Yesterday, a group of countries that include Saudi Arabia and Russia agreed in principle to freeze oil-production rates. On the surface, this sounds like a good thing. But it’s really just a bunch of bull.

As regular Growth Stock Wire readers know, oil prices fell from more than $105 per barrel in mid-2014 to less than $30 per barrel today. That’s a 70%-plus fall in just 18 months.

According to the U.S. Energy Information Administration (“EIA”), the world’s oil supply rose from 91 million barrels per day in 2013 to 96.3 million barrels per day in October 2015 (the latest data available).

[ad#Google Adsense 336×280-IA]That’s a 6% increase in supply in just two years.

Meanwhile, demand isn’t increasing as fast as supply is.

World oil demand was 91.2 million barrels per day in 2013.

The latest EIA estimate puts it around 92.8 million barrels per day as of September 2015 – an increase of less than 2%.

That means the “surplus” oil (supply minus demand) went from about -200,000 barrels per day to 3.5 million barrels per day.

That’s why oil prices collapsed.

Many folks in the oil industry want this production-freeze deal to make a difference in the oil price right away. But it won’t. Here’s why…

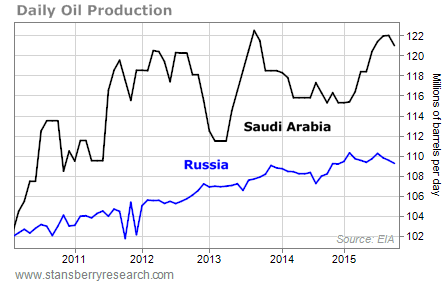

The deal is important because Saudi Arabia and Russia make up 24% of the world’s oil production. These two oil titans agreed to stop increasing production… except that the agreement is coming while we’re near all-time record volumes of oil.

In other words, these countries couldn’t really produce that much more oil anyway. You can see what I mean on the chart below…

The problem is, the one country that could massively increase oil production – Iran – hasn’t agreed to the deal yet. The deal is contingent on Iran’s agreement. And if you know anything about Iran and Saudi Arabia’s relationship, you know this deal is already in doubt.

The problem is, the one country that could massively increase oil production – Iran – hasn’t agreed to the deal yet. The deal is contingent on Iran’s agreement. And if you know anything about Iran and Saudi Arabia’s relationship, you know this deal is already in doubt.

Saudi Arabia and Iran’s relationship is terrible, and Iran isn’t about to agree to restrict oil production right now after 35 years of sanctions.

Iran plans to increase production between 500,000 and 1 million barrels of oil per day. That will add much-needed foreign currency to Iran’s economy. If the deal between Saudi Arabia and Russia hinges on Iran, it’s dead in the water already.

The only way for oil prices to rise from here is if world demand increases and we’re able to consume the oil surplus. Oil-production freezes like this are useless political baloney. They don’t fix the fundamental issue… and that’s what really matters.

Good investing,

Matt Badiali

[ad#stansberry-ps]

Source: Growth Stock Wire