On July 14, representatives from every branch of the U.S. government packed the ballroom of the Marriott hotel in downtown Washington, D.C.

On July 14, representatives from every branch of the U.S. government packed the ballroom of the Marriott hotel in downtown Washington, D.C.

Glancing at the name badges, I saw folks from the Federal Reserve Bank, the Securities and Exchange Commission, and all branches of the military. Embassy staff from foreign governments were there, as were representatives from nearly every oil company in the world. If you’re a player in oil, you had someone at this conference.

[ad#Google Adsense 336×280-IA]We were all there for the U.S. Energy Information Administration’s (EIA) 2014 Energy Conference. Legendary oil analyst and Pulitzer Prize-winning author Daniel Yergin was the lunch keynote speaker.

And he didn’t disappoint…

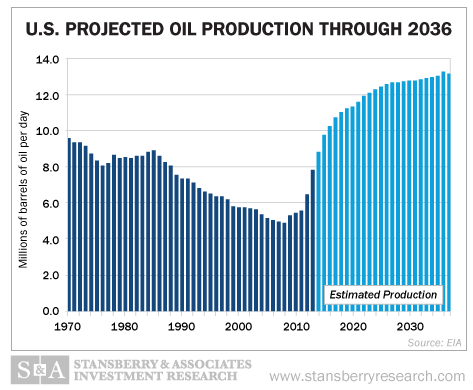

You see, the whole conference agenda rested on the idea that the U.S. is in the early stages of a massive increase in oil production…

During his speech, Daniel Yergin forecasted that the U.S. will hit 14 million barrels of oil production per day.

That’s an extraordinary increase when you consider we hit 8.3 million barrels per day in May 2014… up from 5 million barrels per day in 2008. It’s 44% higher than Saudi Arabia’s current crude-oil production.

Yergin wasn’t making some off-the-wall prediction, either. His estimate is only slightly higher than the official EIA estimate. In other words, although U.S. oil production has skyrocketed over the past five years, it will continue to run higher and higher.

By now, you’ve heard about the shale boom. Innovative technologies have allowed us to extract oil and gas directly from the source rocks… and reverse a nearly 40-year decline in oil production. In 2008, the United States produced 1.8 billion barrels of oil. In 2013, we produced 2.7 billion barrels… a 50% increase in five years. That five-year period has been the most productive period of oil-production growth in American history.

And that trend will continue…

Proven reserves grew from 19.1 billion barrels in 2008 to 30.5 billion barrels in 2012 (the latest EIA data). That’s a massive 60% increase over four years. By now, it’s likely much larger.

And S&A Resource Report readers have profited from the start…

We wrote about hydraulic fracturing or “fracking” of shale all the way back in June 2007. We were writing about North Dakota’s Bakken Shale back in 2009. And we were on the ground in Texas’ Eagle Ford in 2010.

The oil industry is 150 years old, and we’ve been fracking for gas for years… but cracking shale for oil is just five years old. Remember, fracking is the process of injecting high-pressure water and sand into the shale to open up the cracks.

What the process lacks in history, it’s making up in volume. And, as you can see in the chart below, it will have a profound effect on future oil production.

The forecast production (in light blue) calls for a peak of 13.4 million barrels per day in 2036. That’s the EIA’s high-case scenario (their base case is 7.5 million barrels per day).

The forecast production (in light blue) calls for a peak of 13.4 million barrels per day in 2036. That’s the EIA’s high-case scenario (their base case is 7.5 million barrels per day).

However, over the past five years, U.S. production tracked EIA’s high-case estimate almost exactly. As we said earlier, Daniel Yergin’s team put that high point at 14 million barrels per day… slightly higher than the EIA’s high case.

My point is, the boom in U.S. oil production is still in the early innings. If Yergin’s estimates prove true, U.S. oil production will nearly double from today’s output…

This is the biggest of big trends. Over the next decade, oil investors will see growth unlike anything we’ve seen in 50 years. And in tomorrow’s essay, I’ll share some of the best ways you can still get a piece of the action.

Good investing,

Matt Badiali

Sponsored Link: As I mentioned, we’ve been in front of the U.S. oil boom for more than five years in my S&A Resource Report newsletter… and we’ve found dozens of ways to profit. But perhaps the best way to profit isn’t what you’d think. It’s a powerful strategy we’ve been using to generate double-digit income streams from all kinds of resources, not just the U.S. energy boom. You can learn all about this strategy (and how the President uses it) right here.

Source: Daily Wealth