A few months back, I ranked my five favorite dividend ETFs – and shared my top pick to buy and hold forever. Since then, three new ETFs have launched that address the main problem I had with the strategies I reviewed the first time around.

The result? A 585% return over a 15-year period!

[ad#Google Adsense 336×280-IA]I’ll share the specifics and tickers – and my discussion with their portfolio manager – in a minute. But first, let me give you some background on dividend ETFs so you’ll appreciate why these new strategies are superior.

Sadly, Most Dividend ETFs are Dogs

Dividend-focused strategies should outperform the market over the long haul.

I showed you why last week, with a simple investing formula that nets 10% annual returns.

But out of the 100+ ETFs that claim a dividend focus, many of them have somehow managed to underperform the market since inception. Not good considering their inherent advantage!

Their problem? Formulas that, by nature, are “backward looking.” These ETFs emphasize historical yield payments and payout hikes as a predictor of future growth. That’s sometimes the case – but not always, as businesses change and become obsolete over time.

Dividend growth is the sign of a healthy, thriving business with a sustainable “unfair advantage” over its competitors. Companies with profits that grow year-after-year are able to share these rewards with their investors.

This should be the main component of any dividend-focused ETF you buy. A nice current yield is, well, nice. But the growth component is key. My November analysis found that the best-performing dividend ETFs do emphasize growth over current yield.

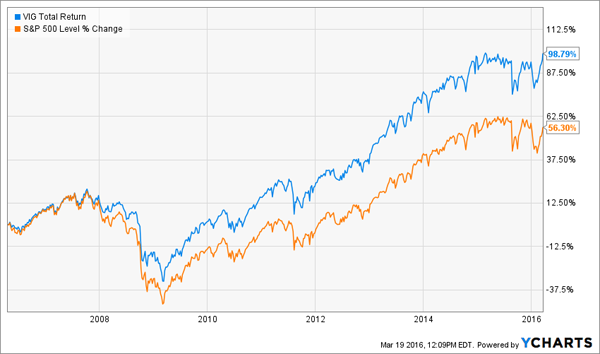

My top pick at the time, the Vanguard Dividend Appreciation ETF (VIG), buys companies that have increased their dividends for at least 10 years running. VIG has Microsoft (MSFT) and International Business Machines (IBM) in its top six – two tech payers we’ve discussed before. In aggregate its portfolio companies are growing earnings by 5.4% annually – enough to power future payout boosts.

VIG’s strategy is as sound as you can get for a backward looking variety. Unlike most other dividend ETFs, it has trounced the broader market since its 2008 inception with a 99% cumulative return:

VIG Moves Higher, Faster

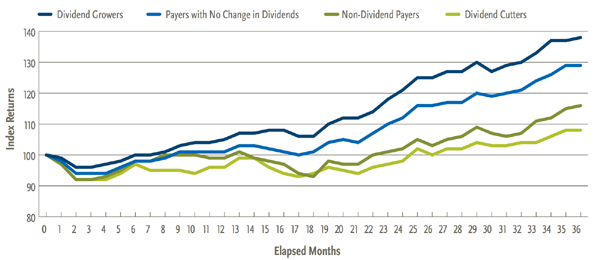

Worried about another Fed rate hike or two? Research from investment firm Nuveen shows that dividend growers are still the place to be. In fact, these stocks outperform their counterparts for three years after a Fed rate increase. Which means you’ll want to be invested in them for at least the next 33 months.

Dividend Growers Win the 36 Month-Period After Fed Hike

You can easily buy a “one-click” basket like VIG and sit back while your portfolio beats the market through 2018. And if you’re going shopping, I have three new ETFs you should consider first. These are the first forward-looking dividend ETFs – so it’s no surprise that their strategies have outperformed in a big way.

3 Forward-Looking Dividend ETFs for 154% to 585% Returns

These funds are the work of top ex-Morgan Stanley advisor Eric Ervin. Lucky for us, Eric’s rich client convinced him to quit several years ago and launch these funds!

While at Morgan Stanley, Eric Ervin developed techniques for profiting from dividend growth. For example, he bought and sold pairs of options on the S&P 500, and did so in a way that his clients profited directly from dividend growth, regardless of what stock prices did.

His wealthy client Charlie Silver loved it so much told Eric that he had to quit and start his own business. Charlie saw an opportunity to scale this strategy, and he offered to fund Eric himself.

I’ve spoken with Eric and his Reality Shares team about their dividend strategies several times. Their proprietary DIVCON algorithm powers their new ETFs. It’s a formula that weighs factors like future earnings, cash flows, consensus ratings, and external financial ratings to determine how likely a firm is to boost, cut, or simply maintain its dividend.

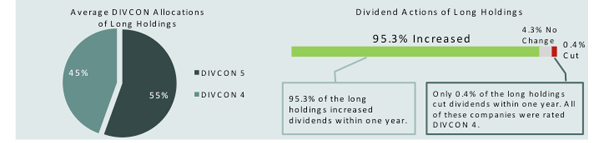

There are five DIVCON buckets. A ranking of 4 or 5 means the dividend is not only safe, but it’s likely to increase. These are companies like 3M (MMM) and Johnson & Johnson (JNJ) (which we recently discussed here). From 2001 through 2015, these firms increased their payouts annually more than 95% of the time.

