“Gold stocks are a better trade today than they were at the bottom in 2008,” the best trader I know told the crowd last week.

“Gold stocks are a better trade today than they were at the bottom in 2008,” the best trader I know told the crowd last week.

Jeff Clark of Stansberry & Associates is the best trader I know… And that was a huge statement from Jeff…

You see, gold stocks soared by 200% in a year from their October 2008 lows.

[ad#Google Adsense 336×280-IA]That 200% gain is not me cherry-picking a good gold stock or two… that was the return of Market Vectors Gold Miners Fund (NYSE: GDX) – the big gold-stock fund – from trough to peak starting at its October 2008 low.

Jeff typically trades options, and he delivered incredible returns for his S&A Short Report readers.

Jeff told the crowd about this “better than 2008” situation at a private investor conference last week at the Greenbrier resort in West Virginia.

I’ve known Jeff for probably 10 years.

And I can’t remember him ever being so emphatic about an investment idea.

After Jeff spoke, I bumped into Garrett Goggin, an analyst with John Doody’s Gold Stock Analyst letter. He and John do great work in that letter. My favorite feature is their simple “overvalued/undervalued” measure for gold stocks. I’ve found that this is the best measure of gold-stock valuation on the planet.

I asked Garrett, “Are gold stocks more undervalued today than they were in late October 2008?”

“Yes they are,” he replied. “As of our May 1 issue, gold stocks were 44% undervalued. And gold stocks are down since that issue came out.”

Wow.

In hindsight, late October 2008 would have been a fantastic buying opportunity in gold stocks. I never thought we’d see such a value ever again.

“It gets even better than that,” legendary natural resources investor Rick Rule said over lunch. “Back in 2008, everything was crashing. Today, that’s not the case – this crash has been limited to these stocks.”

Jeff was bold enough to say, “Last Friday was the bottom in gold stocks.” I can’t know if he is right, of course. But I can tell you Jeff is very good at what he does. He is the best short-term trader I know.

In the most recent issue of my own newsletter, True Wealth, I wrote that “We are DARN CLOSE to an AMAZING buying opportunity in gold.”

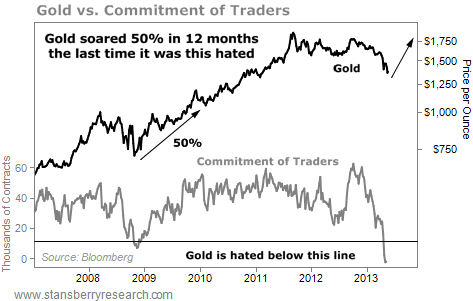

As I told my subscribers, gold is as hated as it gets. The simplest way to see this is in a chart…

The black line is the price of gold. The gray line is the “Commitment of Traders.” The COT is a weekly report that shows how real traders are betting with their money right now. It’s a simple way to gauge investor sentiment. When the gray line is low, small speculators are overly bearish on gold and expect the precious metal to fall.

As the chart shows, the last time gold was even close to this hated – late 2008 – the precious metal soared 50% in 12 months!

As the chart shows, the last time gold was even close to this hated – late 2008 – the precious metal soared 50% in 12 months!

Gold stocks are cheap – they’re 44% undervalued, according to my favorite measure (from the Gold Stock Analyst newsletter). And gold is the most hated it’s been in a decade (according to the chart above).

By my standard, the only thing we’re missing right now is the uptrend…

I told my True Wealth subscribers:

When we see a semblance of an uptrend again, we will buy gold and gold stocks with tight stops. It could be a fantastic trade… as our downside risk would be low (at the previous lows) and (based on what we saw in 2008) our upside potential could be extraordinary.

For the first time this year, the stars are aligning for a solid trade in gold and gold stocks…

Jeff – the best short-term trader I know – says the time is now.

I am not as bold as Jeff today… but I bet he’s right.

Good investing,

Steve

[ad#stansberry-ps]

Source: DailyWealth