Dividend stocks are a “no brainer” compared to Treasuries says Bob Doll, the chief equity strategist for Nuveen Asset Management.

[ad#Google Adsense 336×280-IA]He told Bloomberg Radio that with dividends outpacing yields on government bonds, it’s an easy decision in favor of equities.

But which high yield stocks should be bought, and which are already overbought?

Anything that pays is hot.

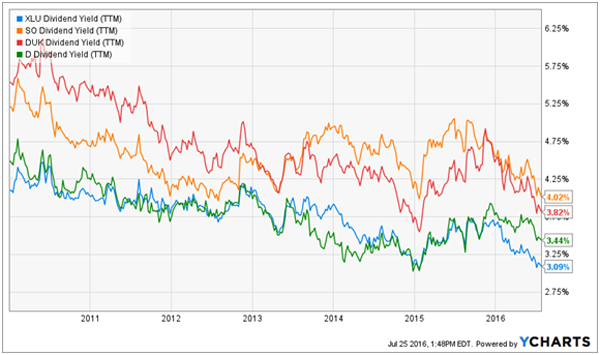

Yields on most utility stocks, for example, are at their lowest levels this decade with popular payers such as Southern Company (SO), Duke Energy (DUK) and Dominion Resources (D) dishing investors between 3.4% and 4% – well below their historical payouts.

Utility Yields Driven Down by Dividend-Hungry Investors

With respect to the 10-Year Bill’s sad 1.6% yield, these dividends look great. Still, it’s not very much income when a $100,000 investment pays just $3,000 or $4,000 per year. Which means a million dollar portfolio barely generates enough income to quality for the Democratic Party’s new proposed minimum wage!

Plus, Your Wages Must Pay Your Monthly Bills

Utility stocks – like most equities – pay their dividends quarterly. A select few do cut their investors checks every month. And while it’s nice to get paid at the same rate in which your bills get delivered, this fast payout pace can make these issues quite popular.

Take Realty Income (O), the ringleader of the bunch. The firm has embraced its payout schedule so much that it brands itself “the monthly dividend company.” It’s raised its payout 86 times since its initial listing on the New York Stock Exchange 22 years ago. During that time, the stock returned 18.2% annually to investors.

Its branding coupled with its impressive performance has made Realty shares hot items. Problem is, the stock’s rising price has driven its yield down historical lows:

Price Up, Yield Down – The Curse of Popularity

Investors who bought years ago are still sitting pretty, but you and I are left with looking elsewhere for meaningful income. Fortunately there’s one asset class that usually pays monthly and is one of the last places where one can find value in the high yield space today.

Closed-End Funds Provide the Best (and Worst) Monthly Offerings

If you feel trapped “grinding out” dividend income with classic 3% or 4% payers, you can double your payouts (or better) immediately by moving to closed-end funds, or CEFs. These funds often payout 6%, 7% and even 8% or more in dividends every year.

Closed-end funds have fixed pools of shares that are actually set – versus open-ended funds, or mutual funds, which issue as many shares as investors want to buy. This is helpful for the closed-end manager, who can invest without worrying about investor redemptions. Money outflows can be a big problem for mutual fund managers, especially during bear markets, as they force the manager to sell stocks at the worst possible time (when they’re cheap) simply to raise the money needed to cash out investors.

CEF managers do have the flexibility to hold their positions as long as they need to. But if investors lose patience (as they always do, usually at the most inopportune time) the fund may sell on the open market at a discount to its net asset value (NAV).

CEFs trade just like stocks, which means you can buy them and sell them simply by typing a ticker into your online broker’s website. They also trade like stocks in that they can sell for much less than their intrinsic value (their NAV) for periods of time.

When looking for potential closed-end funds to buy, I like to search for the steepest discounts first. They’re clear contrarian indicators. The more investors dislike a strategy at the moment, the greater the discount they demand. The irony is that most people love chasing recent performance, which means they’re most inclined to sell a loser at the moment it’s most likely to turn around.

As a result, the bargain bin often contains high payers selling for 10% discounts or better. This means you’re getting the fund’s assets for $0.90 on the dollar – an easy way to lock in likely 10% upside along with your big yield as the discount window closes.

