I get more crazy feedback about one issue than any other…

I get more crazy feedback about one issue than any other…

Many of my readers – I think mostly ones who are new to investing –complain that a few of the stocks I’ve been recommending “haven’t gone anywhere for a long time.”

They’ll read my recommendations, which are often about the world’s best, safest businesses… and then write in to tell me I’ve lost my mind.

Take Microsoft, for example. Microsoft (MSFT) is a safe, dividend-paying cash-generating powerhouse. It dominates its industry. In 1998, it was selling for about $25 a share. Where is it today? About $25.

[ad#Google Adsense 336×280-IA]Or take Wal-Mart. Wal-Mart (WMT) is the King of Retail. It, too, is a steady, dividend-paying, cash-generating business powerhouse. Toward the end of 1999, it had climbed to $60 a share. Today? It’s just under $60.

For my new readers, that’s proof we shouldn’t own these stocks. They’ve been “dead money” for folks who bought in 2000. All that matters to them is the where the share price has been over the past decade.

If you’re in this camp – where past price performance is all that matters to you – it’s extremely unlikely you’ll make money as a long-term investor.

What should matter to folks is how much cash the company is capable of earning and distributing in dividends… and how sustainable that cash-generating ability is over the long term.

If this idea doesn’t immediately make sense to you, try thinking of it like a private business investor would.

Let’s say the owner of a successful, sustainable, cash-generating business wants to sell that business and retire. If you’re looking to buy that business, would you devote your time to figuring out the right price to pay – say seven times annual earnings – or would you devote your research to what the previous owner paid for the business eight years ago?

I imagine that when you look at buying stocks (which are pieces of a business) this way, you’ll agree with me that studying the quality and sustainability of the business is 100 times more important than studying what the business changed hands for more than a decade ago.

And when you understand this concept, you’ll understand why we have a fantastic opportunity today to buy super-high-quality stocks. Let me show you why…

In 2000, shares of Wal-Mart peaked at $70, when it was trading for more than 50 times earnings. Remember, this was during the peak of the 1998-2000 stock mania. Stocks were incredibly expensive back then.

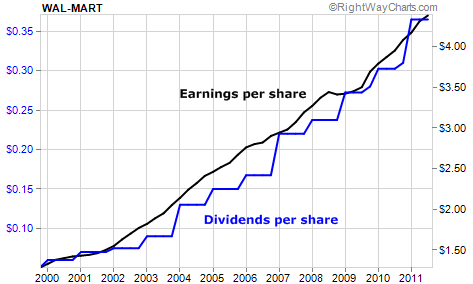

Since that time, as I explained, Wal-Mart’s share price has basically gone nowhere. Meanwhile, the value of the underlying business has soared. Take a look…

Last year alone, Wal-Mart produced $23 billion in cash earnings, bought back $14 billion in stock, and paid out more than $4 billion in cash dividends.

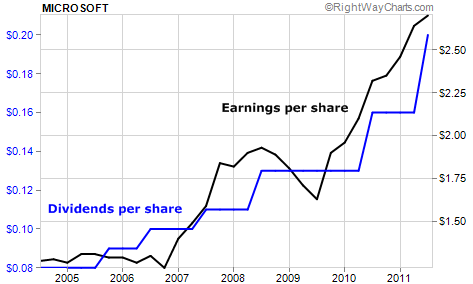

It’s the same story with Microsoft. In 2000, Microsoft peaked at $58 a share and just over 68 times earnings. Like they did with Wal-Mart, folks had bid Microsoft to insanely overvalued levels.

The share price fell more than 65% that year and has gone nowhere ever since. Meanwhile, the value of Microsoft’s business has soared…

Last year, Microsoft produced $24 billion in cash earnings, bought back $9 billion in stock, and paid out more than $5 billion in cash dividends.

I could tell the same story about Intel (INTC), Abbott Labs (ABT), and Coke (KO). When my readers look into the past and focus only on a business’ share price, they figure these stocks are lousy trends to buy into.

But all three companies are also World Dominating Dividend Growers. All three companies have grown cash earnings over the last decade. And all three are increasing the amount of cash they’re paying out to shareholders, just like Wal-Mart and Microsoft.

Those are the trends I care about. Those are the trends that will take a small investment today and compound it into a sizable retirement account down the road. Those are the trends that will keep your capital safe… and reward you for investing it. Those are the trends that turn small current income streams into large annual payouts.

So when a knowledgeable long-term investor talks trends, he talks about business results… not historical share price performance. Now more than ever – with the market whipsawing up and down – the long-term investor must be a buyer of strong businesses… not a predictor of future share price movements… and not someone obsessed with past share price movements.

New investors get caught in this trap more than any other. They get stuck on what has happened with a stock in the past. They think buying a stock like Wal-Mart that has drifted sideways for many years is a bad idea. They don’t understand that past price action has nothing to do with buying a great business at a great price.

And they’re not alone. Right now, the market is stuck looking into the rearview mirror on these super-high-quality stocks. Since many elite businesses have grown their underlying values and cash-generating ability – while watching their share prices drift nowhere – they are now extraordinary values. I recommend buying them before it’s too late.

Good investing,

Dan

[ad#jack p.s.]

Source: Daily Wealth