Closed-end fund (CEF) investors are going crazy again. This time, they’re grossly overpaying.

Today we’ll discuss five incredibly popular funds that are not likely to become more celebrated, and should be sold immediately.

In January 2016, they wanted nothing to do with CEFs.

Exactly when many funds were about to embark on an 18-month tear!

Yet today, they’re willing to pay $1.49 for just $1 in assets.

This is a recipe to lose money.

Or at best, see your portfolio trade sideways.

This Discount/Premium as Margin of Safety (or Lack Thereof)

CEFs, unlike their mutual fund cousins, have fixed share counts. This makes their prices subject to the animal spirit whims of the market – for better or for worse.

As usual, despair is our friend. When CEF investors throw in the towel, the funds they discard can see their shares trade at discounts to their net asset value (NAV). This is basically “free money” for us.

If a fund trades at a 10% discount to its NAV, it means we’re able to buy its underlying assets for just 90 cents on the dollar. That’s exactly the type of “discount to intrinsic value” that many successful stock market investors strive for.

Plus, savvy managers have ways they can force their own discount window to shut again. Such as buying back their own cheap shares.

On the other hand, when CEF investors get greedy, they actually pay premiums for funds. Bad idea! Let me show you why – and give you five “first-level favorites” to avoid.

How to Lose 13% on a 10%+ Payer

PIMCO’s Global StocksPLUS & Income Fund (PGP) has traded at a nosebleed 69% average premium for the last three years as investors flocked to its high (10%+) yield and 5-star Morningstar rating. A 49% premium means buyers paid (and are still paying!) $1.49 for just $1 in assets.

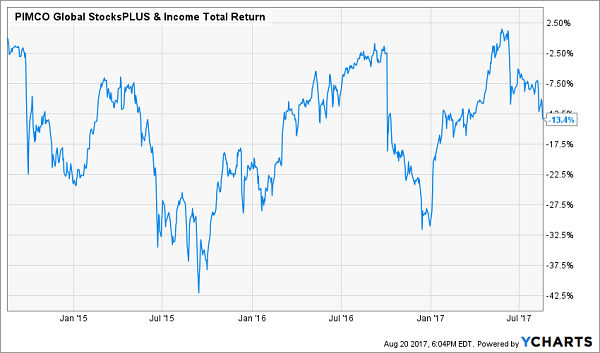

How’d that bidding war work out? Not well, with the fund returning -13.4% over the entire three-year period:

Investors in 5-Star 10%+ Paying PGP Lost Money…

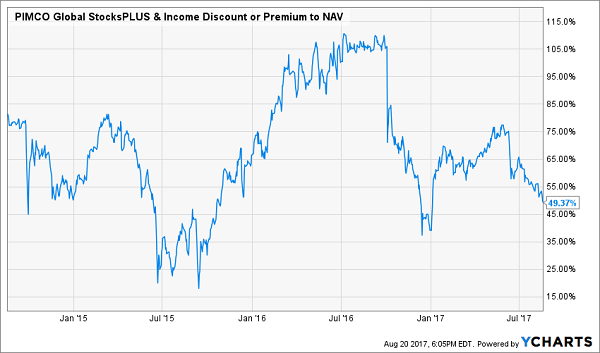

They made the same mistake as those who pay a high price-to-earnings (P/E) multiple for a stock – they simply got crushed when the multiple began to contract:

They made the same mistake as those who pay a high price-to-earnings (P/E) multiple for a stock – they simply got crushed when the multiple began to contract:

… as the “Premium Multiple” Contracted

Scary thing is, with a 49% premium, PGP longs are looking at another potential 33% haircut before their fund trades at par. No thanks.

Scary thing is, with a 49% premium, PGP longs are looking at another potential 33% haircut before their fund trades at par. No thanks.

Sure, there were times you could have bought PGP and made money if you’d timed your buys and sells properly. Summer 2015, in hindsight, would have been a good trading entry – you could have bought shares for a mere 20% over retail, and rode them to 100% of NAV.

But are we investing for dividends, or swing trading? If we’re looking for yield to provide us with retirement income without having to worry about share prices, then we should fade premiums.

4 More First-Level Favorites, for Mediocre Returns (or Worse)

You probably know the “Bond King” Bill Gross. How about his successor, Dan Ivascyn?

When Gross left PIMCO, a tide of cash followed him out the door. But the flow of money quickly subsided when Ivascyn stepped to the plate and outperformed Gross himself. PIMCO let the King walk out the door because they had their next superstar in waiting.

A money manager of Ivascyn’s caliber will usually cost 2% annually (plus 20% of profits). And it’d take a million bucks or two to get his attention.

So it’s understandable that investors would try to “reach” for Ivascyn’s attention and overpay for his fund. That’s exactly what happened with PGP.

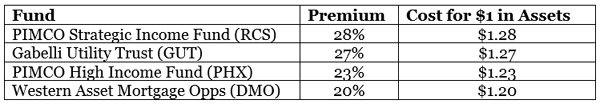

In fact two more PIMCO funds round out our “5 most overpriced” list. If Ivascyn & Co. are at fault, it’s for being too good at what they do. Sadly, though, investors who buy today are paying too much – and likely to see their dividends eaten up by price declines (or worse) in the years ahead:

4 More Popular Premiums to Avoid

Don’t despair though. While there is certainly some froth in CEF-land, there are still some dividend superstars to be had – with a bit of contrary thinking.

Don’t despair though. While there is certainly some froth in CEF-land, there are still some dividend superstars to be had – with a bit of contrary thinking.

Contrarian Income Tip: Buy Discounted CEFs as Rates Rise

Here’s a little-known secret that will help you identify funds that are unfairly discounted:

Higher rates don’t really hurt CEFs.

The theory scares people because it sounds true. Closed-ends have the benefit of borrowing money at Libor to leverage up their returns. Libor is tied closely to the Fed funds rate. So, the thinking goes, higher Fed rates will end the “cheap money” party that benefits CEFs.

Some funds today are selling at discounts to their NAVs on the fear that rate increases will hurt them. But this lazy conclusion is wrong.

In June 2004, Fed chair Alan Greenspan began boosting rates from then-historic lows. Over a two-year period, he increased the federal funds rate from 1% to 5.25%. A dizzying pace by today’s standards.

How’d CEFs perform? These three prominent funds all outperformed the S&P 500 during Greenspan’s aforementioned run!

Higher Rates No Problem for Top CEFs 2004-06

And here are two more blue chip CEFs that moved up along with Libor last hike cycle:

And here are two more blue chip CEFs that moved up along with Libor last hike cycle:

Muni and Infrastructure CEFs Did Well, Too

Let’s put things in perspective. Back then, Greenspan started at 1%. Today, after 15 months of leisurely rate boosts and banter, just now at 1%.

Let’s put things in perspective. Back then, Greenspan started at 1%. Today, after 15 months of leisurely rate boosts and banter, just now at 1%.

With rates once again ticking up, it’s the perfect time to buy the few high quality funds that are still trading for discounts.

— Brett Owens

Sponsor: But which ones?

Today I like three CEFs in particular. They average nearly 8% yields, helping you live off their dividends alone – which is why I call them Dividend Superstars:

A 6.1% payer trading at an absurd 9% discount to NAV,

The brainchild of the one of the top fund managers on the planet that pays 8.6%,

And an 8.4% payer that’s engaged in a massive (and very smart) buyback program.

And right now, thanks to rate hike worries, they are all trading at a generous discount to their NAVs. Which means you can buy them today, bank the big dividends and enjoy 15% to 20%+ price upside to boot.

Source: Contrarian Outlook