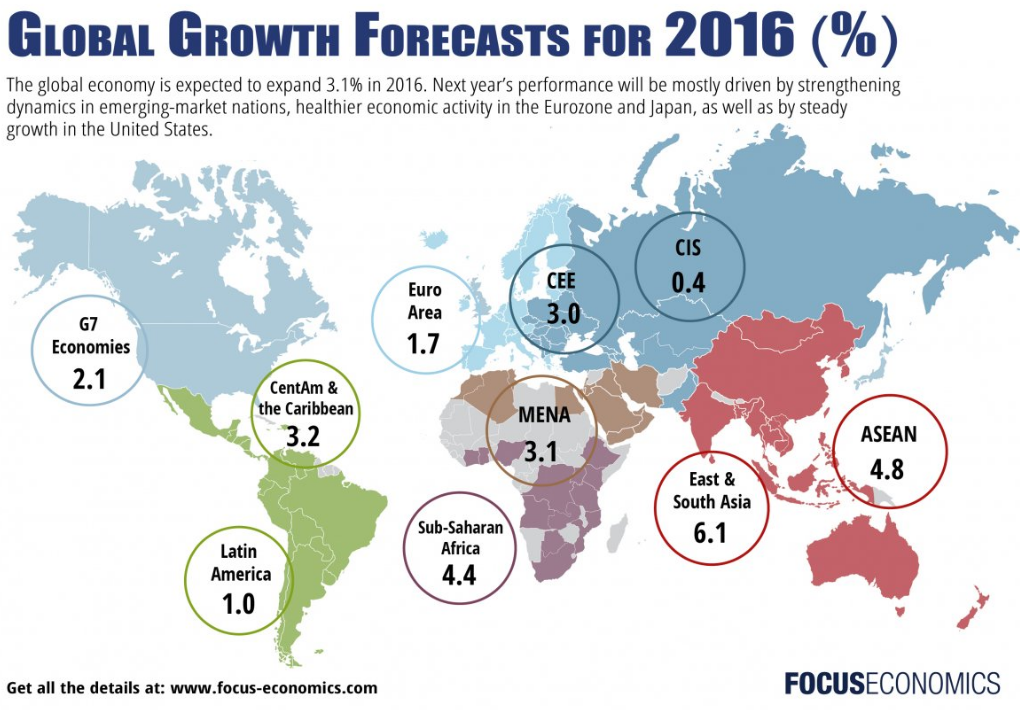

I have spent a lot of time since returning from speaking at the Money Show out at Las Vegas earlier in the month catching up on my reading. Unfortunately, not much that I have reviewed points to much strength in the domestic economy and worldwide activity remains at its lowest levels since 2009. Global demand looks like it will be anemic at least through year-end.

While the United States remains the best house in a bad neighborhood, it is still a fixer-upper home at the moment. We have a contentious presidential election coming up with two candidates that already have the highest unfavorable rating measures in the modern era; these numbers come in before either candidate has spent billions on attack ads.

While the United States remains the best house in a bad neighborhood, it is still a fixer-upper home at the moment. We have a contentious presidential election coming up with two candidates that already have the highest unfavorable rating measures in the modern era; these numbers come in before either candidate has spent billions on attack ads.

[ad#Google Adsense 336×280-IA]Murder rates just had their biggest percentage annual advance in major cities since at least 1960 and the economy has not grown at historical trend levels in some 15 years now.

In short, there is a lot of angst, anger, and anxiety in the general population right now and with good reason.

From an economic view, there are myriad items to be concerned about right now.

We continue to be in the weakest post-war recovery on record despite adding some $8 trillion to the national debt since the financial crisis.

This historically weak rebound has also occurred despite the Federal Reserve quintupling its balance sheet and keeping interest rates near zero for almost a decade now.

It is not only the massive debt at the federal level that should have investors worried on a long-term basis, it is the debt levels both on the personal and corporate sides of the ledger. The huge burden that over $1 trillion in student loans has put on the young has been in the headlines this year leading into the election; although, not as much has been said about the massive default rates in that area of credit. The average graduate who has taken on student loans graduates with between $25,000 and $30,000 in total debt these days.