Dividend Increases 95.3% of the Time for DIVCON 4 and 5

On the other hand, a DIVCON ranking of 1 or 2 spells trouble. For the same 15-year period, these companies have been more likely to cut their payouts than keep or raise them.

Dividend Disasters Abound for DIVCON 1 and 2

Dividend raises are great for a portfolio, but dividend cuts are severely damaging. Recently, Kinder Morgan (KMI) plummeted more than 70% in 9 months as investors sniffed out payout trouble. ConocoPhillips (COP) dropped nearly 40% in 4 months as it cut.

So a winning dividend strategy is simple – buy the high quality raisers, and sell (or short) the low quality pending disasters.

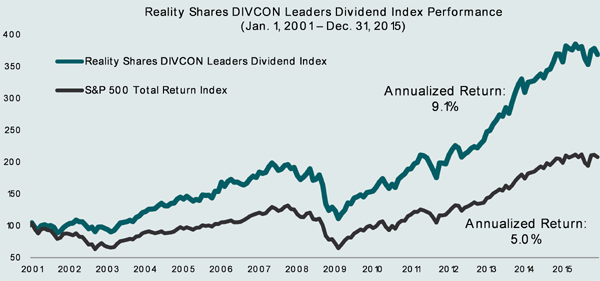

The DIVCON Leaders Dividend ETF (LEAD) buys the best of the lot. These are large-cap U.S. stocks with the highest probability of increasing their dividends within the next year.

Today it owns dividend payers and growers like Emerson Electric (EMR), The Home Depot (HD), Merck (MRK) and Nike (NKE). From 2001 through 2015, this strategy returned 9.1% annually, or 269% cumulatively.

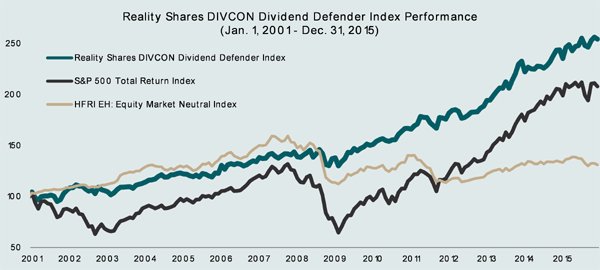

The DIVCON Leaders Dividend ETF (DFND) buys the best and shorts the disasters. It invests 75% of the fund in the most likely dividend raisers, and hedges the remaining 25%

Its long holdings largely overlap with LEAD, while its short holdings largely overlap with dividend stocks I’ve panned – including Exelon (EXC), Marathon Oil (MRO), and FirstEnergy (FE).

From 2001 through 2015, this strategy returned 6.4% annually, or 154% cumulatively. And though it returned less than LEAD, it did so with less volatility. As you can see, this index rarely goes down.

Great Defense and Better Offense Than the S&P 500

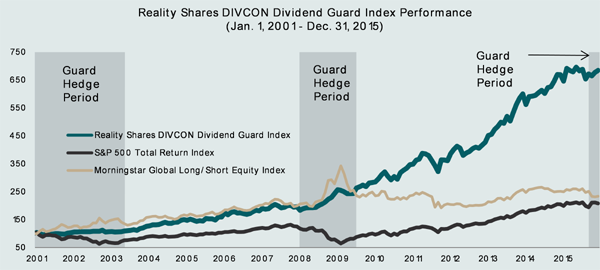

Finally the DIVCON Dividend Guard ETF (GARD) incorporates momentum into the long/short strategy. It buys the best all the time, but only shorts the disasters when the fund’s technical indicators are also pointing south. In other words, it only makes bearish bets when the stock’s sector is in a bear market.

The results from this simple tweak are impressive. From 2001 through 2015, this strategy returned 13.7% annually, or 585% cumulatively!

Since we’re emphasizing long-term performance with these strategies, we’re giving up current yield to do that. LEAD is the only fund that pays a dividend of the three. It will issue its first payout later this month, but the yield will likely be modest. Meanwhile DNFD and GARD don’t pay anything directly to shareholders (gains are be reflected in a higher ETF price).

— Brett Owens

Sponsored Link: If you’re looking for dividend growth AND current yield, then you’ll have to selectively buy individual stocks. My preferred “set it and forget it” portfolio today is a trio of stocks that I handpicked from a booming sector that’s in a multi-decade bull market.

They aren’t as well known as the large caps an ETF would buy and hold. And thanks to their “under the radar” status, their stocks are cheaper… which means their yields are higher. Believe it or not, they pay gaudy current yields of 7.9%, 8.5%, and 9.4% respectively!

Plus, these firms are raising their dividends every year – and in one case, every single quarter. In just a few years, you’ll be earning a growing 10% yield on your initial investment. Now that’s a simple formula for double-digit returns.

Historically, this trio has performed fantastically in all market environments. Since 2001, they’ve returned 172%, 1,910%, and 2,940% respectively to their investors!

Plus, these stocks are extra cheap today thanks to Fed hike worries – which is ironic, because these are the perfect stocks to own as rates rise. Click here, and I’ll give you the name and ticker for each one, along with my full analysis of each pick.

Source: Contrarian Outlook