Higher returns with less risk…

Sound too good to be true? It isn’t, as I’ll show today.

There’s a simple way to generate higher returns with less risk in the markets. It’s not difficult.

[ad#Google Adsense 336×280-IA]It simply requires taking a single step that I’d bet 99% of investors never consider.

Let me explain…

I’m talking about short-selling: attempting to profit from stocks falling in price.

Now, betting against stocks is a tough business.

That’s a big reason why the sophisticated computers behind my True Wealth Systems service haven’t signaled a “short” trade until earlier this year.

But the value of shorting isn’t just to profit from the downside… It is overall portfolio protection.

Let me show you with a visual example…

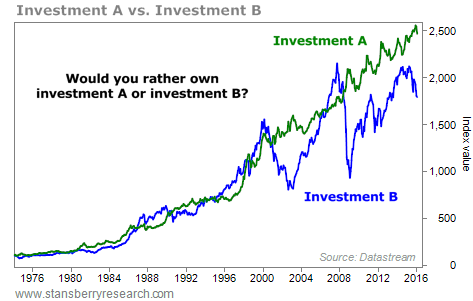

Which investment would you rather own?

1. The upper line, which smoothly goes from lower left to upper right? or

2. The lower line, which takes a much more jagged path?

The answer is “A” – because it gives you higher returns with less volatility.

The lower line is a major index of stocks. You can see the bust in 2008 and the recent correction.

The upper line is a similar index of stocks – that includes short-selling.

What? Isn’t short-selling dangerous? How can it have lower risk than the overall stock market? And how could it have BETTER returns?

You are asking the right questions…

Let me give you some answers…

My research team and I have spent years developing money-making systems… systems that can earn large profits in dozens of sectors and markets around the globe. But the core principle behind nearly all of these systems was going long. Without explicitly saying it, this was our mantra:

Markets have a major upward bias. So we want to focus on finding the absolute best times to buy… And we want to step aside and not worry about profiting when markets fall.

This idea served us well. Since launching True Wealth Systems in 2011, we’ve closed several triple-digit winners. And following all of our TWS recommendations would have drastically outperformed the overall market.

There were two main reasons why we’d never even considered shorting until that point…

- For the past five years, stocks have basically been going up, and we have correctly been on board with that uptrend, not betting against it.

- It is extremely difficult to consistently make money betting on the downside (based on our historical testing).

Now, stocks were up big, again, in the recent weeks. Personally, I believe higher prices are entirely possible… But I can’t know the future. And either way, we’re now seven years into this bull market, which means we’re likely closer to the end than the beginning.

The second point above is also important… Historical testing shows that it is very difficult to profit consistently from shorting. Markets do have a major upward bias. And that makes betting against them a challenge. But it begs a different question…

What’s the real reason you should consider taking a short position?

The best answer isn’t about making large profits. It’s this:

To protect your overall portfolio no matter what happens in the market.

The chart above shows this in action. Shorting, done right, can lead to large returns with much lower risk.

I know it’s something most investors will never consider. But it’s a powerful tool for a safer, more profitable portfolio.

Good investing,

Steve

[ad#stansberry-ps]

Source: Growth Stock Wire