[ad#Google Adsense 336×280-IA]The generally accepted investment “wisdom” is that a high yield equals high risk.

As a high-yield focused analyst, newsletter writer, and investor, I work to find those higher yielding stocks with the lowest potential risk of suffering a loss.

Investors who want to own high-yield stocks need to analyze and understand how each company operates and how they generate free cash flow with which to pay dividends.

To keep you from investing in relatively higher risk high-yield stocks, here are a couple of rules that I use to avoid buying stocks and then experiencing the unpleasant news of dividend cuts or even dividend suspensions.

Rule One: Avoid complicated business models and/or financial products.

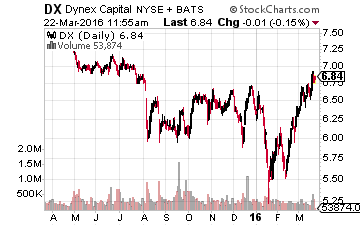

For me, popular high-yield stock Dynex Capital Inc (NYSE: DX) which yields 14% is quickly eliminated from investment consideration by this rule.

For me, popular high-yield stock Dynex Capital Inc (NYSE: DX) which yields 14% is quickly eliminated from investment consideration by this rule.

Dynex is a finance REIT that owns and manages a highly leveraged (6.7 times equity) portfolio of complex commercial and residential mortgage-backed securities (MBS).

For me, I have no idea how to evaluate interest-only, non-agency commercial LADRMBS, so I just stay away from Dynex Capital.

For me, I have no idea how to evaluate interest-only, non-agency commercial LADRMBS, so I just stay away from Dynex Capital.

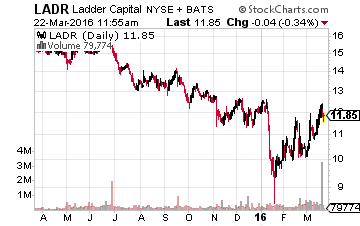

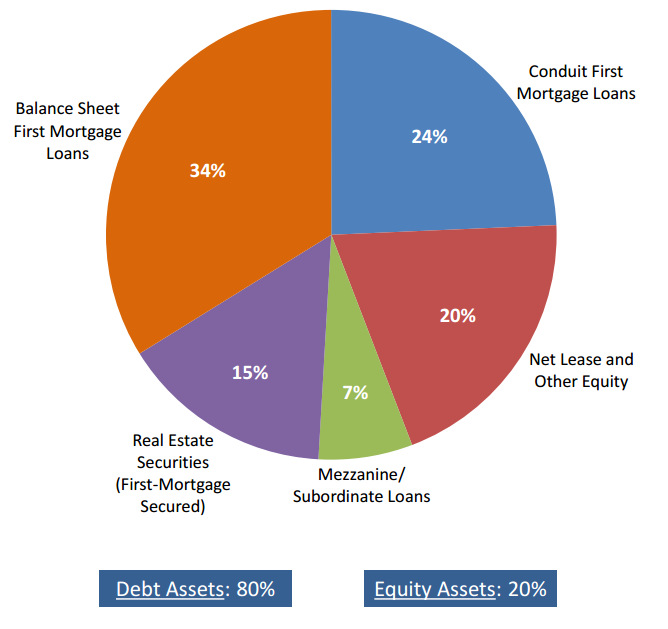

Relatively new finance REIT, Ladder Capital Corp (NYSE: LADR) with a 21% yield is another company that, because of its complicated business model, rule one pushes me away from taking a closer look at its income investment potential.

The company operates in too many different commercial real estate sectors to be an expert in all.

The caveat to rule one is that you can become an expert in a complicated business, and with your expertise make informed investment decisions. Many investors find the operations of New Residential Investment Corp (NYSE:NRZ) that has a 15% yield to be too complicated. However, I have followed the company since before it went public with a spin-off in 2013 and I am comfortable making investment recommendations about NRZ and owing it in my own high-yield portfolio.

The caveat to rule one is that you can become an expert in a complicated business, and with your expertise make informed investment decisions. Many investors find the operations of New Residential Investment Corp (NYSE:NRZ) that has a 15% yield to be too complicated. However, I have followed the company since before it went public with a spin-off in 2013 and I am comfortable making investment recommendations about NRZ and owing it in my own high-yield portfolio.

Rule Two: Avoid stocks that use hedging instruments to protect cash flows and profits.

This lesson was painfully made clear with the recent results from the high-yield upstream MLPs.

This lesson was painfully made clear with the recent results from the high-yield upstream MLPs.

Just two years ago, in 2014, investors felt secure in the knowledge that the oil and gas producing MLPs could support their distributions because they had hedged 80% or more of their expected oil and gas production for three to four years or longer into the future.

But now we are just two years into the steep decline in energy prices and distributions from upstream MLPs have disappeared and several of the companies are on the verge of bankruptcy.

But now we are just two years into the steep decline in energy prices and distributions from upstream MLPs have disappeared and several of the companies are on the verge of bankruptcy.

Hedging does not protect profit margins, it only delays bankruptcy.

Another characteristic of companies that rely on hedging protections is high levels of debt.

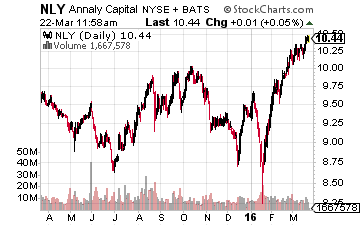

Agency MBS REITs are a second and popular group of companies that rely on hedging to protect their profit and cash flow to pay big dividends.

Agency MBS REITs are a second and popular group of companies that rely on hedging to protect their profit and cash flow to pay big dividends.

These companies own portfolios of government agency MBS purchased with short-term borrowed money to leverage the yield spread between the MBS and short term interest rates.

Interest rate hedges are used to protect against the wide range of problems that can affect a leveraged lend long/borrow short portfolio if interest rates change. Unlike oil and gas hedging, interest rate hedging is a much more complicated task, and has a high probability of failure in the face of significant changes in either short or long-term interest rates.

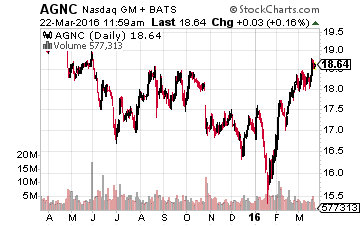

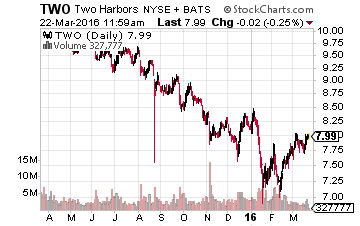

Some popular stocks in this group to avoid are Annaly Capital Management, Inc. (NYSE: NLY), American Capital Agency Corp. (NASDAQ: AGNC), Two Harbors Investment Corp (NYSE: TWO), and Hatteras Financial Corp. (NYSE: HTS). This list is not all inclusive.

The safer stocks in the financial REIT space are the commercial mortgage lenders that actually make loans and use a moderate level of leverage to produce profits and pay large dividends. These companies are not at risk of collapse if interest rates suddenly change. In their businesses, rate disruptions lead to bigger profit opportunities. The two class acts of this group are Starwood Property Trust, Inc. (NYSE: STWD) and Blackstone Mortgage Trust Inc. (NYSE: BXMT).

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

— Tim Plaehn

[ad#ia-tim]

Source: Investors Alley