Don’t give up on coffee yet.

The price of coffee hasn’t moved much since I told you several weeks ago that it may finally be breaking out to the upside.

But if you take a closer look at its current setup, you can see that coffee still looks poised for big gains – possibly starting soon.

Let me explain…

Here’s a look at an updated chart of coffee prices…

After my essay in mid-March (shown by the red arrow), the price of coffee jumped about 10%. But it never made it up to my minimum target of $1.48. Instead, the price peaked at $1.35 and then started to slowly drift back down to where it sits today at $1.19.

[ad#Google Adsense 336×280-IA]The chart has support at about $1.15, so owning coffee at this level doesn’t carry much downside risk.

But the chart setup isn’t especially bullish.

There’s no obvious bottoming pattern… and nothing implies that we’ll see an impending move higher off this level.

It just looks like coffee is stuck in a choppy trading range.

If you bought shares of the iPath Bloomberg Coffee Subindex Total Return Fund (JO) – an exchange-traded note that uses the futures market to track coffee’s performance – on my recommendation back in March, you may be tempted to give up on the trade and move on.

Don’t do it.

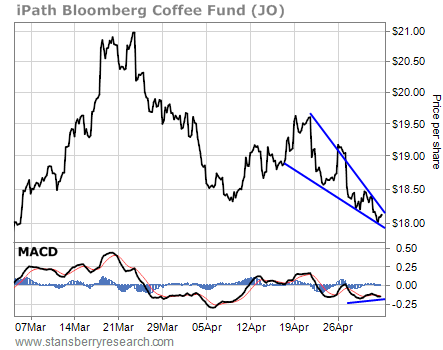

If you shorten the time frame and look at a 60-minute chart of JO, you’ll see an emerging bullish pattern. Take a look…

This chart shows a bullish falling-wedge pattern with positive divergence on the moving average convergence divergence (MACD) momentum indicator. We’ve seen many times before how this type of pattern often breaks out to the upside and leads to a quick move higher.

Since this is a 60-minute chart and JO is approaching the apex of the wedge, we should see a breakout occur within the next two or three days. And depending on the nature and size of that impending move, the action just might be enough to create a more bullish setup on coffee’s daily chart.

So as I wrote earlier, it doesn’t look like owning coffee is too risky at this level. But we could be on the verge of a solid move higher in the short term. And that jump might be enough to kick off the intermediate-term rally we’ve been waiting for.

Best regards and good trading,

Jeff Clark

[ad#stansberry-ps]

Source: Growth Stock Wire