From Aug. 21 onward, “volatility!” has been the message of the month.

Markets have tried their best to retest those August lows, giving us more than our fair share of triple-digit shifts on the Dow Jones Industrial Average.

[ad#Google Adsense 336×280-IA]Plenty of talking heads are clamoring about the technical and fundamental ramifications of earnings this month, but they haven’t settled the question about whether markets will “trick” or “treat” us heading into the end of October.

I’ve got the data that reveals the likely answer for you.

It’s also drawing out some juicy profit opportunities for the fast-approaching earnings season.

Breakout Profits Ahead

Now, third-quarter earnings are usually fairly soft, and that’s built into reports at this time of year.

It’s also built into stock prices for some companies – but not all. There will be short-term opportunities to grab a quick move in specific stocks.

That’s because I have a way to look at past track records with an eye toward determining which companies are best positioned to move higher off earnings announcements. It includes lots of data and a tested strategy.

Let’s have a look…

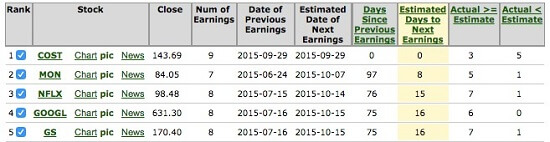

These are just five stocks on a longer list I’m tracking ahead of earnings season. This data is freely available, and the list is ranked by “Estimated Days to Next Earnings.”

Our opportunity lies in how many times a company beat expectations in the last several quarters. Specifically, we’re looking for a perfect record over the last 24 months, or eight quarters, of earnings.

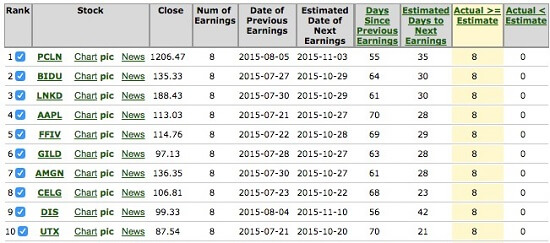

Here’s what the top of that list looks like when ranked for that quality.

Notice the highlighted column which reads “Actual >= Estimate.” The top 10 stocks that are displayed all have a perfect 8-0 record. This means the last eight quarters have resulted in earnings meeting or beating expectations.

This is really valuable data. We want to look at which stocks have dropped the most over the last month and look for short term bounces as earnings are announced.

Notice the majority of stocks on this list are tech and biotech stocks. Now, those certainly haven’t changed fundamentally over the last month.

Rather, they’ve been dragged down by one of two “dictators:” China… and Hillary.

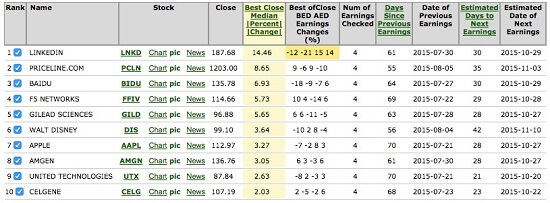

In any event, any positive news on these is likely to pop the stock, but we want to look at their post-earnings performance in quarters past, specifically for the biggest post-earnings moves.

Watch Out: Earnings Throw Us a Curveball

This is where the data gets interesting. Our top 10 stocks, re-ranked again, reveal that… no one really had consistent moves up after earnings, despite positive earnings announcements.

The data doesn’t lie, no matter how much we want to see good news.

This means that even a good earnings announcement might not be good enough for Wall Street. But we can change our tactics and profit anyway…

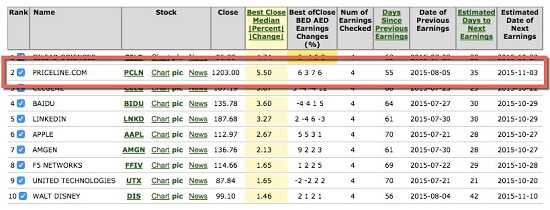

We’ll go bullish on these stocks a week into earnings and have our exit prepared in case the announcement goes the other way for us.

This is how we’ll establish a pattern to go on. Remember: Patterns should never be hard and fast rules, but they work much better than trading on emotion or intuition.

The chart above shows that over the last year, Priceline Group Ltd. (Nasdaq: PCLN) has risen an average of 5% in the week leading up to earnings. It should do so again.

Remember, implied volatility rises leading into an earnings report, which means that, until earnings are released, time decay isn’t really a factor. That eliminates one of the two biggest forces working against an options trader.

Beware, though! Once that report is released, it’s anyone’s game of “buy the rumor, sell the news.”

It’s much, much better to have a higher historical probability of making a small amount than taking potshots at guesswork gains.

— Tom Gentile

[ad#mmpress]

Source: Money Morning