Investors are scared.

Investors are scared.

Over the past few years, we’ve seen investors hit the panic button every time the market sells off even a few percent.

“This is the big one,” they think. So they run for the door as sentiment reaches a negative extreme. But in this bull market, these extremes in sentiment have turned out to be “buy the dip” moments… not the starts of crashes.

Today, we have a similar extreme. It’s not in investor sentiment, but in the actual price movements of companies.

[ad#Google Adsense 336×280-IA]Let me explain…

Today’s extreme comes from a broad look at the entire stock market. We’re not just focusing on the largest companies. We’re looking at the entire picture.

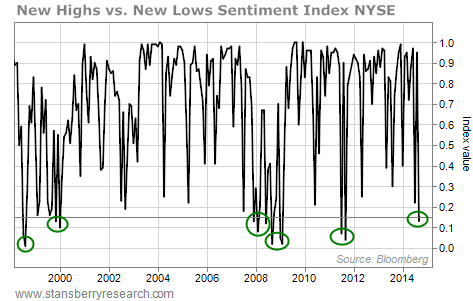

The extreme is in Bloomberg’s New Highs & New Lows Sentiment Index…

This is a simple ratio of New York Stock Exchange-listed companies.

The index forms a ratio of companies making new 52-week highs versus those making new 52-week lows.

Specifically, the ratio is new highs over the combined new highs and new lows.

When the ratio is low, it means few companies have made new 52-week highs versus the amount making new 52-week lows. And today, we’re at one of the lowest readings in years. Take a look…

Late 2011 was the last time we saw a reading this low. And as you probably remember, that was a fantastic time to buy stocks.

After a painful 20%-plus correction, the U.S. market soared after the 2011 bottom. And that kind of action is typical when this index gets this low…

Overall, we’ve seen a reading this low 10 times since the late 1990s. Outside of a few early signals, these have offered fantastic opportunities to buy. The full details are below…

Buying when this ratio fell below 0.15 led to profits 70% of the time. And two of the losers were simply early (in 2008 and 2011). On average, this extreme led to 4.7% gains over the next 1.4 months.

This indicator doesn’t have a perfect track record. And it can be early. But history shows that today’s selloff is likely a “buy the dip” opportunity… not the start of a crash.

We’ve been bullish for years. And even though it’s scary out there, history says we need to stay the course. Now isn’t the time to sell. It’s time to “buy the dip.”

Good investing,

Brett Eversole

[ad#stansberry-ps]

Source: Daily Wealth