If you’re sitting on the fence about jumping into stocks…

If you’re sitting on the fence about jumping into stocks…

My friend, it’s time to get started.

These days, it’s easy to get scared out of stocks and bonds. The headlines say Europe is about to blow up. Unemployment is still high. Every political candidate looking to get into office says how badly his opponent is making things.

Despite a lot of pessimism amongst investors, the FACTS are telling you things are getting better… Even the hated real estate market is showing signs of firming up, as Steve highlighted a few weeks ago with this story about “Grandma’s House.”

[ad#Google Adsense 336×280-IA]Pessimism is still high, but the economy is recovering.

In fact, one of the best “common sense” indicators around is saying the worst is well behind us.

It’s telling us it’s a great time to be an investor… especially an investor looking for safe income.

Here’s how it works…

My “common sense” indicator tracks how well people are paying back debt… specifically, if they are paying off their credit-card charges.

America runs on credit. So when the economy is in the tank, credit-card delinquencies rise. When the economy is recovering, delinquencies fall. (Delinquency rates indicate the future defaults on credit card payments.)

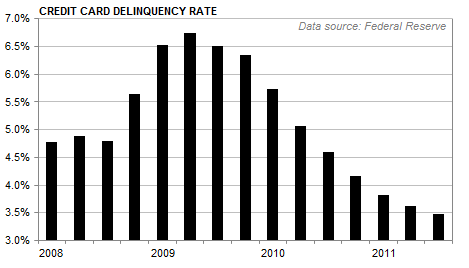

The chart below shows delinquency rates of commercial bank credit cards (cards issued by big banks, like Bank of America). As you can see, the rate peaked at 6.75% in the second quarter of 2009. It then started working lower… and has fallen to a multi-year low of 3.47%.

This means fewer people are defaulting and more people are paying their debt on time.

For investors, the fact that the delinquency rate is trending lower means it’s time to get off the fence and invest. The next chart says it all…

When credit-card delinquencies peaked in 1991, 2001, and 2009, the S&P 500 bottomed. As delinquency rates receded, the stock market climbed… In short, we’re past this peak in delinquencies. And the bottom in stocks is behind us.

I don’t expect delinquencies to tick up any time soon, so I expect the markets to continue their upward trek for at least the next several months (if not years).

This is great news for investors, particularly income investors… As the economy continues to show signs of improvement, many of America’s best companies are once again offering growing dividend yields of 3%-4%. I’m seeing safe corporate bonds yielding 6% right now. Real estate is at (or near) a bottom… which makes buying a rental property and collecting 7%-10% yields attractive (because there is little downside).

Don’t misunderstand me… This is not going to be the Roaring ’20s overnight. But everywhere I travel, I see businesses getting stronger. From hotels to restaurants to cabbies to airlines to manufacturing… the U.S. economy is not falling off a cliff anytime soon. The delinquency rate just confirms what I’m seeing with my own eyes.

If you’ve been scared to death by bearish headlines, make sure to take a deep breath and check the facts. When you do, you’ll see things are slowly getting better… and you should get invested immediately.

Here’s to our health, wealth, and a great retirement,

Dr. David Eifrig

Sponsored Ad: In the January 2012 issue of my Retirement Millionaire advisory, Dr. Eifrig updated readers on the best places to earn safe, high rates of income in both the stock and bond markets. Several of his favorite safe positions yield 5%-8% right now. If you’re interested in collecting safe income on your nest egg funds, these positions are perfect for you. You can learn more about coming on board as a subscriber here.

Source: Daily Wealth