My attraction to investing in small cap biotech stocks is that I have developed a strategy that has led me to some of my most lucrative gains in my investing career. This is the strategy I use every time I select a new biotech investment candidate, and if you follow my picks closely, you will enjoy outsize returns too.

Six weeks ago I posted an article entitled “Finding the Next Triple Digit Biotech Winner for 2015” (find it here) about a few high risk/high reward stocks in the small biotech sector. I have quite a few of these speculative but attractive plays within my Small Cap Gems portfolio.

I thought it would be a good time to revisit those picks as all three stocks have had significant and positive catalysts since then.

I thought it would be a good time to revisit those picks as all three stocks have had significant and positive catalysts since then.

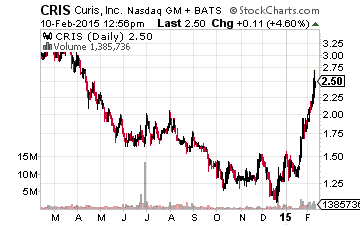

The lead stock in the article, Curis (NASDAQ: CRIS), has already doubled in the 45 days since I recommended investors take a look at it.

Before I get started I want to state I believe in culling positions in this very volatile space.

My rule of thumb is if I get a quick 50% run in a position I will sell 10% of my stake in that stock. If the shares double I will sell 20% of the original position.

[ad#Google Adsense 336×280-IA]If and when they triple I sell another 20% of the original position.

This leaves me with a locked in profit even if the stock blows up and there is nothing wrong with playing with the “house’s” money in this space.

The news driving the stock of Curis sharply higher is that it has entered into an exclusive collaborative partnership deal with Aurigene Discovery Technologies Limited focused on immuno-oncology and selected precision oncology targets.

The partnership provides for the inclusion of multiple programs and gives Curis the option to exclusively license compounds once a development candidate is nominated within each program.

Curis had to issue new stock of approximately 20% of its existing float to Aurigene to facilitate this transaction. However, investors logically realized that this was an attractive price to pay considering that this new deal will give Curis many more “shots on goal” and should also result in a faster path to market for numerous investigative compounds.

Cowen reiterated its “Buy” rating on the stock after this collaboration was announced and two weeks ago Roth Capital reiterated its “Buy” rating and $6 a share price target on this $2.50 stock. I would not be chasing this rocket here and have sold 30% of my original position (see rules of thumb above), but the stock could easily have more substantial upside over time.

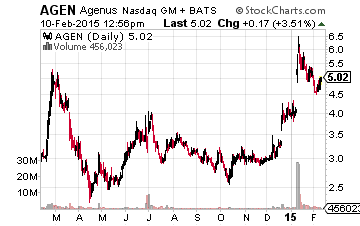

Another stock mentioned in the article, Agenus (NASDAQ: AGEN), has also performed strongly since the piece ran.

Another stock mentioned in the article, Agenus (NASDAQ: AGEN), has also performed strongly since the piece ran.

The stock is up 25% since publication and almost 60% since being included in the Small Cap Gems portfolio a few months ago.

The stock goes for around $5 a share now after getting as high as $6 a share a few weeks ago.

I still hold 70% of my original stake and would add shares if a market pull back got Agenus down to $4.50 a share again.

The catalyst behind the stock’s gain has been the announcement of a partnership with much larger Incyte (NASDAQ: INCY). This deal will entail a global license, development and commercialization agreement focused on novel immunotherapeutics based on Agenus’ Retrocyte antibody discovery platform which develops various checkpoint inhibitors. Since this announcement, MLV & Company has reiterated their “Buy” rating with a $9 a share price target. At the same time Maxim Group put a “Buy” rating and a whopping $11 a share price target on the stock.

Another positive is that a shingles vaccine using an adjuvant from Agenus posted successful Phase III trial results. I look for this vaccine to be on the market by late in the year probably several months after another vaccine for Malaria also using Agenus’ adjuvant gets approved for Europe and Africa. Both vaccines have been developed in conjunction with giant pharma player GlaxoSmithKline (NYSE: GSK) which will be responsible for distribution. Agenus will receive milestone payments on approval as well as its first recurring royalty streams, these should be additional positive catalysts for the company and its share price.

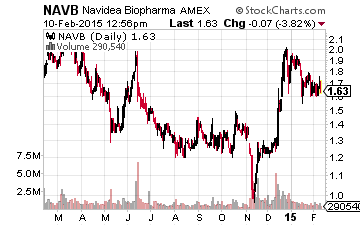

Navidea Pharmaceuticals (NASDAQ: NAVB) is the only pick of three not to stage a significant rally since the original article ran in late December.

Navidea Pharmaceuticals (NASDAQ: NAVB) is the only pick of three not to stage a significant rally since the original article ran in late December.

The stock is down some 10% since then.

The company recently reported quarterly results.

Its lead product Lymphoseek, an imaging agent for various forms of cancer, continues to show strong growth.

Orders were up 20% sequentially (quarter over quarter) and the drug is seeing better than an 80% reorder rate. More importantly, the company continues to grow its customer base with its hospital customer population increasing 34% sequentially. A price increase of 19% for Lymphseek went into effect on December 1st but does not appear to impact new orders.

Lymphseek revenues should continue to grow at an impressive rate as the compound gets approved in Europe and is approved for imaging other cancer types. The company has other neuro-imaging agents in phase III trials.

The most exciting part of Navidea’s story right now is its emerging Manocept technology platform. This revolves around the company’s recent decision to use its technology that enables Lymposeek to target cancer types to image tumors to work into conjunction with other drugs to target cancer types and deliver treatment courses.

This is a nascent effort but holds great potential. As the company starts to sign partnerships with firms interested in using this technology to develop new treatments, these could be positive new catalysts to power capital appreciation and is a development I will be watching closely over the next few quarters.

Although all three of these selections remain speculative, recent events have me even more encouraged about these companies potential and I look forward to continuing coverage of their progress.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley