The next snowstorm is coming… is your portfolio positioned to make money off it?

Last month, I explained that we were experiencing record-warm weather to start this winter, especially in the eastern part of the U.S.

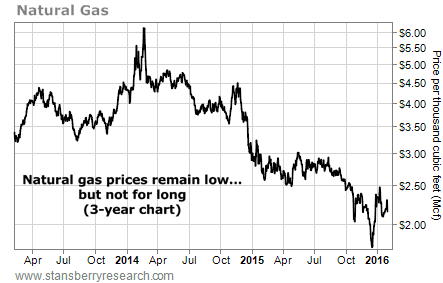

The combination of warm weather and a mild forecast sent natural gas prices plummeting to $1.49 per thousand cubic feet (Mcf), their lowest prices since 1999.

[ad#Google Adsense 336×280-IA]That is, until a massive blizzard swept up the East Coast. That sent natural gas prices ripping higher.

On January 11, natural gas prices hit a three-month high of $2.46 per Mcf based on the coming storm.

Longtime Growth Stock Wire readers know we saw this coming. Our favorite weather site, WeatherBELL, predicted this cold snap last summer.

It also warned us that some major blizzards would hit the U.S. through March.

However, the mainstream weather services still haven’t picked up on those trends. And that’s setting us up with a great speculation today…

As you can see in the chart below, natural gas prices are still low…

That means there is still opportunity to make money in natural gas. As you can see, last winter, prices were around $3 per Mcf. That was partly due to the huge volume of natural gas, which was well above the seasonal average for this time of year. However, the cold snap and blizzard in January helped that situation.

Today – even after a huge snowfall recently hit the East Coast – prices are still less than $2.20 per Mcf.

The reason is simple: We still have a huge supply of natural gas. Every summer, we produce natural gas from wells all over the U.S. We don’t use as much as we produce and the surplus goes into storage.

In the winter, we use more natural gas than we produce, so we draw down the stored gas supply. The volume we have in storage today is about 3.1 billion cubic feet – well above the five-year average.

And now we’re using it up faster than we were last year. Through January 22, we’ve consumed 557 billion cubic feet of natural gas from storage. Compare that with the 546 billion cubic feet we consumed through the same point of 2015. And natural gas consumption is going to continue to rise in the U.S. as the next blizzard heads for the East Coast.

Back in October, I warned you that the “official” forecast from the National Oceanic and Atmospheric Administration (NOAA) was going to be wrong. Now that we know this winter wasn’t completely full of mild weather… it’s time to pay closer attention.

We could be in for a long, cold February and March… which means it’s not too late to speculate on natural gas. You could do that by owning one of the natural gas exchange-traded funds like the United States Natural Gas Fund (UNG) or the VelocityShares 3x Long Natural Gas Fund (UGAZ).

Good investing,

Matt Badiali

Sponsored ad: In the Stansberry Resource Report, I recommended three natural gas producers to profit off this trend. Readers who took my advice are up slightly in four weeks. But I expect big gains to come as the winter goes on. In fact, according to WeatherBELL, the next blizzard will hit us around Valentine’s Day. Natural gas prices should rise again if that storm hits. As I told my subscribers, we aren’t holding this position forever. I’d like to make 25% or 30% on this trade through the end of February or early March. We’ll exit the trade before the weather warms up in the spring and natural gas consumption falls again. It’s not too late to profit from this trade… But you need to act fast. You can access the details to this trade with a 30-day risk-free trial subscription. Learn more here.

Source: Growth Stock Wire