Provided it will eventually close, that is – and that depends on the quality of the fund. The window should shut, because in theory the manager simply needs to buy back his own shares to close it. And in practice a modest repurchase program is often all that’s needed to kickstart the process.

But not all managers deserve our money, as some have a steady history of burning investor’s capital. Some losers in this space are just losers. They don’t deliver any true alpha. In fact, some are nothing more than glorified mutual funds – they buy stocks, declare a distribution and “hope” that capital gains will make up the difference. And they charge steep fees to do so.

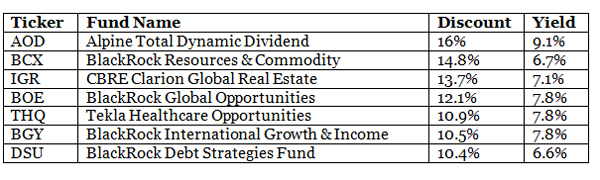

Let’s take a look at seven closed-ends that are currently trading for $0.90 on the dollar or cheaper. All pay 6% or better. And believe it or not, only one is deserving of our investment consideration.

These 7 Funds Look Great – But 6 Are Probably Sells

These seven issues all pay their distributions monthly, and all look quite promising at a glance when compared with the alternatives we discussed earlier.

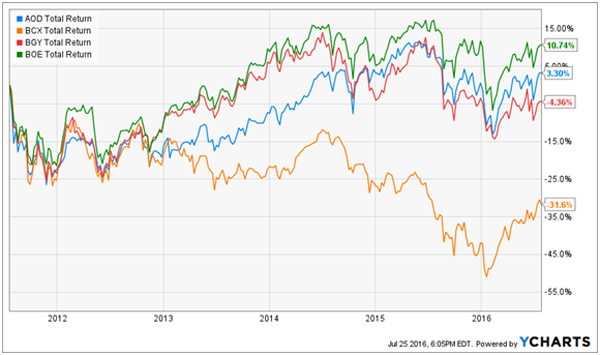

But four out of seven shouldn’t even be considered – because they never manage to make any money over the long run! Here is their five-year track record of trading flat to worse:

Four Dividend Dogs

Here are the three left standing…

The CBRE Clarion Global Real Estate Fund (IGR) has the best five-year track record of the group with a 41% total return. Its steep 13.7% discount is at the high end of the fund’s historical range, so there appears to be some “snap back” price potential. IGR invests in residential, commercial and industrial real estate – a refreshing alpha strategy in a world of posers.

The BlackRock Debt Strategies Fund (DSU) posted a 25% total return over the last five years. It’s been a unique somewhat-bright spot amidst BlackRock’s dog pound of CEFs. However its 35% total 10-year return leaves much to be desired.

Finally the Tekla Healthcare Opportunities Fund (THQ) kicked off just two years ago. While I love the bullish demographics driving the healthcare industry I’m not exactly sure how Tekla is profiting from this megatrend. Management may be similarly puzzled, as the fund has only returned 1.7% over two years.

— Brett Owens

Instead, Buy the Best: The Bond God’s 3 Favorite Closed-End Funds [sponsor]

Rather than messing around with these closed-end pretenders, you’re better off buying known quantities with outstanding track records. I’m talking about the true blue chips of the bunch, and there are 3 in particular that I like the best right now. Like the seven above, they are also trading at big discounts to their NAV (7-15%) and paying big dividends (8% annually or better).

Two of the three funds even pay their dividends like clockwork every month. They’re a great way to play the “Bond God” Jeffrey Gundlach’s advice on closed-end funds.

Worse case, he said a few months back, these investments will trade flat and we’ll collect a fat 8-11% dividend. Best case, they’ll add 20% in price appreciation. Put the two together and we’re talking about gains of 8-31% over the next twelve months!

His usually prescient advice is looking dead-on once again, as these funds are already starting to tick up. So I wouldn’t waste any time moving on this tip from the top fixed income guru on the planet – I’d buy these three issues today. Click here and I’ll share [more information on] these “slam dunk” income plays.

Source: Contrarian Outlook