Yesterday, I shared the best investors you’ve never heard of.

Today, we’ll look at the best investing strategy you’ve never heard of.

I LOVE this strategy… Here’s why:

- It has beaten the stock market… with less risk than the stock market.

- It had only one losing year in 40 years – and that was a loss of 0.6% in 2008, when everything else fell 30% or more.

- It’s so simple a monkey could follow it… It takes five minutes of work a month.

With those three things going for it, how could you NOT want to know how this works?

The beauty of this strategy is its simplicity…

You don’t need to know anything about interest rates, price-to-earnings ratios, elections, wars, or anything else. You don’t need to know anything about “the fundamentals” at all.

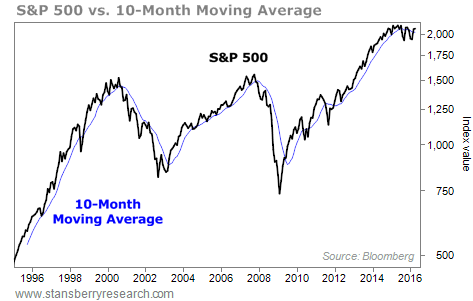

All you need to know is that if the black line is above the blue line, the trend is up. That’s it. Take a look…

When the black line is above the blue line, you want to own stocks. When the black line is below the blue line, you want to be out of stocks. Simple.

The black line is the stock market. The blue line is the “trend” line. (Exactly what the trend line is isn’t that important. But in this case, it is the stock market’s 10-month moving average.)

[ad#Google Adsense 336×280-IA]When the black line is above the blue line, you typically make money in stocks.

Specifically, stocks went up at a double-digit compound annual rate when they were above the blue line.

When the black line is below the blue line, you typically lose money in stocks.

This is the stock market portion of the strategy.

But you do the same thing for other kinds of assets as well… You use the exact same signal (the 10-month moving average) to determine whether to be in or out of bonds, commodities, or anything else.

In short, the strategy only looks at five asset classes. You either own them or you don’t. So you could theoretically be 0% invested.

My friend Meb Faber literally wrote the book on the strategy. (You can read his white paper on it, covering the years 1973 to 2012, here.)

As I write today, Meb’s system is 100% invested. Here’s how it’s allocated:

• 20% U.S. stocks,

• 20% foreign stocks,

• 20% bonds,

• 20% real estate (REITs), and

• 20% commodities

Again, from 1973 to 2012 – the time frame his white paper covers – this strategy beat the stock market, with much less volatility. It only had one losing year – a small loss in 2008.

Best of all, it takes five minutes a month to implement…

If the trend is up in each asset, you own it. If the trend is down, you don’t own it.

Sticking with the trend works far better than most people can imagine. Meb’s simple, fantastic system is yet another example of it…

Good investing,

Steve

[ad#stansberry-ps]

Source: Daily Wealth