You’re in Vegas… at your favorite casino… letting it ride.

You’re in Vegas… at your favorite casino… letting it ride.

You might have a 45% chance of winning money and a 55% chance of losing money. That’s the way it goes.

You might make a little money here, and a little there… But over time, the house always wins.

The stock market is a similar roll of the dice. The moment you place your bet, you are now gambling… And unfortunately, your odds are not that strong.

But what if there was an “ideal wager” out there – a “bet” with no downside risk – but all of the upside potential?

[ad#Google Adsense 336×280-IA]It’s not often that we can find an ideal wager like that – an asymmetrical bet.

But they do exist…

For example, my friends at EverBank have put together a product that lets us get all of the upside in a basket of volatile assets – with no downside risk.

If the assets go up, you’ll pocket all those gains.

But if the assets fall, you won’t lose any money.

How much better does it get than that?

I can’t guarantee you’ll make money. But there is only a microscopic chance you could lose money. And something really extreme would have to happen – like bank and government insurance failures.

Let me explain how this new product works…

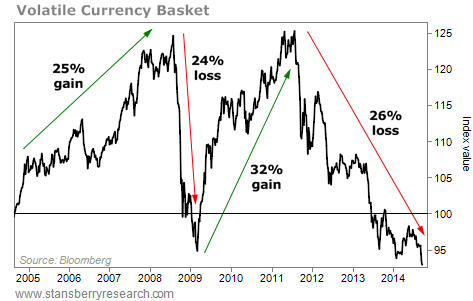

During the global financial crisis, a simple basket of five currencies crashed 24%. Over the next two years, the same basket increased 32%. And since 2011, the same basket is down 26%.

The chart below shows what I mean. It’s the 10-year history of the basket of currencies I described above…

This basket of currencies has crashed and soared 24%-plus four times over the last 10 years. That doesn’t guarantee upside from here… But buying in below financial-crisis lows is a great opportunity.

This basket of currencies has crashed and soared 24%-plus four times over the last 10 years. That doesn’t guarantee upside from here… But buying in below financial-crisis lows is a great opportunity.

The basket is currencies from the BRICS countries. The BRICS include Brazil, Russia, India, China, and South Africa – the emerging markets set to take over the world in the next few decades.

Today, we have a way to buy into a basket of these five currencies with zero downside risk. Importantly, this is an asymmetrical bet… meaning we take all the upside, but lose nothing if these currencies crash in price.

We can do this through EverBank’s newest MarketSafe CD…

EverBank’s MarketSafe CDs work just like traditional bank CDs. They have no downside risk. Your money is safe and government insured. However, instead of paying a micro interest rate like most bank CDs, this CD gives us upside on the BRICS currencies.

Specifically, by owning this CD, you will get the profits based on the returns of these five currencies over the next three years. If they fall in value, it’s no big deal. You’ll receive all of your initial investment back.

Our only risk is opportunity cost. But banks in the U.S. pay practically zero. So if you’re looking to park cash for a few years – and have some upside potential – this CD is a no-brainer.

Of course, we don’t know if these BRICS currencies will rise. What we like is the nature of the bet – we get all the upside potential, with nearly zero downside risk. That’s enough to get me excited!

If you’re interested, you can find the full details, including the Term Sheet and important disclosures, here.

Good investing,

Brett Eversole

P.S. While my parent company has a marketing relationship with EverBank, my publisher – Stansberry Research – receives nothing in return for recommending its products. We only share them with you because we believe in the ideas. And because the folks at EverBank always treat our readers well.

[ad#stansberry-ps]

Source: Daily Wealth