My work puts me in touch with all kinds of investors, from beginners to seasoned pros.

And it’s made me realize that many investors, particularly those who are new to the stock market, are totally unaware that there are different order types, let alone the advantages that come from using them.

[ad#Google Adsense 336×280-IA]So they simply call up their broker and tell him that they want to buy a given stock, bond, or ETF.

There’s a problem with that.

Unless you name a specific price, you’re effectively giving your broker permission to fill your order at any price.

Of course, you’re guaranteed to get filled as long as there’s trading activity – meaning buyers and sellers making a market.

It’s the price that’s the problem.

But there’s a way around that.

Now, the tactic I’m about to show you is perhaps the most important of all. It’s easy to use, and it takes only an extra second or two to put in place.

Even better, it doesn’t cost a penny, it can save you money, and it dramatically increases your odds of success.

And best of all, it puts you in control.

You Wouldn’t Put Up with This at the Store — Don’t Stand for It in Your Trading

Before I tell you what this tactic is, though, I want to tell you why it works. Consider this…

Would you go to your favorite store and tell the salesperson that you’ll take those jeans at any price or head for the gas station to fill up for whatever the pump jockey wants to charge you?

No way – you don’t want to get ripped off.

But that’s exactly the risk you’re taking in the stock market if you don’t tell your broker what you’re willing to spend. For example, “I want to buy XYZ but pay no more than $50 a share.”

Doing so takes away the advantage afforded to the much bigger traders who hold most investors at the mercy of the markets.

It also removes the threat of being played by hedge funds, unscrupulous market makers, and institutional traders who would force you to buy your shares more expensively than you would otherwise.

Let me give you an example.

Carte Blanche for Your Broker Could Cost You More Than $3,000 in a Single Trade

As I write this, Netflix Inc. (Nasdaq: NFLX) is trading at $116.18 per share. The best bid – meaning what somebody will buy it for – is $116.17. The best ask – meaning what somebody will sell it for – is $116.20.

But there are also orders out there for as little as $100 and as much as $130 a share.

If you want to buy 100 shares of Netflix and you don’t specify a price, your broker could execute your trade anywhere in that range. So you could potentially spend as little as $10,000 or as much as $13,000.

However, your order could also be dramatically outside that range.

Let’s say there’s a technical glitch – which we’ve seen happen several times in the recent past – and the best ask on the book is $200 a share. If you put in an order to buy at market, your trade will execute at $200 and you will have spent $20,000, which is probably not at all what you intended.

If you’re a seller, the same risks apply.

If there’s a glitch or you’re trading after hours in thin markets and you simply say sell, you could get the $200 a share or your trade could go right to the $5 a share “lowball” order a guy like me put out there just to go fishing.

Limit orders are almost always the better way to go.

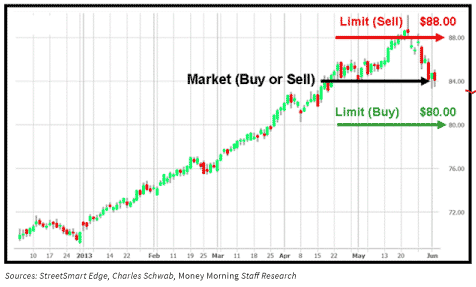

Here’s another example using a more conventional price chart rather than the Level II data I’ve just highlighted.

Imagine XYZ trading at $84 a share. Buyers interested in a bargain may stipulate that they’ll pay no more than $80 a share, while sellers interested in maximizing gains may stipulate that they’ll sell for no less than $88 a share.

Effectively, they’re establishing a range. That’s important because you should never want to buy something badly enough or sell in such a knee-jerk reaction that you’re chasing a trade. That’s a losing proposition no matter which way you cut it.

Returning to our example, the better way to buy Netflix would be to tell your broker to “buy Netflix at $116.25 or lower.”

By simply adding price to the order, a few things happen:

The order is routed to the limit order book, so it’s known and everybody sees it.

The order is guaranteed to fill at a given price that’s defined in advance so you’ll know exactly what price you’ll get.

The risk is that your order may not be hit in fast-moving markets because the limit no longer applies.

For example, if Netflix jumps 18% like it did following last Wednesday’s fabulous earnings report, anybody who specified that they want to buy shares at $114 or less will be left out in the wind and their order will not execute unless the stock returns to that price.

Sometimes that happens. Sometimes that doesn’t.

Either way, you simply adjust your order or move on to another stock because the one you want has gotten too expensive.

The Key Takeaways Are…

- Order are like tools: You want the right one for the job.

- Market orders leave you at the mercy of the markets and larger traders because you have no control over the price you’ll get.

- The simple, easy-to-use way around this is to use a “limit” order that specifies how much or how little you want to pay to the penny… ahead of time. Either you get that price, or the trade doesn’t happen.

Obviously, we’ve just scratched the surface here – there are as many order types as there are ways to serve coffee at Starbucks.

We’ll cover those in due course, along with all sorts of variations, including everything from the big three – market, limit, and stops – right up to those that may as well be an alien language – FOKs (fill or kill), IOCs (immediate or cancel), and GTCs (good till canceled).

In the meantime, I want you to get in the habit of specifying price every time you place an order.

That way you’ll trade on your terms and, in doing so, dramatically increase your profit potential.

— Keith Fitz-Gerald

[ad#IPM-article]

Source: Money Morning