Income investors just got a gift from the market…

Income investors just got a gift from the market…

And if you’re willing to ignore a lot of hype, you can begin earning nearly 6% in tax-free interest… from a very safe investment.

A little over two months ago, I urged investors to take advantage of a selloff in municipal bond funds. At the time, my favorite bond funds were trading for substantial discounts to their underlying values… and offering tax-free yields of 6%. I called the situation a “gift from the market.”

[ad#Google Adsense 336×280-IA]Unlike any other analyst I know, I’ve been telling readers to buy municipal bonds for the past three years.

I even went on national TV to make my case.

Municipal bonds have been – and will continue to be – a great deal for income-seeking investors.

As you probably know, municipal bonds are loans made to state and municipal governments.

To encourage folks to invest in government projects, interest received from “munis” is exempt from federal income tax and, in many cases, state and local income taxes.

This makes them a great way to earn investment income… and keep it from the taxman.

For example, if you earn $1,000 in annual interest in a taxable investment, and you’re in the 28% tax bracket, you’ll pay $280 in taxes to the government… and keep $720. These days, earning income like that takes a lot of work, so why give it up?

In a tax-free investment, you’d keep all $1,000. And since $280 is 39% of $720, you end up with 39% more money. And that’s just in the first year.

The promise of that extra income helped municipal bonds recover after their selloff earlier this year. One of my favorite funds, the Invesco Value Municipal Income Trust (IIM), jumped 8% in a month… which is an extraordinary move for a “boring” bond fund.

But recently, municipal bonds declined… and are now on sale again.

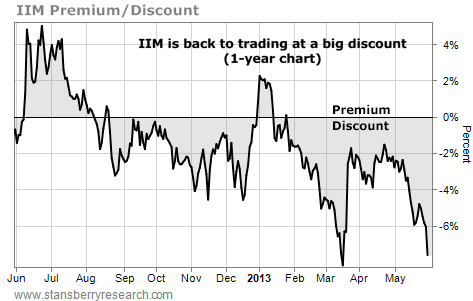

Take a look at the chart below. It tracks the premium or discount investors were paying when they bought IIM over the last year. As you can see, today’s discount is nearly as low as it was back in March… nearly as low as it’s been all year.

Municipal bonds are falling because some investors believe the U.S. economy is heating up… which causes interest rates to rise. When interest rates on Treasurys rise, it makes them more attractive to some investors. And it draws money away from other income investments. This has all produced a big selloff in munis… and the funds that hold them.

Municipal bonds are falling because some investors believe the U.S. economy is heating up… which causes interest rates to rise. When interest rates on Treasurys rise, it makes them more attractive to some investors. And it draws money away from other income investments. This has all produced a big selloff in munis… and the funds that hold them.

But I don’t believe the economy is humming along so fast that interest rates will rise substantially, as some pundits claim. The bottom line is the fear of rising interest rates is overblown.

So, as I mentioned in March, the thing to do here is forget about the price action and focus instead on the income you’re getting. Buying IIM at this price, with this big discount, sets you up for a 6% tax-free income stream… which is equivalent to a 9% yield in a taxable investment.

All you need to earn this 6% is a basic online brokerage account… and the names of the best municipal bond funds.

I don’t know how long munis will stay this cheap. It could be a few days… or it could be a few months. But right now, they’re on sale… and yielding 6%, tax-free.

Here’s to our health, wealth, and a great retirement,

Dr. David Eifrig

[ad#stansberry-ps]

Source: DailyWealth