What’s the perfect setup for an investment?

I like to see a couple things:

1. Incredible fear… “Things can’t possibly get worse.” Along with…

2. The start of an uptrend.

You see, when people have given up and say “things can’t possibly get worse”… you are often near the bottom.

[ad#Google Adsense 336×280-IA]The catch is, you don’t want to be near the bottom… you want to be PAST the bottom.

So the perfect setup is when you have incredible fear AND the start of an uptrend.

This is where the biggest gains happen… I say it’s the time when things go from “bad” to “less bad.”

We saw it in gold stocks in the last couple weeks… Things went from bad to less bad, and gold stocks soared.

And we have a similar “bad to less bad” opportunity shaping up today…

Grains – specifically wheat, corn, and soybeans – need to be on your radar right now.

Wheat hit its lowest level in nearly six years a couple weeks ago. It’s down roughly 50% since 2012. And the other big “grains” – corn and soybeans – have fallen even farther.

U.S. farmers are so paralyzed by these lower prices, they are afraid to plant. Why plant something that you will lose money on when you harvest it?

The U.S. Department of Agriculture put out a crop report last month, saying “U.S. farmers sowed 36.6 million acres of winter-wheat varieties.” That was the second-smallest planting since 1913. The acreage of wheat planted in Nebraska was at a record low.

We have record fear in wheat… We have no supply coming from U.S. farmers, and bets against the price of wheat hit a record in January in the financial markets. Corn and soybeans are in similar positions, though not as extreme.

But something interesting is brewing…

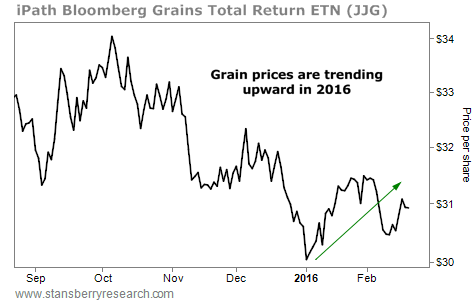

Even though fear is high in the “grains,” prices are actually up since the start of this year – in a world where most other asset prices are down. Take a look:

It’s a small move, I realize. But it could be the start of a major “bad to less bad” rally…

Right now, you could set things up so that your downside is extremely limited… and your upside potential is dramatic.

I’m talking about buying the “grains” fund… the iPath Bloomberg Grains Total Return Fund (NYSE: JJG). JJG is an exchange-traded note that tracks the prices of just three grains: corn, soybeans, and wheat.

The all-time low in JJG is only about $1 below today’s levels.

I suggest setting your stop at the all-time low, limiting your downside risk, in case I’m wrong.

We are trading on this idea in my True Wealth newsletter (though our stop loss is different from the all-time low).

I could be early on this idea… but on a risk-versus-reward basis, this trade looks pretty good. It is not far from being the perfect setup… in a world where perfect setups are hard to come by.

Check it out…

Good investing,

Steve

[ad#stansberry-ps]

Source: Daily Wealth