Editor’s note: Steve recently finished reading a very thought-provoking book called The Death of Money by Jim Rickards. And over the past week, he has been sharing some of the most important ideas from the book. If you missed last week’s essays, you can check them out here, here, and here. Today, he continues the series with a story about the last time the dollar almost died (it wasn’t long ago)…

“Few Americans in our time recall that the dollar nearly ceased to function as the world’s reserve currency in 1978,” Jim Rickards writes in the introduction to his excellent book The Death of Money.

In short, nobody wanted the dollar back then…

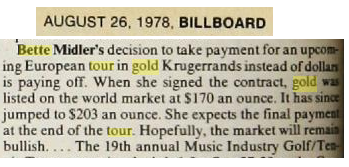

It got so bad, American singer Bette Midler demanded to be paid in gold for her 1978 European tour (as this newspaper clipping from Billboard magazine shows):

“What began as a managed dollar devaluation in 1971, with President Nixon’s abandonment of gold convertibility, became a full-scale rout by the decade’s end,” Rickards writes.

“What began as a managed dollar devaluation in 1971, with President Nixon’s abandonment of gold convertibility, became a full-scale rout by the decade’s end,” Rickards writes.

Americans traveling in Europe found that their dollars were not welcome…

Rickards tells the story of author Janet Tavakoli traveling in Italy:

Americans traveling abroad found that restaurants, hotels, and merchants did not want [dollars]… The manager of the hotel asked departing guests: “Do you have gold? Because look what your American President has done.” He was serious about gold; he would accept it as payment.

I immediately asked to pre-pay my hotel bill in [Italian] lire… The manager clapped his hands in delight. He and the rest of the staff treated me as if I were royalty. I wasn’t like those other Americans with their stupid dollars. For the rest of my stay, no merchant or restaurant wanted my business until I demonstrated I could pay in [Italian] lire.

Rickards summed up the situation in 1978: “Foreign creditors no longer trusted the U.S. dollar as a store of value,” he wrote. In 1978, the U.S. Treasury “was forced to issue government bonds denominated in Swiss francs.”

[ad#Google Adsense 336×280-IA]Desperate measures were needed to save the dollar…

The rout of the dollar didn’t end until Paul Volcker took over at the Federal Reserve.

“Volcker raised interest rates to 19% in 1981 to snuff out inflation and make the dollar an attractive choice for foreign capital.”

Rickards says a “similar constellation of symptoms to those of 1978 can be seen in the world economy today.”

In recent years, the U.S. dollar index hit an all-time low – below the 1978 level. And gold hit an all-time high, around $1,900.

Today, U.S. government debt is at a record high, and the Fed continues to print money at a record pace. There’s no doubt this will end badly, as my colleague Porter Stansberry has predicted. The only question is when. You can’t ignore the possibilities of a potential collapse in the dollar.

In his book The Death of Money, Rickards puts the dollar under the microscope, and then explains the signs to watch for as the dollar – as we know it – heads toward what he believes is an inevitable death.

His book is deep and thought-provoking. Whether you agree with Rickards or not, I urge you to read it…

Good investing,

Steve

[ad#stansberry-ps]

Source: Daily Wealth