However, student loans are not the only debt weighing the consumer down. U.S. credit-card balances are set to crack the one-trillion-dollar mark by the end of the year. This would be right near the record $1.02 trillion for credit-card loans registered in July 2008 just before the implosion at Lehman threw the nation into the financial crisis.

Total auto loan debt in the U.S. has now reached $1.1 trillion, up 30% from its pre-recession peak. In addition, a significant share of those auto loans are being made to people with lower credit scores who are much more likely to default should the economy downshift into a recession at some point on the horizon. Ironically, car payments tend to be 45% to 75% higher than the average student debt payment and yet we are seeing much less focus here by politicians as a potential problem point.

This indebtedness is one reason consumer spending has been so tepid despite a huge gasoline “tax cut” and solid but not spectacular job growth. It is also a key reason quarterly results just reported from Macy’s (NYSE: M), Nordstroms (NYSE: JWN), Target (TGT), The Gap (NYSE: GPS) and many other well-known retailers were so dismal. The continued migration to online retailers like Amazon (NASDAQ: AMZN) was another key factor. These are the main reasons I continue to be substantially underweight the retail sector in my own portfolio.

On the corporate side, corporations are increasing debt to finance stock buybacks as that is one of the few ways they can achieve any sort of earnings per share growth due to the anemic global backdrop. Cash balances among the non-financial part of the S&P 500 grew one percent to $1.84 trillion in 2015 according to S&P Global Ratings. 51% of this cash was held by just 25 companies, up from 38% five years ago.

Debt, however, at these same firms grew some 15% to $6.6 trillion in 2015, obviously an unsustainable pace. Some sectors of the economy are already paying for the imprudent growth of debt. This is particularly true in the energy sector which has already seen more defaults and bankruptcies in the first four months of 2016 than in all of 2015, which in turn saw much higher defaults than in 2014.

Even with crude rising some 80% from its lows in February, many more small and mid-tier energy players will declare bankruptcy this year. This is why I continue to underweight this sector as well as mining which faces many of same concerns.

Debt becomes harder to service in a low-growth economy even with today’s historically low interest rates which will eventually have to rise.

Debt becomes harder to service in a low-growth economy even with today’s historically low interest rates which will eventually have to rise.

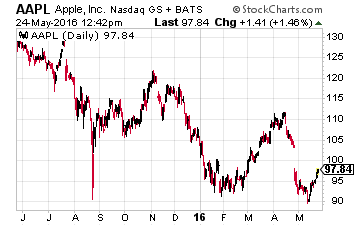

It is one reason I continue to favor large cap names with pristine balance sheets.

These include Apple (NASDAQ: AAPL) despite its recent challenges.

At around 10 times trailing earnings with almost a 2.5% dividend yield, a lot of bad news is priced into the stock and it really sells more like eight times earnings if one accounts for the huge amount of net cash on the balance sheet.

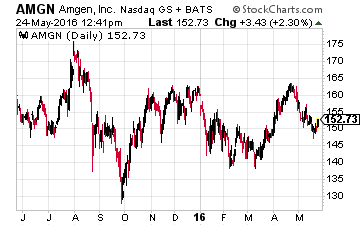

A slew of large biotech names like Amgen (NASDAQ: AMGN) and Gilead Sciences (NASDAQ: GILD) also sell for less than the overall market multiple, have no net debt on their balance sheets, deep pipelines and also yield over two percent.

A slew of large biotech names like Amgen (NASDAQ: AMGN) and Gilead Sciences (NASDAQ: GILD) also sell for less than the overall market multiple, have no net debt on their balance sheets, deep pipelines and also yield over two percent.

Given their financial flexibility, they are well-positioned to make strategic acquisitions to boost growth in the coming quarters.

Not the most exciting game plan. However, given the market is likely to trade sideways at best until earnings growth returns and the state of the balance sheets of consumers, corporations and the nation improve, it is probably a prudent one.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley

Positions: Long AAPL, AMGN, GILD, M