CME Group (Nasdaq: CME), formerly known as the Chicago Mercantile Exchange, was founded in 1898 as the Chicago Butter and Egg Board.

Today, it owns and operates marketplaces for the trading of derivatives, including the CME, CBOT, NYMEX and COMEX.

[ad#Google Adsense 336×280-IA]The business has changed radically over the past 10 years as many traders have moved off the trading floor to electronic trading.

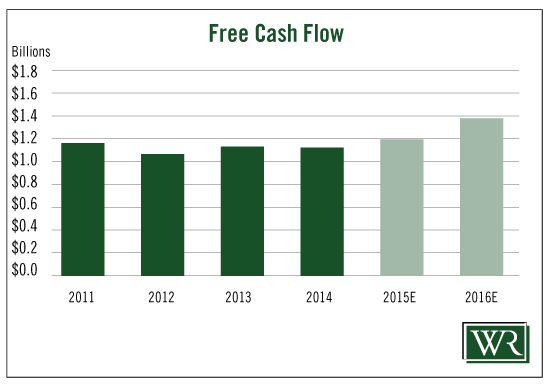

Over the past 12 months, the company has generated $1.3 billion in free cash flow. It has paid out $1.3 billion in dividends. A 100% payout ratio concerns me.

If you look up CME Group on Yahoo Finance or any other major financial site, it tells you it pays a $2 per share annual dividend and the yield is somewhere in the 2% range.

But that’s not entirely accurate. The company currently pays a $0.50 quarterly dividend. It also pays a special dividend in December. That special dividend has ranged from $1 per share in 2008, when it began paying it, to $2.60 per share in 2013. Last year, the special dividend was $2.

Based on free cash flow this year, I expect the company to pay shareholders another $2 in December. If so, the yield is not 2.2%, but 3.9%.

CME’s dividend safety gets penalized for the high payout ratio. It pays out all of its free cash flow in dividends. So if cash flow goes lower, while it may not cut the quarterly dividend, the special dividend may be reduced.

CME also hasn’t had much cash flow growth over the last several years. Generally speaking, I want to see free cash flow steadily climb in order to ensure the dividend is safe and to increase the likelihood of a dividend boost.

Over the past four years, free cash flow went nowhere, starting to rise only this year. It is projected to grow nearly 13% next year.

Should cash flow grow as expected, CME will either boost the dividend or give itself a little more breathing room.

But since those 2015 and 2016 figures are only estimates, we have to go with the historical data, which is not particularly impressive.

But since those 2015 and 2016 figures are only estimates, we have to go with the historical data, which is not particularly impressive.

Because of the historically flat to negative free cash flow and the extremely high payout ratio, the dividend cannot be considered very safe.

That being said, should CME Group grow its cash flow, I expect the stock will be upgraded in the future.

Dividend Safety Rating: D

Hoping your longs go up and your shorts go down,

Marc Lichtenfeld

[ad#wyatt-income]

Source: Wealthy Retirement