CHINA BULLS: GET READY FOR AN UPSIDE BREAKOUT

CHINA BULLS: GET READY FOR AN UPSIDE BREAKOUT

China bears take note…

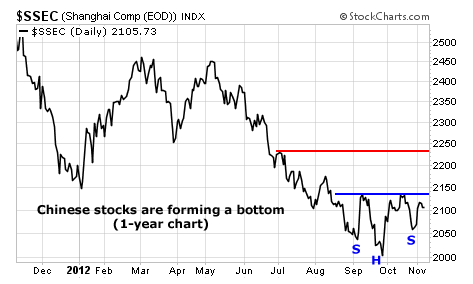

Today’s chart shows the Shanghai Stock Exchange Index (SSEC). This index is like the “Dow Industrials of China.” It tracks the price action in the country’s most important equities.

For much of the past three years, this index has slumped.

[ad#Google Adsense 336×280-IA]But as you can see in the chart below, China is slowly turning bullish.

The SSEC shows the potential for an inverse head-and-shoulders pattern.

This is a bottoming formation, which usually indicates the reversal of a trend from bearish to bullish.

The pattern starts to form when a chart hits a new low, as the SSEC did in October.

It then rallies and breaks the trend of lower highs. If the next decline fails to make a lower low before it starts to rally again, the potential for a trend reversal is in place.

If the SSEC can break above the neckline (the blue line) of the pattern – at about 2,130 – it should be a quick trip up to the next resistance line near 2,250 (the red line).

– Jeff Clark

[ad#stansberry-ps]

Source: Market Notes