Flowers Foods (FLO) is a Dividend Contender with a 15-year streak of increasing its dividend. Its most recent increase was in June, when it delivered a 10.3% raise to its shareholders.

Flowers is the company that brings us Wonder Bread and Nature’s Own, among other brands. It yields about 4.2%. For a good analysis of the company, see this article.

FLO is highly rated for dividend safety. Simply Safe Dividends gives FLO a score of 68 for dividend safety, meaning that its dividend is considered to be safe.

Simply Safe Dividends’ scores range from 0-100 and fall along the following scale:

Simply Safe Dividends’ scores range from 0-100 and fall along the following scale:

Safety Net Pro gives Flowers Foods an even more positive rating for dividend safety:

Safety Net Pro gives Flowers Foods an even more positive rating for dividend safety:

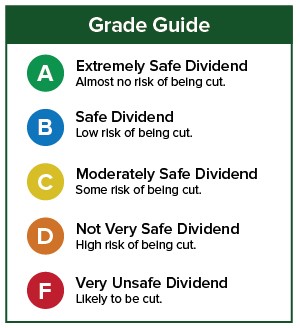

Their scoring scale looks like this:

Their scoring scale looks like this:

Let’s go through our valuation steps and see how Flowers stacks up. For a complete discussion of how I determine valuation, please consult Dividend Growth Investing Lesson 11: Valuation.

Let’s go through our valuation steps and see how Flowers stacks up. For a complete discussion of how I determine valuation, please consult Dividend Growth Investing Lesson 11: Valuation.

Step 1: FASTGraphs Default Valuation

In the the first step, we compare the stock’s current price to FASTGraphs’ basic estimate of its fair value.

FASTGraphs’ basic estimate is based on the long-term price-to-earnings (P/E) ratio of the whole stock market, which is 15.

That fair value level is shown by the orange line on the following graph, while the black line is FLO’s actual price.

You can see that FLO’s price has been tanking since late last year. If you are a potential buyer, that is a good thing, assuming that the price drop is not caused by some fundamental problem with the company.

You can see that FLO’s price has been tanking since late last year. If you are a potential buyer, that is a good thing, assuming that the price drop is not caused by some fundamental problem with the company.

[ad#Google Adsense 336×280-IA]Even with the price drop, FLO is still trading above the orange reference line.

How much? We answer that by comparing the stock’s P/E ratio (shown at the upper right) to the ratio of 15 that was used to draw the orange line.

We get 16.5 / 15 = 1.10. In other words, FLO is trading 10% above the orange reference line by this method of determination.

That happens to be the break-point that I use to describe whether a stock is fairly valued or overvalued.

So by this first measure, FLO is either at the upper edge of the fair-value range or at the bottom edge of the overvalued range.

Its fair price would be its current price divided by the ratio 1.10, or $14. I round off to the nearest dollar to avoid creating a sense of false precision.

Step 2: FASTGraphs Normalized Valuation

In the second step, we compare Flower’s current P/E ratio to its own long-term average P/E ratio. In other words, instead of judging fair valuation by how the market has valued all stocks over many years, we judge it by how the market historically has valued this stock itself.

Using this method, FLO’s stock is clearly undervalued.

Using this method, FLO’s stock is clearly undervalued.

I use a 10-year look-back period to compute Flower’s historical P/E ratio. As shown in the dark blue box, that is 21.3, which is indicated on the graph by the dark blue line. That represents fair value based on FLO’s own historical treatment by the stock market.

As above, we can compute the degree of undervaluation by comparing FLO’s present P/E ratio to the historical average: 16.5 / 21.3 = 0.77. In other words, this suggests that FLO is trading at a 23% discount to its fair value.

Its fair price under this scenario is $20.

Step 3: Morningstar Star Rating

The next step is to see what Morningstar has to say.

Morningstar’s discounted cash flow (DCF) approach to valuation is different from the first two approaches based on P/E ratios. Morningstar discounts all of the stock’s future cash flows back to the present to arrive at a fair value estimate.

When this technique is done right, many investors consider it to be the finest way to value a stock.

![]() Unfortunately, Flowers Foods is not rated by Morningstar. They assign no stars and do not compute a fair value for this company.

Unfortunately, Flowers Foods is not rated by Morningstar. They assign no stars and do not compute a fair value for this company.

That happens occasionally. Morningstar’s analysts cover around 2000 stocks, but FLO is not one of them. That is not surprising, as FLO is not a giant company.

Step 4: Current Yield vs. Historical Yield

Finally, we compare the stock’s current yield to its historical yield. The higher the stock’s current yield is compared to its historical average, the better value it represents.

This is how Flowers’ current yield compares to its 5-year average (from Morningstar):

From the display, FLO’s current yield (shown as 4.0% although it is currently about 4.2%) is well above its 5-year average. 4.2 / 2.5 = 1.68.

From the display, FLO’s current yield (shown as 4.0% although it is currently about 4.2%) is well above its 5-year average. 4.2 / 2.5 = 1.68.

I always use this last method conservatively, so I cut off the difference at 20% (in other words, I treat the 1.68 as if it were 1.20).

So by this method, FLO is about 20% undervalued, and its fair price computes to $18.

Averaging the 4 Valuation Steps

Using the 4 approaches just described, our valuation for Flowers Foods comes out like this.

Thus by my reckoning, Flowers Foods is undervalued at the current time, trading at about 12% less than its fair price of $17.

Thus by my reckoning, Flowers Foods is undervalued at the current time, trading at about 12% less than its fair price of $17.

For a sanity check, I looked at S&P Capital IQ’s analysis of FLO. They assign it a current fair value of $15.30 and a 1-year price target of $16.00.

As always, this is not a recommendation to buy Flowers Foods. Always perform your own due diligence. Check out the company’s quality, financial position, and business prospects. Also consider whether it fits (or does not fit) into your portfolio in terms of diversification and your long-term investing goals.

— Dave Van Knapp

[ad#wyatt-income]