Here’s a fact: if you want to clock out of the workforce in any kind of comfort, you’ll need $4,000 a month—$4,074, to be exact.

How do I know?

Because that’s what your average 65- to 74-year-old couple shells out every month, according to the Bureau of Labor Statistics. It comes out to $48,885 a year.

According to a recent CNBC survey, all of these states ranked in the middle of the pack by cost of living.

So for plenty of folks, that $4,074 figure probably isn’t far off.

But there’s a problem.

If you want to live on dividends alone—a goal we need to shoot for if we want to ensure our retirement really is crash proof—you’ll be hard pressed to bring in even this modest level of income … even with a $1-million nest egg!

Exhibit A: The S&P 500, with an average yield of just 1.9%. Even if we had a cool mil in the bank, we’d be pulling in just $19,000 in income. That’s not even 40% of what we’ll need and not far above the poverty line ($14,507) for a two-person over-65 household!

Ten-year Treasuries are a bit better, but at 2.25%, you’re only getting $1,875 a month, or $22,500 per year, on a million bucks, which isn’t even halfway there.

Neither option is good enough.

In a moment, I’ll show you 4 rock-solid income plays that will easily beat a 4.9% payout, the number you’d need to live on dividend income alone in this scenario, without having to sell a single share in retirement.

Before I do, here’s another benefit these 4 red-hot buys share—and few other investments can match.

The Power of Monthly Dividends

I don’t know about you, but I hate marrying a monthly stream of bills with an income stream that rolls in quarterly. It just doesn’t work.

Luckily there’s an easy fix: stocks that pay dividends just as your bills arrive: every single month.

It’s no wonder retirees love monthly dividend payers. Non-retirees love them too, because they let you reinvest your cash faster, giving your long-term return a slight bump thanks to the magic of compound interest.

Trouble is, hardly any blue chips pay monthly.

But as I just showed you, the big names are mostly also-rans in the dividend game anyway, so who cares? A 2% yield isn’t much help, no matter if it’s paid quarterly, monthly … heck, even daily.

Instead, we’re going to ditch regular stocks and go with real estate investment trusts (REITs) and a closed-end fund (CEF) to build our 4-stock “monthly retirement portfolio.”

Because these often-overlooked corners of the market boast an almost embarrassing number of solid monthly payers. And many of them are terrific bargains, too.

3 Monthly Dividend REITs Paying 5.2% …

When it comes to REITs, you could easily buy the Vanguard REIT ETF (VNQ), lock it away and collect a nice 4.4% yield.

But there are two problems with that. First, VNQ pays dividends quarterly, not monthly, so you’re missing out on the convenience factor.

Second, it’s been trounced by three individual REITs I like much more.

The first is STAG Industrial REIT (STAG), which is up nearly 13% since I recommended it on February 13. STAG owns warehouses and manufacturing plants across the country.

The first is STAG Industrial REIT (STAG), which is up nearly 13% since I recommended it on February 13. STAG owns warehouses and manufacturing plants across the country.

Our other two plays here are long-term-care-facility operator LTC Properties (LTC) and EPR Properties (EPR), owner of theaters and entertainment complexes across the US.

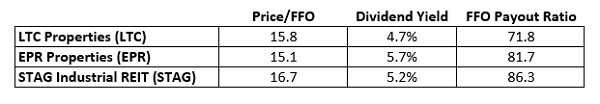

Between them, these three REITs yield 5.2%, on average, so we’re already above our “breakeven” 4.8%, and those payouts are easily covered by funds from operations (FFO; the REIT equivalent of earnings per share). That means we can look forward to some nice dividend growth here, too, which will goose our yield even higher.

The topper: all three are bargains.

… and 1 Closed-End Fund to Juice Our Monthly Payout to 5.5%

… and 1 Closed-End Fund to Juice Our Monthly Payout to 5.5%

If you haven’t heard of CEFs, don’t worry. There are only 600 or so out there, as opposed to some 1,800 ETFs.

The main benefit: fat dividend yields. Plus, many CEFs also trade at discounts to their net asset value (or NAV).

Translation: we can buy cheap, then sit tight as those discount windows slam shut!

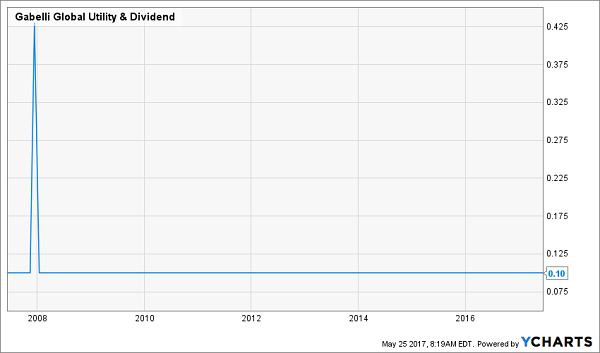

The Gabelli Global Utility & Income Fund (GLU) yields 6.3% and sports a 13.2% discount to NAV now. That’s a slightly narrower gap than its 52-week average of 14%, so there may not be much immediate “price snapback” potential here. But the fact that GLU trades close to its average discount gives us some downside protection.

And as my colleague Michael Foster wrote in March, the market has disrespected GLU for some time, and the fund actually traded at a premium to NAV a little more than three years ago, so we’re long overdue for a shift.

Either way, we’ll happily pocket GLU’s 6.3% dividend (paid monthly, of course), because it’s as steady as they come:

There’s nothing complicated here: superstar investor Mario Gabelli buys top utilities like AT&T (T), Vodafone (VOD) and Canada’s Rogers Communications (RCI), then uses a reasonable amount of leverage, borrowed cheaply, to boost their returns even more.

There’s nothing complicated here: superstar investor Mario Gabelli buys top utilities like AT&T (T), Vodafone (VOD) and Canada’s Rogers Communications (RCI), then uses a reasonable amount of leverage, borrowed cheaply, to boost their returns even more.

Add it up, and you get a nice 4-stock portfolio that delivers exposure to real estate (healthcare, utilities and retail) and global and US utilities. Plus, your average yield of 5.5% hands you $4,583 a month on a $1-million nest egg, well above what the Bureau of Labor Statistics says we need.

— Brett Owens

Sponsor: But there’s still an obvious problem: what if you don’t have a million bucks saved?

Or what if you do have a cool mil but want a few thousand extra dollars to spend without tapping into your savings?

To do either, you’re going to need a much higher yield than 5.5%—even with the dividend growth you’re getting from the 3 REITs above.

What if I told you I could safely goose that average payout all the way up to 8.0%?

Think about that for a moment.

On a million bucks, you’d be pulling in $80k a year, or $6,667 a month, far more than our $4,074 baseline. Or if you’re happy to just cover off your $4k in monthly costs, you could choose to save up a lot less than $1 million.

In fact, you could easily make $4k a month on just over $600k with my 8.0% “No-Withdrawal” retirement portfolio. I’ve built this all-star portfolio with 6 of the absolute best preferred stocks, REITs and CEFs out there. Plus, their relentless dividend growth means your 8.0% yield will be more like 10% in short order.

I’m ready to take you inside this “no-worry” retirement portfolio now. Click here and I’ll show you the 6 bargain investments inside it and give you their names, tickers, buy-under prices and much more.

Source: Contrarian Outlook