With great yield comes great risk.

A double-digit yielder is a pretty rare thing.

[ad#Google Adsense 336×280-IA]Among the 7,000 or so stocks, exchange-traded funds and closed-end funds on the market, a relative handful (135) dole out 10% or more in annual income.

And because sky-high yields are often the product of tanking share prices or excessive risk, many of them are traps – and only a select few are worth considering.

Today, I’m going to show you a trio of stocks that yield more than 12% and have earned a closer examination.

But first, let me show you just how rough it is for the big-income club.

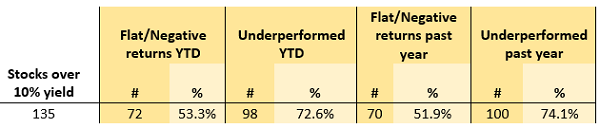

The following table is a quick look at the world of super-high-yielding stocks, according to stock screener FinViz, and how they have performed both since Jan. 1, and over the past year or so.

If you were asking Lady Antebellum, she’d tell you “It ain’t pretty.”

More than half of these stocks have merely come up square or worse over the past five and 12 months, and nearly three-quarters have underperformed the market! There’s a little chicken-and-the-egg going on here, of course – some of these stocks yield more than 10% because they’ve been battered so much, but some of these stocks yield more than 10% because they need to entice investors to invest in high-risk businesses that are capable of putting up such lousy performances.

Naturally, if you add income payments into these figures, the underperformance isn’t as stark, but you have to ask yourself – if a high dividend is merely helping you break even with the market, what’s the point? Just buy the SPY and go home.

Investors who actually want to beat the market with massive total returns need to weigh sky-high payouts against business quality, dividend growth and the potential for big returns ahead.

That’s why today, I’m looking at three dividend powerhouses yielding 12% or more that look attractive at first glance, but only one of them is a buy. The other two are toxic traps that will quickly poison a retirement or other long-term portfolio.

Icahn Enterprises LP (IEP)

Dividend Yield: 12.5%

Icahn Enterprises LP (IEP) is a holding company controlled by (surprise surprise) none other than investor Carl Icahn himself. But that hardly qualifies as a seal of quality nowadays, as Icahn has fallen on some particularly hard times.

While IEP offers investors a fairly diversified portfolio of energy, automation, gaming, real estate and other areas, as well as a stake in Icahn’s hedge fund, Icahn has managed to squander that by scattering his failures across a number of industries. Icahn’s hedge fund itself posted an 18% loss in 2015, then following that up with a 20% loss last year! IEP declined 36% total across both years.

Among his high-profile difficulties are big losses in Chesapeake Energy (CHK), Hertz (HTZ), Trump Taj Mahal. Now, he’s pinning his turnaround plans on expanding his automotive-industry holdings via the buyout of Precision Auto Care (PACI).

Icahn is a well-known investor, but the results haven’t been there for years. Meanwhile, the MLP structure is another strike against IEP that forces investors to deal with K-1s and additional tax complexity. The 12% yield is literally the only attractive thing about this company.

Carl Icahn Has Lost His Touch

Washington Prime Group (WPG)

Dividend Yield: 12.9%

There are a few reliable real estate investment trusts (REITs) in the battered retail world, but Washington Prime Group (WPG) isn’t one of them.

Washington Prime is the product of a 2014 spinoff from Simon Property Group (SPG), then a 2015 acquisition of Glimcher Realty Trust. It holds numerous properties across roughly 30 states, including malls, strip malls and other shopping centers.

The struggles of so-called anchor stores like Sears (SHLD), Macy’s (M) and JCPenney (JCP) are naturally a worrisome development for mall REITs like WPG, but not just because of the risk of shuttered stores driving up vacancies and drying up rents.

There are also “co-tenancy clauses,” meant to shelter smaller retailers from the impact of losing anchor retailers. In short, if an anchor retailer closes, other retailers on the property may temporarily pay less (or nothing) in rent. So if WPG is sitting with any of these agreements on the table, closed Sears, Macy’s and JCPenney stores could be a double whammy. Even if it’s not, Washington Prime will have its hands full with either filling enormous spaces or renovating the property to alter or remove the anchor slot.

