Today, we have a real shot at doubling our money in one of the market’s highest-yielding sectors.

Today, we have a real shot at doubling our money in one of the market’s highest-yielding sectors.

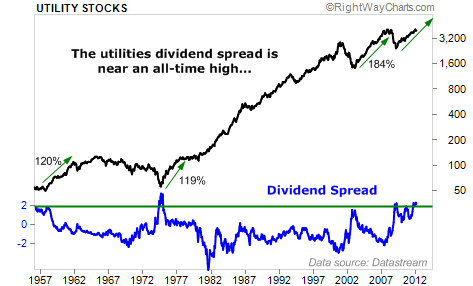

In the past, this high-yield sector has soared triple digits over roughly three years every time this setup has occurred. It happened in 1956 (and led to 120% returns). It happened in late 1974 (119%). And it happened in 2003 (184%).

It’s happening again now… And if you invest right away, you could reap triple-digit gains in the next two to three years. Let me show you why…

The high-yield sector I’m talking about is utilities.

[ad#Google Adsense 336×280-IA]Utility companies provide the necessities in life… electricity, gas, and water, to name a few.

Many investors love these traditional income stocks for their big dividends.

Because utilities provide the “basics,” the government heavily regulates how they do business.

These regulations lead to steady, slowly increasing profits… most of which go directly to shareholders as dividends.

Utilities have always been a safe way to collect income in the stock market. Today, this sector pays around 4%. That might not sound like much. But in our near-zero percent world, it’s a solid payout.

The thing is, right now, these stocks offer more than just a 4% dividend.

What excites me is an opportunity my colleague Steve Sjuggerud introduced to DailyWealth readers late last year. It relates to the “spread” between utilities and U.S. Treasurys.

The “spread” is simply the utility sector’s dividend yield minus the 10-year Treasury yield. As Steve explained, it’s smart to pay attention to utility stocks when their dividend yield rises far above the yield on Treasurys – when the “spread” is wide. Take a look…

Since 1960, the average spread has been -1%. Currently, the spread is 2.2%. This is only the fourth time in the last 60 years that utilities have yielded that much more than 10-year Treasurys.

The first time we saw a “spread” over 2% was in 1957. Within the next three years, utility stocks soared 120%. The spread peaked again during the 1974-1975 and 2000-2002 stock market crashes… triggering three-year, triple-digit rallies both times.

The spread topped 2% most recently in 2009. Utilities are up 58% since then. But the spread is STILL over 2% today.

Utility stocks would need to double from here to return the spread to its historical average. If utilities double, their yield would fall in half, to around 2%. With Treasurys also near 2%, our spread would be zero. And that’s still above the long-term average of nearly -1%.

What if Treasury yields rise to 3%? Utilities would have to double for the spread to reach its long-term average. So in addition to a solid dividend yield, at current prices, we could see triple-digit gains from these high-yield stocks.

And these stocks will likely get a boost as anything with a decent yield attracts new money. As DailyWealth editor in chief Brian Hunt explained, “Our guess is that, in 2012, more and more people recognize the safety and income-producing power of basic dividend payers.” This will create a tailwind behind utility stocks…

Of course, we can’t know if today is the start of a major bull market for utility stocks. But based on history, we have an excellent opportunity to buy this high-yield sector right now.

The easiest way to invest is through the Utilities Select Sector SPDR Fund (XLU). This fund holds a basket of 34 utility companies. It pays a current yield of 4%.

Buying today gets you a safe 4% dividend. And thanks to a rare extreme in the “spread,” your capital gains upside is enormous.

Good investing,

Brett Eversole

[ad#jack p.s.]

Source: Daily Wealth