If you make just one New Year’s resolution this year, make it this: buy monthly dividend stocks. Today I’m going to give you 3 that should be at the top of your list.

The benefits of monthly payouts go way beyond the convenience of getting paid every month, just as our bills show up (although that’s a great bonus that can save you a lot of time watching your cash flow in retirement).

There are a couple other overlooked benefits monthly payers give you:

- They’re a sign of dividend safety: Smart C-suite types know that a dividend is a promise to investors, and they wouldn’t commit to sending one out every month if they weren’t serious about keeping—or raising—the payout.

- They amp up your gains: If you’re not leaning on your portfolio for income, getting your dividend cash every month as opposed to every quarter lets you put it to work faster.

For example, let’s say you buy 2,000 shares of a $100 stock that pays dividends quarterly and yields 5%.

But the same investment in a monthly payer would be worth $696,258, or nearly $3,600 more!

Funny thing is, many folks avoid monthly payers because buying them means going beyond the “sacred cows” of the S&P 500—most “monthlies” are real estate investment trusts (REITs) or closed-end funds (CEFs).

But that’s fine for us, because these two ignored corners of the market boast some of the highest—and safest—dividends out there! As my colleague Michael Foster, our in-house “CEF professor,” tells us over and over, there are many safe 7%+ dividend payers in the CEF space.

And as I write this, the REIT benchmark Vanguard REIT ETF (VNQ) yields 4.7%, nearly 3 times the S&P 500 average. Don’t get hung up on that number, though, because the two monthly-dividend REITs in our “3 pack” of monthly payers easily top that.

So let’s get to them, starting with…

Monthly Dividend Pick No. 1: This “Apple” Pays a Safe 6.2% Dividend

My first pick is Apple … but not that Apple. I’m talking about Apple Hospitality REIT (APLE), owner of 238 modern hotels under the Marriott and Hilton banners.

And when I say “modern,” I mean it: the average age of Apple’s portfolio is just four years.

If you hear “hotels” and think “Airbnb,” let me drive that elephant from the room now, because Apple makes a policy of going where the home-sharing giant isn’t.

In the first nine months of 2017, for example, suburban markets chipped in 59% of Apple’s adjusted hotel EBITDA (earnings before interest, taxes, depreciation and amortization). Airports, resorts, smaller cities and interstates supplied 19%. Only 22% came from big cities, which are prime Airbnb territory.

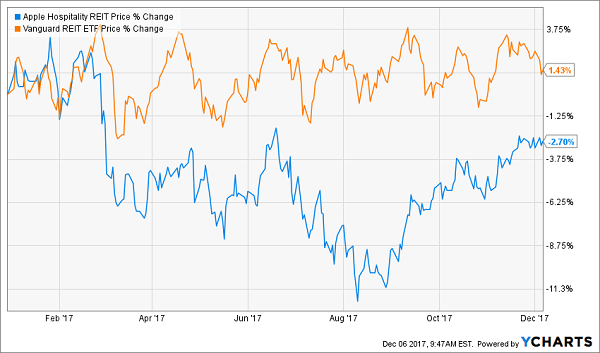

Too bad none of those numbers have won over first-level investors. Look how Apple has performed compared to VNQ this year:

High-Quality REIT Lags the Pack

Apple’s decline has it trading at just 11 times modified funds from operations (FFO, the REIT equivalent of earnings per share).

That’s ridiculous for a REIT that’s throwing off steady FFO and growing like a weed. In Q3, management spent $120 million to add three hotels—in Birmingham, Alabama; Portland, Maine; and a suburb of Salt Lake City.

This growth sets the stage for a future payout hike. But either way, Apple yields a gaudy 6.2% today, and it only paid out 69% of its last 12 months of FFO as dividends. That’s easily manageable for a REIT.

Monthly Dividend Pick No. 2: A Tech Titan in Disguise

STAG Industrial (STAG) owns 347 warehouses in 37 states. As I’ve written before, that puts STAG, which yields 5.2%, in the sweet spot of the e-commerce boom.

The proof? Three of its top 10 tenants are courier companies, which supply the muscle behind the online shopping bonanza. I’m talking about DHL, FedEx (FDX) and XPO Logistics (XPO).

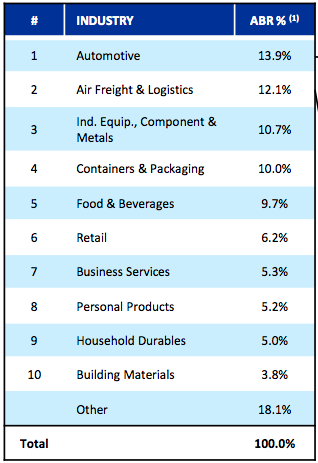

But don’t worry, you’re not betting your income on the shifting sands of retail here. Check out the diversification this unsung company boasts—particularly the straight-line spread among its top 10 sectors as a percentage of annualized rental income:

From Car Parts to Plastic Cups

Right now, STAG’s payout accounts for 84% of FFO. That’s higher than Apple’s payout ratio but no problem for STAG, whose FFO surged 7.5% in Q3.