Again, Washington Prime has a huge (and well-covered) dividend, but you can forget about growth – WPG is even selling stakes in mall properties just to raise cash – and additional declines look likely from here.

Big Dividends Can’t Save Washington Prime (WPG) From Massive Underperformance

New Residential Investment (NRZ)

Dividend Yield: 12%

We all know about the struggles of many mortgage REITs over the past few years, but for the past 18 months or so, New Residential Investment (NRZ) has been a breath of fresh air.

NRZ – a spinoff of Newcastle Investment (NCT) – invests in, among other things, mortgage servicing rights (MSRs), which “provides a mortgage servicer with the right to service a pool of mortgage loans in exchange for a fee.” Specifically, NCT specializes in investments in “excess MSRs,” which is the money left over from the MSR once basic servicing feeds have been taken out to whoever is actually servicing the loan. These excess MSRs are an outstanding, stable source of cash flows.

New Residential also invests in plain MSRs, residential securities and call rights, residential and consumer loans and servicer advancements.

The company is just a few months removed from a freshly hiked dividend, which at 48 cents per share is both well covered by 54 cents in core earnings, and good for a sweet 12% yield. Like most other mREITs, don’t expect NRZ to be a smooth ride, but longer-term, the business (and the stock) are pointed in the right direction.

New Residential (NRZ) Is a Double-Digit Yield You Should Chase

— Brett Owens

Live Off Dividends Forever With This “Ultimate” Retirement Portfolio[sponsor]

If you want to retire comfortably, you need big dividends, and that’s just a fact. The steady drumbeat of income is what helps pays the bills and keeps you afloat when you’ve stopped collecting a paycheck.

But if you want to get through retirement without ever touching your nest egg, you need more than just giant dividends – you need dividend growth to beat back inflation, and you need capital appreciation to keep building your nest egg! Losers like WPG and IEP can’t do that … but the “triple threat” stocks in my 8%-yielding “No Withdrawal” retirement portfolio sure can!

How many times have you seen a pundit shill for OK-yielding blue chips like Coca-Cola or Kellogg? They’re not bad companies, but they leave you with just 3% to 4% in dividends, paltry payout hikes and little in the way of growth potential. You and I both know that math doesn’t add up. Those 3% to 4% returns on a nest egg of half a million dollars will only generate $20,000 in annual income from dividends at the high end!

You’ve worked your tail off for decades. So you deserve more out of your retirement.

My “No Withdrawal” portfolio ensures that you won’t have to settle during the most important years of your life. I’ve put together an all-star portfolio that allows you to collect an 8% yield, while growing your nest egg – an important aspect of retirement investing that most other strategies leave out.

I’ve spent most of the past few months digging into the high-dividend world, and I’ve had to weed out several yield traps that looked great on their surface, but potentially disastrous at a closer look. The result is an “ultimate” dividend portfolio that provides you with …

- No-doubt 6%, 7% even 8% yields – and in a couple of cases, double-digit dividends!

- The potential for 7% to 15% in annual capital gains

- Robust dividend growth that will keep up with (and beat) inflation

This all-star cluster of stocks features the very best of several high-income assets, from preferred stocks to REITs to closed-end funds and more, that combine for a yield of more than 8%.

This portfolio will let you live off dividend income alone without ever touching your nest egg. That means never having to worry about how you’ll pay your monthly bills, and never having to worry about wrecking your retirement account if disaster strikes.

Don’t scrape by on meager blue-chip returns and Social Security checks. You’ve worked too hard to settle when it matters most. Instead, invest intelligently and collect big, dependable dividend checks that will let you see the world and live in comfort for the rest of your post-career life.

Let me show you the path to the retirement you deserve. Click here and I’ll provide you with THREE special reports that show you how to build this “No Withdrawal” portfolio. You’ll get the names, tickers, buy prices and full analysis of their wealth-building potential – and it’s absolutely FREE!

Source: Contrarian Outlook