Better yet, that dividend is growing—up 18% in the last 4 years—so you’ll quickly boost the yield on your original investment.

Finally, thanks to a selloff that has nothing to do with STAG and everything to do with the fear that rising interest rates will hurt REITs (a stubborn myth I’ve debunked before), STAG is ripe for buying, trading at 16.5 times FFO.

Monthly Dividend Pick No. 3: A “Boring” Fund With a 5.8% Payout

Now that we’re nicely diversified among REITs, let’s add another income-hound favorite: utilities—but not through individual stocks.

Instead, we’re going to get our monthly dividend fix from a closed-end fund (CEF): the Gabelli Utility & Income Trust (GLU).

Right away, we can see that GLU is a serious income producer, throwing off a 5.8% yield, and that payout is as steady as they come: GLU has paid $0.10 a share monthly since inception in 2004—plus it’s delivered 4 hefty special dividends, too.

That’s because GLU’s dividend is backed by a portfolio of “steady eddies,” which provide wireless services, pipelines and even give us international exposure through wireless provider Koninklijke KPN (KKPNY) of the Netherlands, Canada’s Rogers Communications (RCI) and Severn Trent (STRNY), a UK water company:

One other thing backstops that dividend: the fund’s discount to net asset value (NAV)—or the markdown between GLU’s price and the value of its portfolio. Keep that in your head for a moment, because this is why CEFs deserve your attention, especially if you’re on the hunt for income.

Because while the fund’s yield on market price is 5.8%, the yield on NAV is only 5.3%, a return that’s even easier for management to get.

That discount is also the trigger for some nice “pent-up” gains: GLU trades at an 8.2% discount to NAV, but it has regularly traded at a premium to NAV in its 13-year history. If that discount were to vanish (a matter of time, in my view), it would unlock quick 9% upside to go with our 5.8% dividend!

And Give This Fan Favorite a Miss

Let’s wrap up with a monthly payer you’ve probably heard of, Realty Income (O), owner of 5,000 properties across the country.

Realty Income management knows the marketing value of a monthly payout: the REIT even calls itself “the monthly dividend company”!

There’s only one problem here (two, actually).

The first? Low yields. Right now, O yields 4.6%, which doesn’t even top VNQ’s 4.8%! Worse, VNQ’s dividend has surged 60% in the last five years, while Realty Income holders have had to settle for 17% growth.

The second? Even though the REIT boast has a well-diversified tenant list, its reliance on brick-and-mortar retailers in the age of Amazon.com (AMZN) is a big red flag—and the main reason why I recommend staying clear of retail REITs.

Finally, Realty Income trades at 18 times FFO, pricier than our two other REITs, which boast higher yields and have either matched or bested O on a price basis since May 18, 2015, when Apple Hospitality went public:

Higher Price, Lower Returns

So don’t get sucked in by the popular monthly dividend payer, especially when there are cheaper—and higher—yields to be had.

— Brett Owens

Your Best Play for 2018: Monthly Payouts and 8% Yields [sponsor]

There’s no doubt that monthly payers deserve a place in your portfolio, for the 2 reasons we just discussed: for retirees, they keep your cash flow smooth as silk.

And if you’re not retired, you can reinvest your dividends faster—giving your nest egg a nice extra boost.

If that’s not a win-win, I don’t know what is!

That’s why I’ve dropped 4 monthly dividend stocks into the “6 pack” of steady investments that make up my 8% “No-Withdrawal” portfolio.

I’ve custom-built this unique portfolio to debunk the myth the so-called experts on Wall Street and in the media preach to anyone who will listen: that unless you have a million bucks, you can kiss a comfortable retirement goodbye!

Don’t fall for it.

The truth is, with the 6 stout dividend payers in this portfolio, you could clock out of the workforce on a nest egg half the size of what the talking heads say you need.

And you can do it on dividends alone, without drawing a single penny of your hard-earned capital in retirement.

I’m talking about a rock-solid $40,000-a-year income stream on just a $500,000 upfront investment. That’s an 8% dividend yield—a cut above the yields you’ll grab on the 4 stocks I showed you above.

Best of all, you won’t have to go back to “lumpy” quarterly payouts to do it.

Because thanks to the top-flight monthly dividend payers in my 8% No-Withdrawal portfolio, at least two-thirds of that $40,000 a year will drop into your account every single month.

And maybe more, depending on how you split up your nest egg!

I’m ready to give you everything you need to know about this dynamic retirement portfolio now. CLICK HERE and I’ll share my proven monthly-dividend strategy, plus the names, tickers and ALL of my research on these 6 income wonders.

Source: Contrarian Outlook